Delving into finest automotive insurance coverage illinois, this introduction immerses readers in a novel and compelling narrative, with the purpose of offering insightful details about the subject.

The state of Illinois has varied automotive insurance coverage choices out there, every with its personal set of necessities and protection limits. Understanding the several types of insurance coverage and what’s wanted to drive legally is essential, as is figuring out the important thing components that have an effect on automotive insurance coverage charges. On this article, we are going to break down the varied elements of automotive insurance coverage in Illinois, together with the varieties of insurance coverage out there, components influencing automotive insurance coverage charges, and the way to decide on the perfect automotive insurance coverage firm in your wants.

Understanding Automobile Insurance coverage in Illinois

Automobile insurance coverage is an important side of driving in Illinois, offering monetary safety in opposition to accidents, damages, and different unexpected occasions. Within the state of Illinois, automotive homeowners are required to have a minimal stage of insurance coverage protection to function their autos on public roads.

There are a number of varieties of automotive insurance coverage out there in Illinois, every providing totally different ranges of protection and safety. Understanding the several types of insurance coverage will help you make knowledgeable choices about your coverage.

Forms of Automobile Insurance coverage in Illinois

In Illinois, you may select from a number of varieties of automotive insurance coverage, together with:

Legal responsibility Insurance coverage

Legal responsibility insurance coverage covers damages to different folks’s property and bodily accidents ensuing from an accident you trigger. It’s the minimal requirement in Illinois, and you should have at the very least $25,000 in bodily harm legal responsibility protection per particular person and $50,000 per accident.

Collision Insurance coverage

Collision insurance coverage covers damages to your automobile within the occasion of an accident, no matter who’s at fault. Such a insurance coverage is optionally available however extremely beneficial, particularly when you have a brand new or costly automobile.

Complete Insurance coverage

Complete insurance coverage covers damages to your automobile from non-accident-related occasions corresponding to theft, vandalism, hearth, and pure disasters.

Private Damage Safety (PIP) Insurance coverage

PIP insurance coverage supplies protection for medical bills, misplaced wages, and different associated prices should you or your passengers are injured in an accident.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection protects you in case you’re concerned in an accident with a driver who doesn’t have insurance coverage or doesn’t have enough insurance coverage protection.

Different Non-compulsory Coverages

Different optionally available coverages embody roadside help, rental automotive protection, and customized gear protection.

Minimal Required Insurance coverage Protection in Illinois

The minimal required insurance coverage protection in Illinois is:

* $25,000 in bodily harm legal responsibility protection per particular person

* $50,000 in bodily harm legal responsibility protection per accident

* $20,000 in property harm legal responsibility protection

You should have these minimal ranges of insurance coverage to register your automobile in Illinois and to function it on public roads.

Insurance coverage Premiums and How They’re Calculated

Insurance coverage premiums are the charges you pay to buy automotive insurance coverage. The price of premiums varies relying on a number of components, together with:

* Age and driving expertise

* Credit score rating

* Automobile make and mannequin

* Annual mileage

* ZIP code and placement

* Protection limits and deductibles

Insurance coverage firms calculate premiums utilizing a mix of those components and the state-mandated minimal necessities. The extra complete your protection and the upper your threat, the upper your premiums can be.

Elements Influencing Automobile Insurance coverage Charges in Illinois

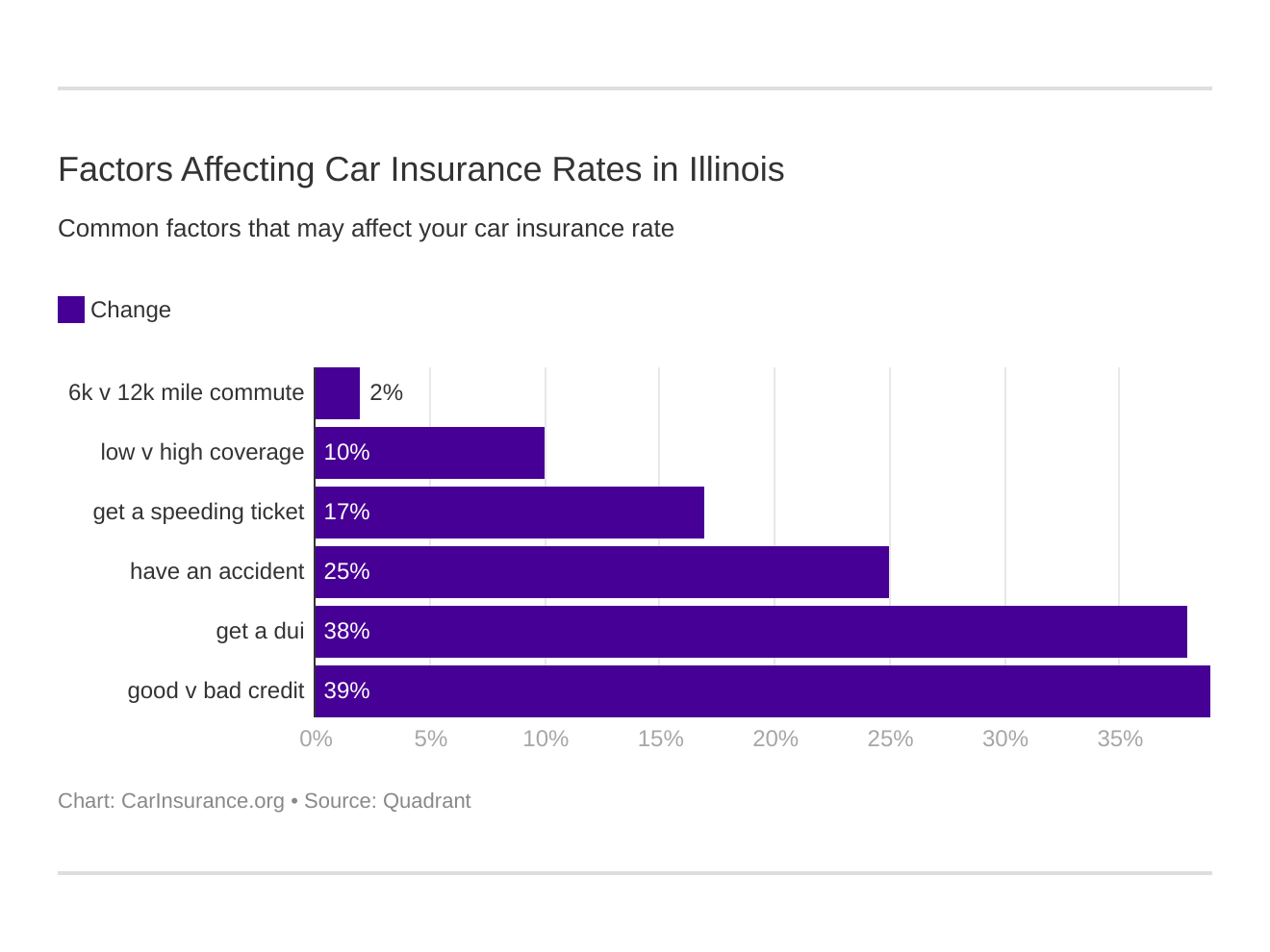

In Illinois, automotive insurance coverage charges are influenced by a mix of things that impression the probability of accidents, harm, and claims. These components differ amongst people and play a big function in figuring out the price of automotive insurance coverage. A few of the key components influencing automotive insurance coverage charges embody age, driving historical past, and placement.

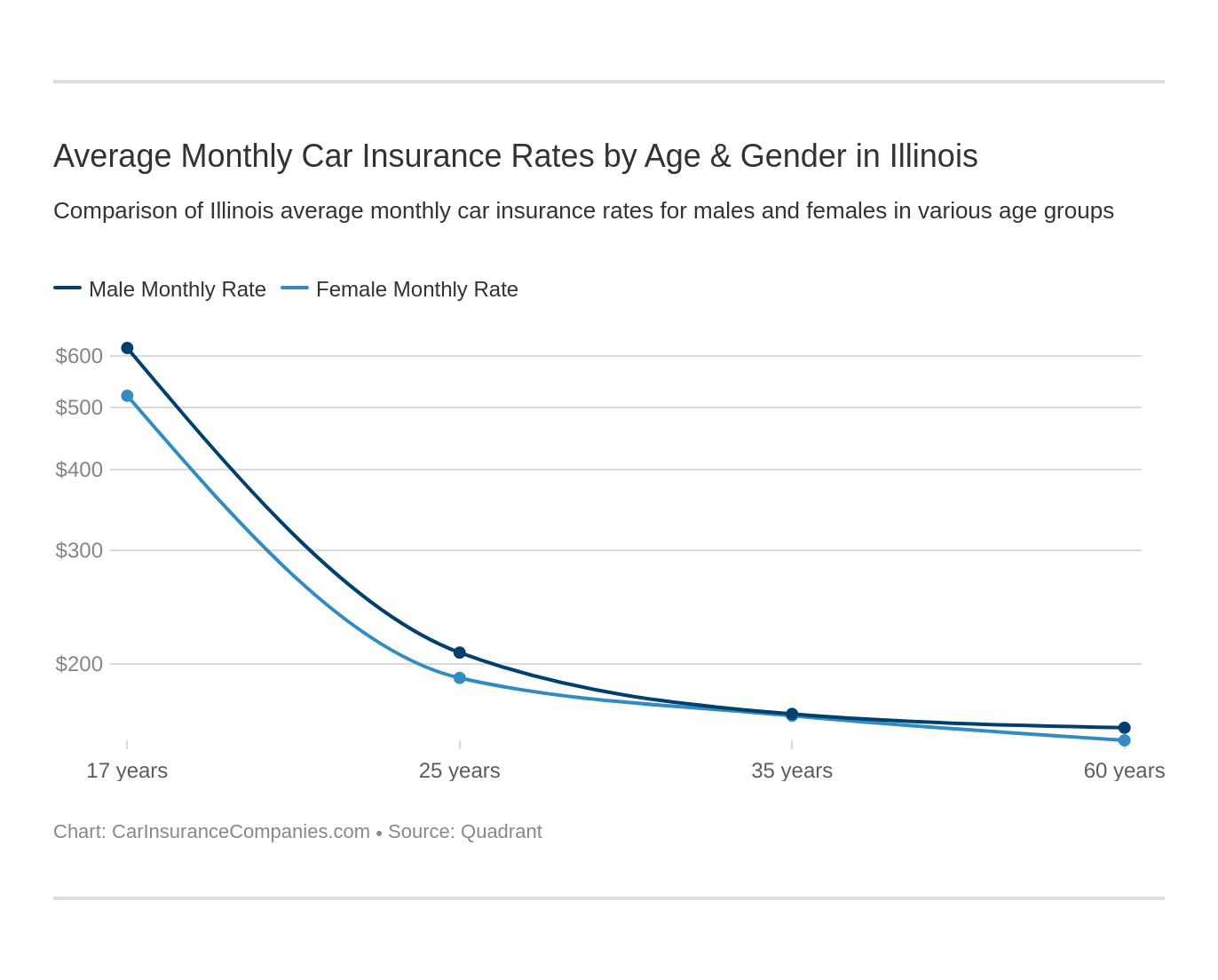

Age and Automobile Insurance coverage Charges

Age is a big think about figuring out automotive insurance coverage charges in Illinois. Automobile insurance coverage charges are inclined to lower with age, however the lower isn’t linear. Younger drivers, significantly these beneath the age of 25, are thought of high-risk drivers and pay increased premiums. This is because of their inexperience and better probability of being concerned in accidents. In line with the Illinois Division of Insurance coverage, the common automotive insurance coverage price for a 20-year-old driver is round $400 per thirty days, whereas an individual of their mid-30s or older pays round $250 per thirty days.

- The price of automotive insurance coverage is increased for younger drivers as a result of their inexperience and better probability of being concerned in accidents.

- As drivers grow old, their automotive insurance coverage charges are inclined to lower, reflecting their improved driving expertise and decrease probability of accidents.

Driving Historical past and Automobile Insurance coverage Charges

A driver’s historical past performs a vital function in figuring out automotive insurance coverage charges in Illinois. A clear driving report with no accidents, tickets, or claims ends in decrease premiums. However, drivers with a historical past of accidents, tickets, or claims pay increased premiums. In line with the Illinois Division of Insurance coverage, a driver with a clear report can count on to pay round 10% lower than a driver with a single accident on their report.

A single at-fault accident can enhance a driver’s automotive insurance coverage charges by as much as 20%.

| Driving Document | Common Automobile Insurance coverage Charge |

|---|---|

| Clear Driving Document | $250 per thirty days |

| One Accident on Document | $300 per thirty days |

| A number of Accidents on Document | $400 per thirty days |

Credit score Scores and Automobile Insurance coverage Charges

Credit score scores additionally play a task in figuring out automotive insurance coverage charges in Illinois. Drivers with good credit score scores, sometimes above 700, pay decrease premiums than these with poor credit score. In line with the Illinois Division of Insurance coverage, a driver with an excellent credit score rating can count on to pay round 10% lower than a driver with a poor credit score rating. A research by the Nationwide Affiliation of Insurance coverage Commissioners discovered that drivers with good credit score scores pay as much as 15% much less in automotive insurance coverage premiums than these with poor credit score.

- Drivers with good credit score scores pay decrease automotive insurance coverage premiums as a result of decrease threat.

- Drivers with poor credit score scores pay increased automotive insurance coverage premiums as a result of increased threat.

Minimal Necessities for Automobile Insurance coverage in Illinois

In Illinois, drivers are required to fulfill sure minimal insurance coverage necessities to make sure they’ve ample protection in case of an accident. These necessities are Artikeld within the state’s Monetary Accountability Legislation, which goals to guard drivers and their passengers from monetary losses ensuing from an accident.

The Monetary Accountability Legislation in Illinois

The Monetary Accountability Legislation in Illinois requires drivers to hold a minimal stage of insurance coverage protection to show they’ve the monetary means to cowl damages ensuing from an accident. This legislation is also referred to as the “Proof of Monetary Accountability” legislation.

Minimal Legal responsibility Insurance coverage Protection Limits in Illinois

In Illinois, drivers should carry a minimal of $25,000 in bodily harm legal responsibility protection per particular person, $50,000 in bodily harm legal responsibility protection per accident, and $20,000 in property harm legal responsibility protection. That is usually abbreviated as 25/50/20.

25/50/20: $25,000 per particular person, $50,000 per accident, $20,000 in property harm.

Penalties of Driving With out Insurance coverage in Illinois

Driving with out insurance coverage in Illinois can lead to extreme penalties, together with fines, penalties, and even the suspension of your driver’s license. In case you are concerned in an accident and are discovered to be uninsured, you might be held personally answerable for damages, which can lead to monetary smash.

- Fines and penalties: The primary offense can lead to a wonderful of as much as $1,000, and subsequent offenses can lead to even increased fines.

- License suspension: Your driver’s license could also be suspended for a interval of as much as one 12 months.

- Automobile impoundment: Your automobile could also be impounded, and you might be required to pay a charge to retrieve it.

- Felony expenses: In some circumstances, driving with out insurance coverage could end in felony expenses, corresponding to a Class A misdemeanor.

Extra Protection Choices in Illinois

Having the fitting automotive insurance coverage protection is essential in Illinois. Whereas the state requires a minimal stage of legal responsibility protection, you might need to think about further choices to guard your self and your automobile. On this part, we’ll discover the variations between full protection and liability-only insurance coverage, in addition to optionally available protection for riders, boats, or bikes.

Distinction between Full Protection and Legal responsibility-Solely Insurance coverage

Full protection insurance coverage consists of legal responsibility protection, collision protection, and complete protection. Legal responsibility protection helps pay for damages to different folks’s property or medical bills in case of an accident. Collision protection covers damages to your automobile, even when the accident is your fault. Complete protection protects your automobile from non-accident occasions, corresponding to theft, vandalism, hearth, or pure disasters.

Legal responsibility-only insurance coverage, however, solely covers damages to different folks’s property or medical bills. In case you go for liability-only insurance coverage, you may have to cowl any damages to your automobile your self.

Advantages and Drawbacks of Including Complete and Collision Protection

Including complete and collision protection can present peace of thoughts and monetary safety. Here is a breakdown of the advantages and disadvantages:

* Advantages:

+ Complete protection will help you recuperate from theft, vandalism, or pure disasters.

+ Collision protection will help you restore or substitute your automobile should you’re concerned in an accident.

* Drawbacks:

+ Complete and collision protection include increased premiums.

+ You might have to pay a deductible when submitting a declare.

Non-compulsory Protection for Riders, Boats, or Bikes, Greatest automotive insurance coverage illinois

You probably have riders, boats, or bikes, you might need to think about further protection to guard these property. Listed here are some choices:

* Private Damage Safety (PIP) protection: This protection helps pay for medical bills, no matter who’s at fault.

* Uninsured/underinsured motorist protection: This protection helps shield you from drivers who haven’t got insurance coverage or ample insurance coverage.

* Watercraft protection: This protection protects your boat or different watercraft from harm or theft.

* Motorbike protection: This protection protects your bike from harm or theft.

Forms of Extra Protection

When contemplating further protection, maintain the next varieties in thoughts:

*

- Private Damage Safety (PIP) protection:

+ Helps pay for medical bills, no matter who’s at fault.

+ Usually included with complete and collision protection.

+ Will be personalized to incorporate particular advantages, corresponding to imaginative and prescient care or bodily remedy.

*

- Uninsured/underinsured motorist protection:

+ Protects you from drivers who haven’t got insurance coverage or ample insurance coverage.

+ Helps pay for medical bills, property harm, or different losses.

+ Could also be included with complete and collision protection.

The Means of Submitting a Declare

The method of submitting a automotive insurance coverage declare in Illinois sometimes includes the next steps: contacting your insurance coverage supplier, offering documentation, and receiving a declare adjustment. Here is an in depth overview of the method:

First, notify your insurance coverage supplier as quickly as doable after the lined occasion. This may assist make sure that your declare is processed shortly and effectively. While you contact your insurance coverage supplier, you may sometimes be requested for some fundamental data, corresponding to your coverage quantity, the date and placement of the incident, and an outline of what occurred.

As soon as you have reported the declare, your insurance coverage supplier will ship an adjuster to evaluate the harm to your automobile. In case your automobile is broken, you might have to take it to a restore store specified by your insurance coverage supplier. Your insurance coverage supplier can even ask for documentation, corresponding to police reviews, witness statements, and restore estimates.

After you have supplied all the required documentation, your insurance coverage supplier will assessment your declare and decide the quantity of the declare adjustment. In case your declare is authorised, you may obtain a fee for the damages. In case your declare is denied, your insurance coverage supplier will clarify why and supply steerage on the way to proceed.

Deductibles and Declare Changes

When submitting a automotive insurance coverage declare, you might be required to pay a deductible. A deductible is a set quantity that you should pay for every declare earlier than your insurance coverage supplier pays out any damages. The deductible quantity is often a share of the full damages or a flat charge, relying in your coverage.

For instance, when you have a $1,000 deductible and your automobile is broken to the tune of $3,000, you may have to pay the primary $1,000, and your insurance coverage supplier can pay the remaining $2,000. Remember the fact that not all insurance policies require deductibles, so remember to examine your coverage particulars fastidiously.

Examples of Declare Experiences

To higher perceive what to anticipate when submitting a automotive insurance coverage declare in Illinois, let’s take a look at a couple of examples of declare experiences:

* Sarah was concerned in a fender bender whereas driving to work. She reported her declare to her insurance coverage supplier and supplied all the required documentation. Her insurance coverage supplier shortly processed her declare, and he or she obtained a fee for the damages.

* John’s automobile was stolen from his driveway. He reported his declare to his insurance coverage supplier, and so they despatched an adjuster to evaluate the scenario. John’s insurance coverage supplier in the end denied his declare as a result of he did not have complete protection.

* Emily was rear-ended whereas driving residence from work. She reported her declare to her insurance coverage supplier and supplied all the required documentation. Her insurance coverage supplier processed her declare shortly, and he or she obtained a fee for the damages.

These examples illustrate the significance of understanding your insurance coverage coverage and the claims course of. By realizing what to anticipate, you may assist make sure that your declare is processed effectively and that you simply obtain the compensation you are entitled to.

Desk of Claims Timelines

| Declare Sort | Common Timeline for Declare Approval |

| — | — |

| Auto accident declare | 10-20 enterprise days |

| Theft or vandalism declare | 15-30 enterprise days |

| Complete declare | 20-40 enterprise days |

Word: These timelines could differ relying on the complexity of the declare and the insurance coverage supplier’s processing occasions.

Significance of Documentation

When submitting a automotive insurance coverage declare in Illinois, documentation is essential. Your insurance coverage supplier will sometimes require you to offer documentation, corresponding to police reviews, witness statements, and restore estimates.

Automobile Insurance coverage Legal guidelines and Laws in Illinois: Greatest Automobile Insurance coverage Illinois

The state of Illinois has a strict set of legal guidelines and laws in place to control the insurance coverage business. These legal guidelines are designed to guard shoppers and make sure that insurance coverage suppliers function pretty and in compliance with state laws. On this part, we are going to discover the function of the Illinois Secretary of State in implementing insurance coverage laws, the implications of the Illinois Insurance coverage Code on automotive insurance coverage suppliers, and the penalties for violating automotive insurance coverage legal guidelines within the state.

The Function of the Illinois Secretary of State

The Illinois Secretary of State performs a vital function in implementing insurance coverage laws within the state. The Secretary of State’s workplace is answerable for licensing and regulating insurance coverage firms, brokers, and brokers. This consists of reviewing and approving insurance coverage firm charges, insurance policies, and contracts. The workplace can also be answerable for investigating client complaints and taking disciplinary motion in opposition to insurance coverage firms that fail to adjust to state laws.

The Secretary of State’s workplace makes use of quite a lot of instruments to implement insurance coverage laws, together with:

- Common audits of insurance coverage firms to make sure compliance with state laws

- Investigating client complaints and taking disciplinary motion in opposition to insurance coverage firms that fail to resolve disputes pretty

- Monitoring insurance coverage firm charges and insurance policies to make sure they’re truthful and in compliance with state laws

The Illinois Insurance coverage Code

The Illinois Insurance coverage Code is a complete set of legal guidelines that govern the insurance coverage business within the state. The code requires insurance coverage firms to offer protection to drivers within the state, together with minimal legal responsibility protection, uninsured motorist protection, and private harm safety (PIP) protection. The code additionally requires insurance coverage firms to offer discover to policyholders of modifications to their protection or premiums, and to keep up a minimal stage of monetary reserves to fulfill claims.

The Illinois Insurance coverage Code additionally requires insurance coverage firms to file their charges and insurance policies with the Secretary of State’s workplace for approval. This ensures that insurance coverage firms should not participating in price gouging or promoting insurance policies that aren’t in compliance with state laws.

Penalties for Violating Automobile Insurance coverage Legal guidelines

Insurance coverage firms that fail to adjust to Illinois automotive insurance coverage legal guidelines face critical penalties, together with:

- Revocation of their license to function within the state

- Fines of as much as $100,000 per violation

- Restoration of all income made on account of the violation

Policyholders who fail to keep up minimal required insurance coverage protection additionally face penalties, together with:

- Revocation of their driver’s license

- Fines of as much as $1,000

- Impoundment of their automobile

Shopper Protections

The Illinois Insurance coverage Code supplies a number of client protections, together with:

- The fitting to file a grievance in opposition to an insurance coverage firm with the Secretary of State’s workplace

- The fitting to obtain discover of modifications to protection or premiums

- The fitting to request a listening to with the Secretary of State’s workplace if a dispute can’t be resolved pretty by the insurance coverage firm

The Illinois Insurance coverage Code is designed to guard shoppers by making certain that insurance coverage firms function pretty and in compliance with state laws. Policyholders ought to pay attention to their rights and the penalties for non-compliance to make sure that they’re protected within the occasion of a dispute.

Wrap-Up

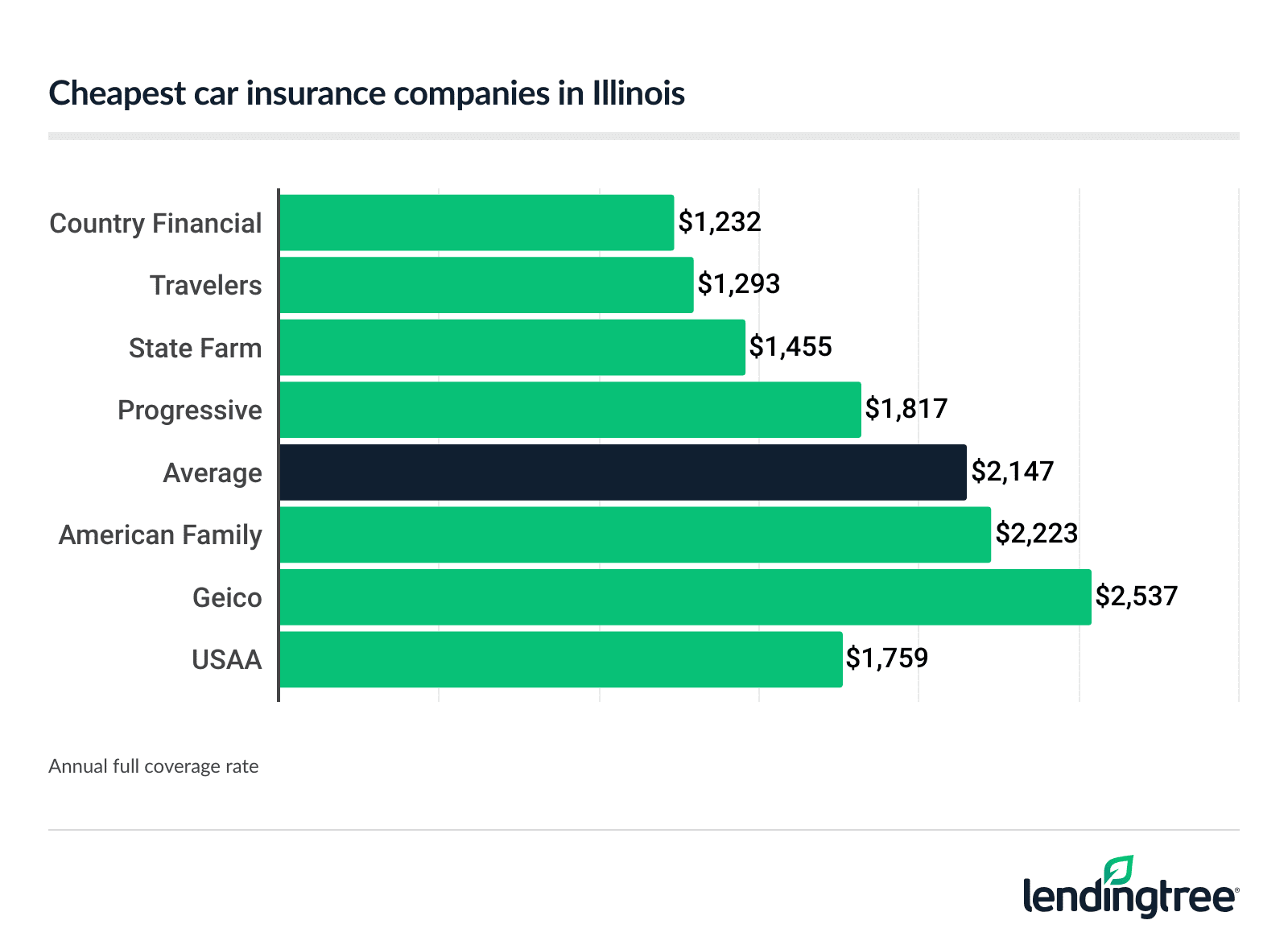

In terms of discovering the perfect automotive insurance coverage in Illinois, there are a number of components to think about, together with your funds, driving historical past, and placement. By understanding your choices and doing all of your analysis, you can also make an knowledgeable determination and select a coverage that meets your wants and supplies the fitting stage of safety. Bear in mind to at all times assessment your coverage fastidiously and ask questions should you’re not sure about something.

Key Questions Answered

What’s the minimal required automotive insurance coverage in Illinois?

The minimal required automotive insurance coverage in Illinois is legal responsibility insurance coverage, which covers damages to different folks and property within the occasion of an accident.

How do I select the perfect automotive insurance coverage firm in Illinois?

When selecting a automotive insurance coverage firm in Illinois, think about components corresponding to customer support, claims dealing with, and coverage choices. You can too learn opinions and scores from different prospects to get an thought of how the corporate performs.

What reductions can be found for Illinois drivers?

Some automotive insurance coverage firms in Illinois provide reductions for drivers who’ve a number of vehicles insured, have accomplished a defensive driving course, or who bundle their residence and auto insurance coverage insurance policies.