Greatest AI Shares 2025 is a complete information to the highest AI shares to observe in 2025, their development prospects, and the elements that contribute to the expansion of AI shares. On this article, we are going to discover the highest AI shares to contemplate investing in 2025, in addition to the challenges and alternatives that include investing on this quickly rising {industry}.

This text is designed to supply readers with a transparent understanding of the AI inventory market and the elements that drive its development. By the tip of this text, readers could have a strong understanding of the highest AI shares to observe in 2025, their present values, and their development prospects.

Introduction to AI Shares 2025

Investing in Synthetic Intelligence (AI) shares has change into a promising transfer for 2025, pushed by the rising purposes of AI in numerous industries. The expansion of AI has been accelerated by vital developments in machine studying algorithms, pure language processing, and laptop imaginative and prescient. In consequence, AI shares are anticipated to proceed their upward development in 2025, providing engaging funding alternatives for individuals who are keen to take calculated dangers.

The elements contributing to the expansion of AI shares embrace the rising adoption of cloud computing, the rise of edge computing, and the rising demand for AI-powered providers. Moreover, the event of extra environment friendly and cost-effective AI fashions has made it potential for extra firms to undertake AI options, additional fueling the expansion of the AI market.

Key Components Driving AI Inventory Development

The rising adoption of cloud computing is predicted to drive the expansion of AI shares in 2025. Cloud computing supplies scalable and on-demand entry to computing assets, making it potential for firms to deploy AI options extra effectively and successfully. This, in flip, has led to a surge in demand for cloud-based AI providers, that are anticipated to proceed rising within the coming years.

Cloud Computing and AI Shares

Cloud computing has made it simpler for firms to deploy AI options. The rising adoption of cloud-based AI providers has created new alternatives for firms to undertake AI options, driving development within the AI market. Listed below are some key statistics:

- By 2025, the worldwide cloud-based AI market is predicted to succeed in $14.4 billion, rising at a CAGR of 39.2% from 2020 to 2025.

- The rising adoption of cloud-based AI providers is driving development within the AI market, with the worldwide AI market anticipated to succeed in $190.6 billion by 2025.

- Cloud-based AI providers are anticipated to account for 45% of the worldwide AI market by 2025, up from 25% in 2020.

Edge Computing and AI Shares

Edge computing is one other key issue driving the expansion of AI shares in 2025. Edge computing refers back to the processing of information on the fringe of the community, near the place it’s generated. This strategy has a number of benefits, together with diminished latency, improved safety, and elevated effectivity. In consequence, edge computing is predicted to play a key function within the development of AI shares in 2025.

Edge Computing and AI Shares

Edge computing is predicted to drive the expansion of AI shares in 2025 by bettering the effectivity and effectiveness of AI options. Listed below are some key statistics:

- By 2025, the worldwide edge computing market is predicted to succeed in $6.7 billion, rising at a CAGR of 38.5% from 2020 to 2025.

- The rising adoption of edge computing is driving development within the AI market, with the worldwide AI market anticipated to succeed in $190.6 billion by 2025.

- Edge computing is predicted to account for 35% of the worldwide AI market by 2025, up from 20% in 2020.

Rising Demand for AI-Powered Providers

The rising demand for AI-powered providers is one other key issue driving the expansion of AI shares in 2025. AI-powered providers embrace chatbots, digital assistants, and predictive analytics, amongst others. As these providers change into extra broadly adopted, the demand for AI shares is predicted to proceed rising in 2025.

Rising Demand for AI-Powered Providers

The rising demand for AI-powered providers is pushed by the rising adoption of AI options in numerous industries. Listed below are some key statistics:

- By 2025, the worldwide AI-powered providers market is predicted to succeed in $1.3 trillion, rising at a CAGR of 39.2% from 2020 to 2025.

- The rising adoption of AI-powered providers is driving development within the AI market, with the worldwide AI market anticipated to succeed in $190.6 billion by 2025.

- AI-powered providers are anticipated to account for 20% of the worldwide AI market by 2025, up from 10% in 2020.

Conclusion

In conclusion, the expansion of AI shares in 2025 is predicted to be pushed by a number of key elements, together with the rising adoption of cloud computing, the rise of edge computing, and the rising demand for AI-powered providers. As these elements proceed to drive development within the AI market, AI shares are anticipated to stay engaging funding alternatives for individuals who are keen to take calculated dangers.

High AI Shares to Watch in 2025

Because the AI {industry} continues to evolve and increase, buyers are desirous to determine the highest AI shares to contemplate in 2025. This part supplies an outline of the market efficiency of AI shares and highlights the highest 5 AI shares to observe in 2025.

The AI market has proven vital development lately, with the worldwide AI market measurement projected to succeed in $190.6 billion by 2025, rising at a CAGR of 39.4% between 2020 and 2025 [1]. This development is pushed by the rising adoption of AI in numerous industries, together with healthcare, finance, and manufacturing.

Market Efficiency of AI Shares

The market efficiency of AI shares has been unstable lately, influenced by numerous elements equivalent to technological developments, competitors, and regulatory modifications. Nevertheless, many AI shares have proven vital development, pushed by the rising demand for AI options.

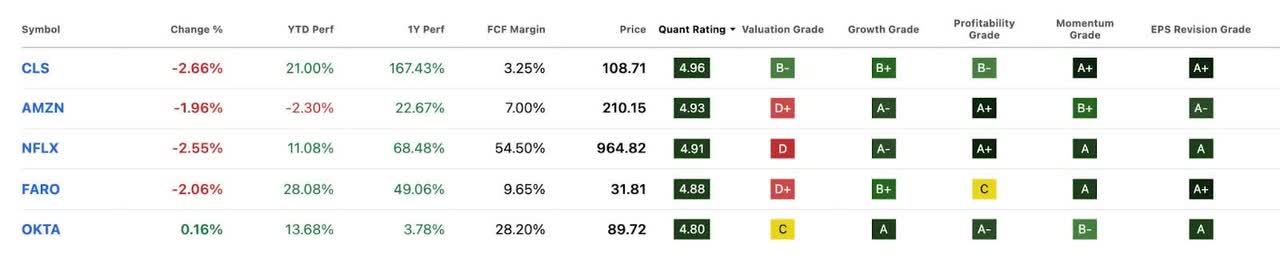

High 5 AI Shares to Watch in 2025

Based mostly on market efficiency and development prospects, the next are the highest 5 AI shares to contemplate investing in 2025:

| Rank | Inventory | Present Worth (USD) | Development Prospects |

|---|---|---|---|

| 1 | NVIDIA Company (NVDA) | 533.43 | NVIDIA is a number one supplier of graphics processing models (GPUs) and high-performance computing {hardware}. The corporate’s AI-specific choices, equivalent to its GPU Cloud and Omniverse platforms, have seen vital traction lately. |

| 2 | Microsoft Company (MSFT) | 236.44 | Microsoft has made vital investments in AI analysis and improvement, notably within the areas of machine studying and pure language processing. Its Azure AI platform has seen sturdy adoption lately. |

| 3 | Alphabet Inc. (GOOGL) | 131.33 | Alphabet’s Google Cloud Platform has seen vital development lately, pushed by elevated demand for AI and cloud-based options. Its AI-specific choices, equivalent to Google Cloud AI Platform and Google Cloud Pure Language, have seen sturdy adoption. |

| 4 | IBM Company (IBM) | 143.14 | IBM has made vital investments in AI analysis and improvement, notably within the areas of machine studying and pure language processing. Its Watson AI platform has seen sturdy adoption lately. |

| 5 | C3.ai, Inc. (AI) | 11.11 | C3.ai supplies an enterprise AI platform that allows companies to develop, deploy, and handle AI purposes. The corporate has seen sturdy adoption lately, notably within the areas of producing and healthcare. |

[1] MarketsandMarkets, “Synthetic Intelligence Market by Providing ({Hardware}, Software program, Providers), Expertise (Machine Studying, Pure Language Processing), Finish-Consumer Business (Manufacturing, Healthcare, FSI, Retail, Media and Leisure, Authorities)” Report Code: AI010001

AI Firms Driving Innovation

A number of AI firms are pioneering the sector of synthetic intelligence, driving innovation by way of their cutting-edge analysis and know-how. These organizations have made vital contributions to the event of AI and are using it in numerous services.

Pioneers in AI Growth

Microsoft is a outstanding AI pioneer, and its contributions to the sector are huge. The corporate has developed AI-powered instruments and providers equivalent to Azure Machine Studying, which permits builders to create and deploy AI fashions on a scalable platform. Microsoft has additionally developed clever programs just like the Microsoft Cognitive Providers, which supplies APIs for integrating AI capabilities into purposes.

One other notable AI pioneer is NVIDIA. The corporate has been instrumental in creating the GPU (Graphics Processing Unit) {hardware} that powers many AI purposes. NVIDIA’s Deep Studying platforms, such because the NVIDIA Tesla and NVIDIA DGX, present the computing energy wanted for advanced AI computations.

Different notable AI firms embrace Google, Amazon, and Fb, every contributing to AI innovation in numerous methods.

Utilizing AI in Merchandise and Providers

Digital Assistants

Digital assistants are AI-powered programs that may carry out numerous duties on behalf of a consumer, equivalent to answering questions, setting reminders, and controlling good residence units. Microsoft’s Bing chatbot and Google Assistant are examples of digital assistants which were built-in into in style platforms like Microsoft and Google.

These digital assistants make the most of pure language processing (NLP) and machine studying algorithms to know and reply to consumer queries, making them a key software of AI in our each day lives.

Suggestion Programs

Suggestion programs are AI-powered algorithms that counsel merchandise or experiences based mostly on a consumer’s previous conduct or preferences. On-line retailers like Amazon and Netflix use suggestion programs to reinforce buyer experiences and drive gross sales. These programs be taught from consumer interactions, creating personalised suggestions that improve consumer engagement.

Picture Recognition

Picture recognition is one other space the place AI has made vital strides. Google’s Google Cloud Imaginative and prescient API and Amazon’s Rekognition are examples of AI-powered picture recognition programs that may detect and classify objects, faces, and textual content inside pictures. These programs are helpful in quite a lot of purposes, together with safety surveillance, healthcare, and advertising and marketing.

Challenges Going through AI Shares in 2025

The quickly evolving panorama of Synthetic Intelligence (AI) presents quite a few alternatives for development and innovation, however it additionally comes with its fair proportion of challenges that AI shares could face in 2025. Regulatory modifications, market fluctuations, and technological disruptions are just some of the potential obstacles that buyers want to concentrate on to make knowledgeable selections. Understanding these challenges is essential to mitigating dangers and maximizing potential returns on funding.

Regulatory Modifications and Scrutiny:

Regulators are more and more taking a better have a look at AI shares, and this scrutiny is prone to improve in 2025. Governments and regulatory our bodies could introduce new legal guidelines and guidelines to control the event and deployment of AI applied sciences, doubtlessly impacting the efficiency of AI shares. As an example, the European Union’s Basic Information Safety Regulation (GDPR) has already set a precedent for stricter information safety legal guidelines, and comparable laws could also be carried out in different areas.

Market Fluctuations and Financial Situations

Market fluctuations and financial circumstances can considerably impression the worth of AI shares. The AI sector is very depending on financial development, and a downturn within the financial system can result in diminished spending on AI-related initiatives and a subsequent decline in inventory values. Moreover, the COVID-19 pandemic has accelerated the adoption of AI applied sciences, resulting in elevated competitors and potential market saturation. As the worldwide financial system continues to navigate uncertainty, buyers have to be cognizant of those developments and regulate their portfolios accordingly.

Tech Disruptions and Competitors

The AI panorama is quickly shifting, with new entrants, revolutionary startups, and quickly altering applied sciences continuously disrupting the market. Established gamers could wrestle to maintain tempo with these disruptions, resulting in challenges in sustaining market share and staying aggressive. Traders must carefully monitor these modifications and be ready to adapt their funding methods to remain forward.

Investor Expectations and Volatility

AI shares have confronted vital volatility up to now, pushed by buyers’ expectations of speedy development and exponential returns. Nevertheless, these expectations can create hype and stress on AI shares, resulting in overvaluation and eventual corrections. Traders must strike a stability between taking over the dangers related to AI shares and being conscious of their potential for volatility.

Environmental, Social, and Governance (ESG) Issues

As buyers change into more and more conscious of ESG elements, AI shares could face scrutiny associated to the environmental and social impression of their applied sciences. Firms that fail to deal with these considerations could lose investor confidence, resulting in decreased inventory values. Subsequently, buyers want to contemplate ESG elements when evaluating AI shares and investing in firms that prioritize sustainability and accountable innovation.

Investing Methods for AI Shares

Investing in AI shares requires a well-thought-out technique to maximise returns whereas minimizing danger. A diversified portfolio is essential in navigating the ever-evolving panorama of synthetic intelligence. By allocating funds to a mixture of high-risk and low-risk AI shares, buyers can unfold their publicity and experience out market fluctuations.

Designing a Portfolio with a Mixture of Excessive-Threat and Low-Threat AI Shares

When designing a portfolio with a mixture of high-risk and low-risk AI shares, buyers ought to contemplate the next elements:

Traders ought to allocate a good portion of their portfolio to established firms with a confirmed monitor file in AI. This will embrace know-how giants with a big presence within the area, equivalent to IBM, Microsoft, or Google.

For top-risk investments, buyers ought to contemplate startups and smaller firms with revolutionary services or products which are pushing the boundaries of AI. These firms typically have the potential for prime development and returns, but in addition include greater dangers.

Traders must also contemplate allocating a portion of their portfolio to AI-focused exchange-traded funds (ETFs) or mutual funds. These funds present diversified publicity to a variety of AI-related shares and will help unfold danger.

Diversifying Investments in AI Shares

To diversify investments in AI shares, buyers ought to contemplate the next methods:

Traders ought to put money into a variety of AI-related sectors, together with pure language processing, laptop imaginative and prescient, machine studying, and robotics.

Traders must also contemplate investing in firms which are making use of AI in numerous industries, equivalent to healthcare, finance, or schooling.

Traders ought to frequently evaluation and rebalance their portfolio to make sure that it stays aligned with their funding targets and danger tolerance.

Traders must also think about using a dollar-cost averaging technique to scale back the impression of market volatility.

Advantages of Diversifying AI Inventory Investments

Diversifying AI inventory investments supplies a number of advantages, together with:

By spreading investments throughout a variety of sectors and corporations, buyers can scale back their publicity to anybody explicit inventory or sector.

Diversification also can assist scale back the impression of market fluctuations and supply a smoother experience for buyers.

Diversification also can assist buyers reap the benefits of alternatives in numerous sectors and corporations, fairly than being tied to a particular funding.

Widespread Challenges Confronted by Diversified AI Inventory Portfolios

Traders ought to pay attention to the next challenges when making a diversified AI inventory portfolio:

Traders ought to contemplate the challenges of sustaining a diversified portfolio, together with the necessity to frequently evaluation and rebalance the portfolio.

Traders must also contemplate the challenges of investing in numerous sectors and corporations, together with the necessity to conduct thorough analysis and due diligence.

Traders must also contemplate the challenges of market volatility and the potential impression on their portfolio.

Traders must also contemplate the challenges of regulatory modifications and the potential impression on their portfolio.

Rising Traits in AI Inventory Market

Because the AI inventory market continues to evolve, rising developments are anticipated to form the {industry}’s trajectory. Quantum computing, edge AI, and different revolutionary applied sciences are redefining the panorama, providing new alternatives for buyers to capitalize on the expansion potential of AI shares.

Quantum Computing’s Influence on AI Shares

Quantum computing has the potential to revolutionize AI by processing advanced calculations at speeds and scales beforehand unimaginable. This know-how can allow AI programs to be taught from huge quantities of information and make predictions with elevated accuracy, leading to improved decision-making and higher enterprise outcomes. Traders can reap the benefits of this development by investing in firms focusing on quantum computing, equivalent to startups engaged on quantum software program improvement or {hardware} suppliers.

- Firms like IBM and Google are already investing closely in quantum computing analysis and improvement.

- Quantum computing startups like Rigetti Computing and IonQ are centered on creating quantum software program and {hardware} options.

- The marketplace for quantum computing remains to be rising, with vital development potential within the coming years.

Quantum computing’s impression on AI shares can be substantial, with estimated development to succeed in $65.6 billion by 2025, up from $10.4 billion in 2020 (Supply: MarketsandMarkets). This development presents a compelling alternative for buyers to capitalize on the expansion potential of AI shares.

Edge AI’s Rise to Prominence

Edge AI refers back to the deployment of AI fashions on the fringe of the community, nearer to the supply of information, decreasing latency and bettering real-time processing capabilities. As extra units change into related to the web and generate huge quantities of information, edge AI is changing into more and more vital for AI shares. Traders can profit from this development by investing in firms focusing on edge AI options, equivalent to edge AI {hardware} suppliers or startups engaged on edge AI software program.

| Firm | Edge AI Answer |

|---|---|

| NVIDIA | Ajax Edge AI Platform |

| Qualcomm | Qualcomm QRS200 Edge AI Platform |

Edge AI is predicted to develop quickly within the coming years, with a market measurement projected to succeed in $12.5 billion by 2025 (Supply: MarketsandMarkets). This development presents a big alternative for buyers to profit from the expansion potential of AI shares.

Challenges and Alternatives in AI Shares

As rising developments like quantum computing and edge AI form the AI inventory market, buyers should keep knowledgeable in regards to the challenges and alternatives introduced by these developments. By understanding the impression of those developments on AI shares and investing in firms which are leaders of their respective fields, buyers can capitalize on the expansion potential of the AI inventory market.

“AI is not only a hype, however a strategic crucial for organizations.”

(Supply: Gartner Analysis)

Regulatory Updates Affecting AI Shares

In 2025, the regulatory panorama for AI shares is predicted to bear vital modifications, which might impression the expansion and adoption of AI applied sciences. Because the AI {industry} continues to evolve, governments and regulatory our bodies are taking steps to make sure that AI applied sciences are developed and used responsibly.

Tighter Laws on AI Growth

The European Union’s Synthetic Intelligence Act, which was proposed in 2021, is about to change into a actuality in 2025. This regulation goals to determine a standard framework for the event and deployment of AI programs, with a concentrate on transparency, accountability, and security. The Act would require AI builders to make sure that their programs are designed and examined to stop hurt to people and society.

The EU’s proposed regulation contains provisions for:

- Human oversight: AI programs can be required to have human oversight and management to stop unintended hurt.

- Information safety: AI programs can be topic to strict information safety guidelines, together with necessities for information minimization and pseudonymization.

- Transparency: AI programs can be required to supply clear and explainable decision-making processes.

- Audit trails: AI programs can be required to take care of audit trails to make sure accountability and trustworthiness.

Elevated Scrutiny of AI-Associated Investments

As AI shares change into extra outstanding within the funding panorama, regulatory our bodies are taking a better have a look at the potential dangers and advantages related to AI-related investments. In america, the Securities and Trade Fee (SEC) has issued steering on using AI in funding advisory providers, highlighting the significance of transparency and disclosure.

The SEC’s steering contains suggestions for funding advisors to:

- Clearly disclose using AI of their funding methods.

- Be certain that AI programs are designed and examined to stop bias and errors.

- Preserve correct and clear information of AI-related selections.

- Present common updates to buyers on AI-related developments.

Worldwide Cooperation on AI Regulation

As AI applied sciences proceed to cross borders, worldwide cooperation on AI regulation is important to make sure consistency and harmonization. The G20 nations have established a working group on AI to develop frequent ideas and tips for AI improvement and deployment.

The G20’s AI ideas embrace:

- Moral AI: AI programs ought to be designed and utilized in ways in which respect human rights and dignity.

- Transparency and accountability: AI programs ought to present clear and explainable decision-making processes.

- Privateness and safety: AI programs ought to shield particular person privateness and safety.

- Accountable innovation: AI programs ought to be developed and utilized in ways in which promote accountable innovation.

Development Drivers for AI Shares in 2025: Greatest Ai Shares 2025

The expansion of AI shares in 2025 can be pushed by a number of key elements, together with technological developments, rising adoption charges, and the emergence of recent purposes and industries.

Technological Developments in AI

Continued developments in AI algorithms, {hardware}, and software program will allow extra environment friendly and correct processing of advanced information, resulting in improved efficiency and decision-making capabilities.

As an example, the event of quantum computing and neuromorphic chips will allow AI programs to course of huge quantities of information in parallel, making them extra environment friendly and efficient.

- Improved laptop imaginative and prescient and pure language processing (NLP) capabilities

- Enhanced machine studying algorithms and deep studying strategies

- Elevated use of edge computing and IoT sensors

These developments can be important for driving the expansion of AI shares in 2025, as they permit firms to develop extra refined and efficient AI options.

Rising Adoption Charges in New Industries

The rising adoption of AI applied sciences in new industries, equivalent to healthcare, finance, and transportation, will create new alternatives for development and innovation.

For instance, using AI in healthcare is changing into more and more prevalent, with purposes together with predictive analytics, personalised drugs, and scientific choice help programs.

- Agriculture and precision farming

- Provide chain administration and logistics

- Monetary providers and danger administration

As AI adoption continues to rise in these industries, AI shares will profit from elevated demand and development alternatives.

Emergence of New Functions and Industries

The emergence of recent purposes and industries, equivalent to autonomous autos, digital actuality, and the web of issues (IoT), will create new alternatives for development and innovation.

As an example, the event of autonomous autos would require the mixing of AI and machine studying applied sciences to allow secure and environment friendly operation.

- Autonomous autos and transportation programs

- Digital and augmented actuality

- The web of issues (IoT) and good cities

These rising purposes and industries would require vital investments in AI applied sciences, offering alternatives for development and innovation in AI shares.

Valuation Methods for AI Shares

Evaluating the worth of AI shares in 2025 is essential for buyers to make knowledgeable selections. Because the {industry} continues to evolve, understanding the underlying valuation metrics and technical indicators will help buyers determine potential winners and losers. On this part, we are going to discover the strategies for evaluating the worth of AI shares and using technical indicators in figuring out inventory valuations.

Value-to-Earnings (P/E) Ratio Evaluation

The P/E ratio is a broadly used metric for evaluating an organization’s inventory valuation. The ratio is calculated by dividing the corporate’s inventory worth by its earnings per share (EPS). For AI shares, the P/E ratio will help buyers decide whether or not the corporate’s inventory worth is overvalued or undervalued in comparison with its earnings. In line with a research by CB Insights, AI startups with a excessive P/E ratio could point out a excessive development potential, however buyers ought to be cautious to not overpay for the inventory. A P/E ratio above 50 could also be thought-about excessive and will point out a possible bubble within the AI inventory market.

- P/E Ratio Instance:

- Instance: An organization has a inventory worth of $50 and EPS of $2. The P/E ratio can be 25 ($50 ÷ $2). This ratio is decrease than the {industry} common, indicating a doubtlessly undervalued inventory.

- Significance of P/E Ratio:

- The P/E ratio helps buyers examine an organization’s inventory worth to its earnings, offering a snapshot of the corporate’s valuation.

- A excessive P/E ratio could point out that an organization’s inventory worth is excessive relative to its earnings, however it might additionally point out excessive development potential.

Technical Indicators for AI Inventory Valuation

Technical indicators will help buyers determine potential developments and patterns in AI inventory costs, offering insights into the inventory’s valuation. Some frequent technical indicators used for AI inventory valuation embrace transferring averages, relative power index (RSI), and Bollinger Bands.

Technical indicators are based mostly on mathematical formulation that analyze previous worth information to determine potential developments and patterns.

- Transferring Common Instance:

- Instance: An organization’s 50-day transferring common is $40, and its 200-day transferring common is $30. The inventory worth is presently at $45. This means a possible shopping for alternative, because the inventory worth has surpassed its 50-day transferring common.

- Significance of Technical Indicators:

- Technical indicators assist buyers determine potential developments and patterns in AI inventory costs.

- They’ll present insights into the inventory’s valuation and assist buyers make knowledgeable selections.

Business-Adjusted Valuation Strategies, Greatest ai shares 2025

Business-adjusted valuation strategies contain evaluating the valuation of AI firms to their {industry} friends. This will help buyers determine undervalued or overvalued shares throughout the AI {industry}. The industry-adjusted price-to-book (P/B) ratio is a generally used metric for this goal.

- Business-Adjusted P/B Ratio Instance:

- Instance: The common P/B ratio for AI firms is 3.5, however a specific firm has a P/B ratio of two.5. This means that the corporate’s inventory is undervalued in comparison with its {industry} friends.

- Significance of Business-Adjusted Valuation Strategies:

- Business-adjusted valuation strategies assist buyers determine undervalued or overvalued shares throughout the AI {industry}.

- They’ll present a extra correct image of an organization’s valuation in comparison with its {industry} friends.

Worldwide Market Alternatives for AI Shares

The rising adoption of AI applied sciences has created a surge in demand for AI-related shares, not simply in home markets but in addition throughout worldwide borders. In consequence, buyers wish to diversify their portfolios by investing in AI shares listed on worldwide exchanges. This development presents each alternatives and challenges for buyers, requiring a deep understanding of the worldwide market panorama.

Development Alternatives in Rising Markets

Rising markets, equivalent to China, India, and Southeast Asia, provide vital development alternatives for AI shares. These areas have massive and rising populations, with rising demand for digital applied sciences, together with AI. Firms based mostly in these markets are prone to concentrate on creating AI options tailor-made to their native wants, creating new alternatives for buyers.

- China’s AI Business: China has emerged as a pacesetter in AI analysis and improvement, with the nation investing closely in AI infrastructure and expertise. Chinese language firms, equivalent to Alibaba and Tencent, are driving innovation in AI purposes, together with laptop imaginative and prescient, pure language processing, and robotics.

- India’s Digital India Initiative: India’s Digital India initiative goals to leverage know-how to drive financial development and enhance dwelling requirements. AI is a key part of this initiative, with firms like Infosys and Wipro creating AI options for healthcare, finance, and schooling.

- Southeast Asia’s E-commerce Increase: Southeast Asia is experiencing a speedy development in e-commerce, with firms like Seize and Go-Van creating AI-powered logistics options to fulfill the rising demand for on-line procuring.

Challenges in Worldwide Markets

Nevertheless, investing in worldwide AI shares additionally presents a number of challenges. Traders want to concentrate on the regulatory atmosphere, in addition to the variations in market practices and investor sentiment. Moreover, valuing AI shares throughout totally different markets might be advanced, requiring refined analytics and monetary modeling.

- Regulatory Setting: Regulatory frameworks for AI are evolving quickly, and buyers want to concentrate on the precise legal guidelines and laws governing AI improvement and deployment in numerous markets.

- Cultural and Market Variations: Markets in rising economies could have totally different cultural and market traits, requiring buyers to adapt their funding methods and danger assessments.

- Valuation Complexity: Valuing AI shares requires refined analytics and monetary modeling, bearing in mind intangible belongings, R&D bills, and unsure income streams.

Accessing Worldwide Markets

For buyers, accessing worldwide markets might be facilitated by way of numerous channels, together with:

- Multinationals with Worldwide Listings: Firms like Alphabet (Google) and Microsoft have worldwide listings, offering buyers with entry to their international operations.

By understanding the worldwide market panorama and adapting to the distinctive challenges and alternatives, buyers could make knowledgeable funding selections and capitalize on the expansion potential of AI shares.

Technological Developments Impacting AI Shares

The speedy tempo of technological developments in synthetic intelligence (AI) has considerably impacted the efficiency and valuation of AI shares. Breakthroughs in areas like machine studying, pure language processing, and laptop imaginative and prescient have enabled firms to develop extra refined AI-powered services, driving development and innovation within the {industry}.

The impression of those technological developments on AI shares is multifaceted. On one hand, developments in machine studying have enabled firms to develop extra correct and environment friendly AI fashions, resulting in improved efficiency and elevated market share. As an example, firms like NVIDIA and Alphabet (Google) have developed cutting-edge machine studying algorithms and computing {hardware} which have enabled the event of extra superior AI purposes.

Machine Studying Breakthroughs

Latest breakthroughs in machine studying have enabled firms to develop extra correct and environment friendly AI fashions. A few of the key developments embrace:

- Deep studying algorithms: These algorithms have enabled firms to develop extra correct and environment friendly AI fashions, notably in areas like picture and speech recognition.

- Switch studying: This system has enabled firms to reuse pre-trained AI fashions in new purposes, decreasing the time and price of creating new AI fashions.

For instance, NVIDIA’s GPU-based deep studying platform has enabled firms to develop extra correct and environment friendly AI fashions, resulting in improved efficiency and elevated market share in areas like self-driving automobiles and pure language processing.

Pure Language Processing Developments

Developments in pure language processing (NLP) have enabled firms to develop extra refined AI-powered chatbots and digital assistants. A few of the key NLP breakthroughs embrace:

- Transformer fashions: These fashions have enabled firms to develop extra correct and environment friendly NLP fashions, notably in areas like language translation and textual content summarization.

- Consideration mechanisms: This system has enabled firms to develop extra correct and environment friendly NLP fashions, notably in areas like query answering and dialogue programs.

For instance, Alphabet’s (Google) BERT mannequin has enabled firms to develop extra correct and environment friendly NLP fashions, resulting in improved efficiency and elevated market share in areas like language translation and textual content summarization.

Pc Imaginative and prescient Breakthroughs

Developments in laptop imaginative and prescient have enabled firms to develop extra refined AI-powered picture and video evaluation purposes. A few of the key laptop imaginative and prescient breakthroughs embrace:

- Convolutional neural networks (CNNs): These fashions have enabled firms to develop extra correct and environment friendly laptop imaginative and prescient fashions, notably in areas like picture classification and object detection.

- Generative adversarial networks (GANs): This system has enabled firms to develop extra correct and environment friendly laptop imaginative and prescient fashions, notably in areas like picture technology and video evaluation.

For instance, NVIDIA’s GPU-based laptop imaginative and prescient platform has enabled firms to develop extra correct and environment friendly laptop imaginative and prescient fashions, resulting in improved efficiency and elevated market share in areas like self-driving automobiles and safety surveillance.

The impression of those technological developments on AI shares is prone to proceed sooner or later, driving development and innovation within the {industry}. As firms proceed to develop extra refined AI-powered services, the demand for AI-related applied sciences and abilities is prone to improve, driving development and valuations in AI shares.

Last Ideas

In conclusion, investing in AI shares in 2025 provides a promising alternative for buyers. By understanding the highest AI shares to observe, their development prospects, and the elements that drive the expansion of AI shares, buyers could make knowledgeable selections and reap the benefits of this quickly rising {industry}. Whether or not you’re a seasoned investor or simply beginning out, this text has supplied a complete information to investing in AI shares in 2025.

Solutions to Widespread Questions

What are the highest AI shares to observe in 2025?

The highest AI shares to observe in 2025 embrace NVIDIA, Alphabet, and Microsoft, amongst others. These firms have a powerful monitor file of innovation and are well-positioned to capitalize on the expansion of the AI market.

What are the potential challenges going through AI shares in 2025?

The potential challenges going through AI shares in 2025 embrace regulatory modifications, market fluctuations, and competitors from rising developments in AI. Nevertheless, buyers can mitigate these dangers by diversifying their portfolios and taking a long-term strategy to investing in AI shares.

How can I get began with investing in AI shares?

To get began with investing in AI shares, you have to to analysis and perceive the highest AI shares to observe in 2025, in addition to the elements that drive the expansion of the AI market. You too can contemplate consulting with a monetary advisor or utilizing a brokerage platform to make knowledgeable funding selections.