Greatest use of amex factors – From explaining the assorted methods to earn American Categorical factors on journey, eating, and on a regular basis purchases, to sharing methods for maximizing the worth of your factors when reserving journey or redeeming for rewards, this text will stroll you thru the ins and outs of taking advantage of your Amex factors.

Maximizing American Categorical Factors Incomes Alternatives

With American Categorical, you may earn rewards factors on numerous classes, making it a flexible choice for maximizing your factors earnings. Whether or not you are eating, touring, or making on a regular basis purchases, you may earn rewards factors with American Categorical.

Incomes American Categorical Factors on Journey

When touring, you may earn American Categorical factors on numerous travel-related bills, together with flights, resorts, and automotive leases. For example, the American Categorical Platinum Card affords 5x factors on flights booked straight by Amex Journey. Moreover, you may earn factors on different journey bills, corresponding to taxis, subways, and parking.

- Flights: Earn 5x factors on flights booked straight by Amex Journey

- Inns: Earn 1x level on resort bookings

- Automotive Leases: Earn 1x level on automotive leases

- Public Transportation: Earn 1x level on taxis, subways, and parking

With American Categorical, you too can get pleasure from advantages like journey insurance coverage, automotive rental insurance coverage, and flight delay insurance coverage, making your journey experiences much more rewarding.

Incomes American Categorical Factors on Eating

Eating is one other space the place American Categorical factors may be earned. With the American Categorical Platinum Card, you may earn 5x factors at US eating places worldwide. Moreover, you may earn factors on different eating bills, corresponding to espresso retailers, bars, and high quality eating institutions.

- US Eating places: Earn 5x factors

- Espresso Outlets: Earn 1x level

- Bars: Earn 1x level

- Wonderful Eating: Earn 1x level

With American Categorical, you may get pleasure from advantages like eating reservations, rewards for loyalty applications, and unique entry to high quality eating experiences, making your eating experiences much more pleasant.

Incomes American Categorical Factors on On a regular basis Purchases

On a regular basis purchases are additionally eligible for incomes American Categorical factors. With the American Categorical On a regular basis Card, you may earn 2x factors on fuel and groceries. Moreover, you may earn factors on different on a regular basis bills, corresponding to utilities, cellphone payments, and streaming companies.

- Fuel: Earn 2x factors

- Groceries: Earn 2x factors

- Utilities: Earn 1x level

- Telephone Payments: Earn 1x level

- Streaming Companies: Earn 1x level

With American Categorical, you may get pleasure from advantages like no overseas transaction charges, journey insurance coverage, and buy safety, making your on a regular basis purchases much more rewarding.

Advantages of Having a Credit score Card with No International Transaction Charges

Having a bank card with no overseas transaction charges is a major profit when touring overseas. American Categorical bank cards don’t cost overseas transaction charges, making them a lovely choice for worldwide vacationers.

No overseas transaction charges means you may earn factors on worldwide purchases with out incurring extra expenses.

With American Categorical, you may get pleasure from advantages like no overseas transaction charges, journey insurance coverage, and buy safety, making your worldwide travels much more rewarding.

Comparability to Different Fashionable Credit score Card Rewards Applications

American Categorical factors may be in comparison with different widespread bank card rewards applications. For instance, Chase Final Rewards and Citi ThankYou Rewards additionally supply factors on numerous classes, together with journey and eating.

| Credit score Card | Journey Earnings | Eating Earnings |

| — | — | — |

| American Categorical Platinum Card | 5x factors | 5x factors |

| Chase Sapphire Most well-liked Card | 2x factors | 2x factors |

| Citi Premier Card | 3x factors | 1x level |

Whereas all three bank card rewards applications supply factors on journey and eating, American Categorical affords extra beneficiant rewards on these classes. Nevertheless, it is important to contemplate your particular person spending habits and desires when selecting a bank card rewards program.

Redemption Methods for Most Worth

Maximizing the worth of American Categorical factors requires a considerate strategy to redemption. By strategically reserving journey or utilizing factors in inventive methods, cardholders can get essentially the most out of their rewards. This part explores efficient redemption methods for American Categorical factors.

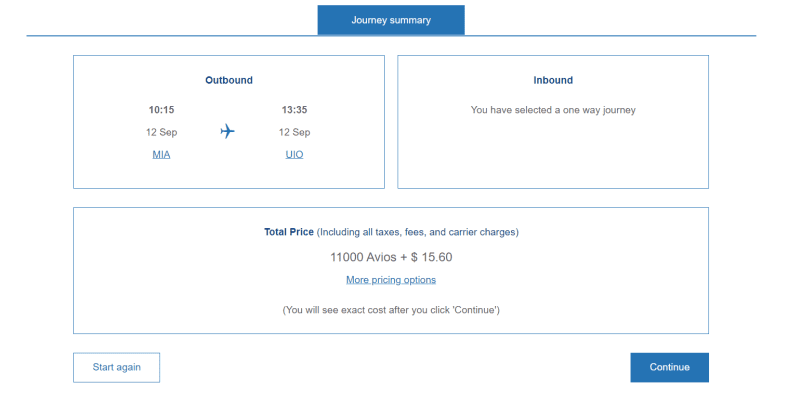

Reserving Journey Immediately with American Categorical

American Categorical affords a spread of journey reserving choices, permitting cardholders to e book flights, resort rooms, and extra straight utilizing their factors. This strategy affords a number of advantages, together with:

- Comfort: Reserving journey straight with American Categorical streamlines the method and eliminates the necessity to search a number of websites for one of the best offers.

- Assured Availability: American Categorical usually affords assured availability on flights and resort rooms, offering peace of thoughts for vacationers.

- Unique Affords: American Categorical could supply unique offers or reductions on journey bookings, maximizing the worth of factors.

- Simple Redemptions: Reserving journey straight with American Categorical makes it simple to redeem factors, with clear pricing and availability.

For instance, American Categorical’s “Membership Journey” program offers entry to unique offers on flights, resort rooms, and trip packages, providing cardholders a median of 30-40% extra worth than reserving with different journey corporations.

Transferring Factors to Loyalty Applications

American Categorical factors may be transferred to airline and resort loyalty applications, providing cardholders entry to unique rewards and advantages. This strategy requires a strategic understanding of loyalty program buildings and redemption alternatives.

Necessities for Redeeming American Categorical Factors, Greatest use of amex factors

To redeem American Categorical factors, cardholders should meet particular necessities, together with:

- Complete Factors Steadiness: Cardholders will need to have a minimal factors steadiness to redeem rewards, sometimes 1,000-5,000 factors.

- Membership Standing: Some rewards could require cardholders to have particular membership standing, corresponding to Platinum or Gold.

- Journey Bookings: Redemptions for journey could require a minimal journey length or particular journey dates.

For example, American Categorical requires a minimal of three,000 factors to redeem a present card, whereas assertion credit require a minimal of 1,000 factors.

Redeeming Factors for Rewards Apart from Journey

Whereas journey is a main redemption choice, American Categorical factors can be utilized for different rewards, corresponding to reward playing cards, assertion credit, and merchandise. These options could supply higher worth for sure cardholders.

- Present Playing cards: American Categorical affords a spread of reward playing cards, with various redemption values (e.g., $25 for two,500 factors).

- Assertion Credit: Cardholders can use factors to offset assertion expenses, offering flexibility in redemption choices.

- Merchandise: Redemption for merchandise, corresponding to electronics or residence items, could supply higher worth than journey redemptions.

Conclusion

Maximizing American Categorical factors requires a considerate strategy to redemption, contemplating reserving journey straight, transferring factors to loyalty applications, and understanding redemption necessities. By leveraging these methods, cardholders can unlock the total potential of their factors and revel in unique rewards and advantages.

Managing American Categorical Factors and Rewards

![What Are Amex Membership Rewards Points Worth? [37 FAQs] Best use of amex points](https://www.theglobetrottingteacher.com/wp-content/uploads/2023/07/ANAIAHHNDBiz-800x372.png)

American Categorical factors could be a invaluable useful resource for vacationers, buyers, and people who get pleasure from rewards applications. By understanding find out how to handle and redeem these factors, customers can maximize their advantages and revel in a variety of rewards and advantages.

Transferring American Categorical Factors to Different Loyalty Applications

Some of the efficient methods to leverage American Categorical factors is by transferring them to different loyalty applications that provide extra invaluable rewards. This could be a strategic transfer to maximise the worth of your factors, particularly when you’re close to the purpose threshold for a particular redemption.

Some widespread loyalty applications that settle for American Categorical factors transfers embrace:

- Australia and New Zealand Airline Teams: Customers can switch American Categorical factors to airline loyalty applications like Qantas Frequent Flyer, Virgin Australia Velocity Frequent Flyer, and Singapore Airways KrisFlyer amongst others.

- European Airways: Customers can switch factors to airline loyalty applications like British Airways Government Membership, Avios, and Cathay Pacific Asia Miles, with the choice to earn miles on flights inside Asia and throughout the globe.

Transferring factors to those loyalty applications can present customers with extra flexibility in redeeming their factors for flights, upgrades, or different travel-related rewards.

Incomes Rewards and Advantages with American Categorical Factors

Accruing a sure variety of American Categorical factors can unlock unique rewards and advantages. A few of these rewards embrace:

- Free flights or journey credit on associate airways or journey suppliers.

- Room upgrades or complimentary stays at luxurious resorts and resorts.

- Experiences like live shows, sports activities, or cultural occasions.

- Restaurant and eating reductions or credit.

The rewards and advantages related to accumulating American Categorical factors can improve the consumer expertise and supply alternatives to take pleasure in luxurious or discover new experiences with out breaking the financial institution.

Monitoring and Organizing American Categorical Factors Incomes and Redemption

Efficient level administration requires monitoring your earnings and redemption exercise. This may be achieved by:

- Utilizing the American Categorical cell app or on-line portal to watch your factors steadiness and up to date transactions.

- Setting reminders for upcoming redemption deadlines or level expiration dates.

- Organizing your factors into classes (e.g., journey, eating, or buying) to higher perceive your incomes patterns.

By staying organized and knowledgeable, customers can maximize the worth of their American Categorical factors and benefit from their rewards applications.

Methods for Preserving Monitor of Rewards Steadiness and Deadlines

To remain on prime of rewards steadiness and deadlines:

-

Arrange automated reminders or calendar occasions for upcoming redemptions or level expiration dates.

-

Use a spreadsheet or spreadsheet template to trace your factors steadiness, earnings, and redemptions over time.

-

Often overview your American Categorical account on-line or cell app to make sure accuracy and replace your monitoring information.

By implementing these methods, customers can decrease the danger of lacking out on invaluable rewards and optimize their level utilization for max profit.

Frequent Misconceptions About American Categorical Factors

American Categorical factors have usually been misunderstood as being much less invaluable than different rewards applications. Nevertheless, this could not be farther from the reality. By understanding the true worth of American Categorical factors and profiting from their advantages, anybody can maximize their rewards potential. American Categorical affords a variety of advantages, together with incomes bonus factors in particular classes, which may be significantly helpful for many who regularly spend in these areas.

Rumors of Decrease Worth

Many individuals imagine that American Categorical factors are much less invaluable than different rewards applications, corresponding to Chase or Citi. Nevertheless, this isn’t essentially true. Whereas it is true that sure redemption choices would possibly supply decrease redemption values, the general worth of American Categorical factors may be greater when contemplating their numerous redemption choices and advantages. For instance, American Categorical affords switch companions, corresponding to Delta Airways or Hilton Inns, which might supply considerably greater redemption values for journey.

Incomes Bonus Factors

One of many main advantages of American Categorical factors is incomes bonus factors in particular classes. For example, the American Categorical Blue Money Most well-liked Card earns 6% money again on grocery purchases, making it a wonderful alternative for customers who regularly store at grocery shops. Equally, the American Categorical Membership Rewards Program affords a spread of incomes classes, together with fuel stations, eating places, and extra. By incomes bonus factors in these classes, cardholders can maximize their rewards earnings.

Overcoming Obstacles

One of many primary challenges of incomes and redeeming American Categorical factors is staying inside their redemption thresholds. For example, some redemption choices require a minimal of 10,000 miles or 7,500 factors. Nevertheless, there are methods to beat these obstacles. Cardholders can earn extra factors by profiting from sign-up bonuses, utilizing referral hyperlinks, or maximizing their incomes potential with American Categorical bank cards that provide greater incomes charges. Moreover, American Categorical affords a spread of redemption choices that permit cardholders to redeem factors in numerous methods, corresponding to transferring factors to switch companions or redeeming them straight for assertion credit.

Comparability to Different Rewards Applications

American Categorical factors are sometimes in comparison with different widespread rewards applications, corresponding to Chase or Citi. Whereas these applications supply distinctive advantages and redemption alternatives, American Categorical factors have a number of benefits. For example, American Categorical affords a extra various vary of switch companions and redemption choices, which might supply greater redemption values for journey. Moreover, American Categorical bank cards usually supply extra complete advantages, corresponding to insurance coverage protection, concierge companies, and extra. When evaluating rewards applications, it is important to contemplate the precise wants and spending habits of the person cardholder.

American Categorical Redemption Worth Estimates

American Categorical factors are sometimes in comparison with different rewards applications based mostly on their estimated redemption values. In response to numerous estimates, American Categorical factors could supply redemption values starting from 1.6 to 2.2 cents per level. Whereas these estimates might not be universally relevant, they’ll present a normal concept of the worth of American Categorical factors. For instance, a 40,000-point redemption would possibly supply a price of round $640-$800, assuming a 1.6 to 2.2 cents per level redemption worth.

Conclusion (non-obligatory not included)

Conclusion: Greatest Use Of Amex Factors

In conclusion, maximizing the usage of your American Categorical factors requires a mixture of information, technique, and adaptability. By understanding the assorted methods to earn factors, maximizing the worth of your factors when redeeming, and profiting from the advantages and perks provided by Amex bank cards, you may get essentially the most out of your bank card rewards and obtain your monetary objectives.

Generally Requested Questions

What’s one of the best ways to earn American Categorical factors?

The easiest way to earn American Categorical factors is by utilizing your Amex bank card for on a regular basis purchases, corresponding to groceries, fuel, and eating, in addition to by profiting from sign-up bonuses and incomes factors on journey and different classes.

How do I maximize the worth of my American Categorical factors?

To maximise the worth of your American Categorical factors, think about using them to e book journey straight by Amex or transferring them to airline or resort loyalty applications, which might present extra worth in your factors.

What are the advantages of getting an American Categorical bank card?

The advantages of getting an American Categorical bank card embrace entry to airport lounges, journey insurance coverage, buy safety, and unique reductions and rewards.

Can I switch my American Categorical factors to different loyalty applications?

Sure, you may switch your American Categorical factors to different loyalty applications, corresponding to airline or resort loyalty applications, to maximise their worth.

How do I monitor and manage my American Categorical factors?

To trace and manage your American Categorical factors, think about using the Amex cell app or on-line account portal to watch your factors steadiness and redemption choices.