Finest brokerage accounts for choices reddit – the final word information to navigating the world of choices buying and selling. Whether or not you are a seasoned investor or a newcomer to the scene, discovering the fitting brokerage account could make all of the distinction in your success.

On this article, we’ll delve into the highest brokerage accounts for choices buying and selling on Reddit, exploring their options, charges, and person opinions. We’ll additionally focus on key issues when selecting a brokerage account, together with buyer assist, technical evaluation instruments, and cellular apps.

Overview of Choices Buying and selling on Reddit

On the huge panorama of retail investing, choices buying and selling on Reddit has emerged as a vibrant group the place lovers congregate to share data, methods, and experiences. On this world of economic hypothesis, Reddit’s choices buying and selling subreddits have grow to be a go-to vacation spot for these in search of to capitalize on volatility and navigate the complicated realm of derivatives.

The attract of choices buying and selling on Reddit lies in its community-driven method, the place seasoned merchants and newcomers alike share their insights and experience. By partaking with like-minded people, contributors can acquire invaluable steerage, keep away from pricey errors, and refine their buying and selling methods. Furthermore, Reddit’s platform supplies an accessible and nameless setting, permitting customers to discover and study choices buying and selling with out the strain of a dwell buying and selling ground.

A number of the hottest subreddits devoted to choices buying and selling embody:

Well-liked Choices Buying and selling Subreddits

These communities supply a wealth of knowledge, from beginner-friendly sources to superior buying and selling methods and market evaluation.

- r/choices

- r/options_trading

- r/option_premium

- r/options_gambling

This subreddit serves as a hub for choices buying and selling discussions, overlaying matters resembling technical evaluation, danger administration, and buying and selling methods.

This group focuses on choices buying and selling methods, together with iron condors, credit score spreads, and butterfly spreads.

This subreddit explores the idea of possibility premium, together with methods for maximizing returns and minimizing danger.

This group delves into the realm of speculative choices buying and selling, with discussions on hedging, hypothesis, and danger administration.

“Choices buying and selling is akin to navigating a posh chessboard, the place each transfer has potential penalties. A deep understanding of the underlying belongings, market situations, and buying and selling methods is crucial for achievement.”

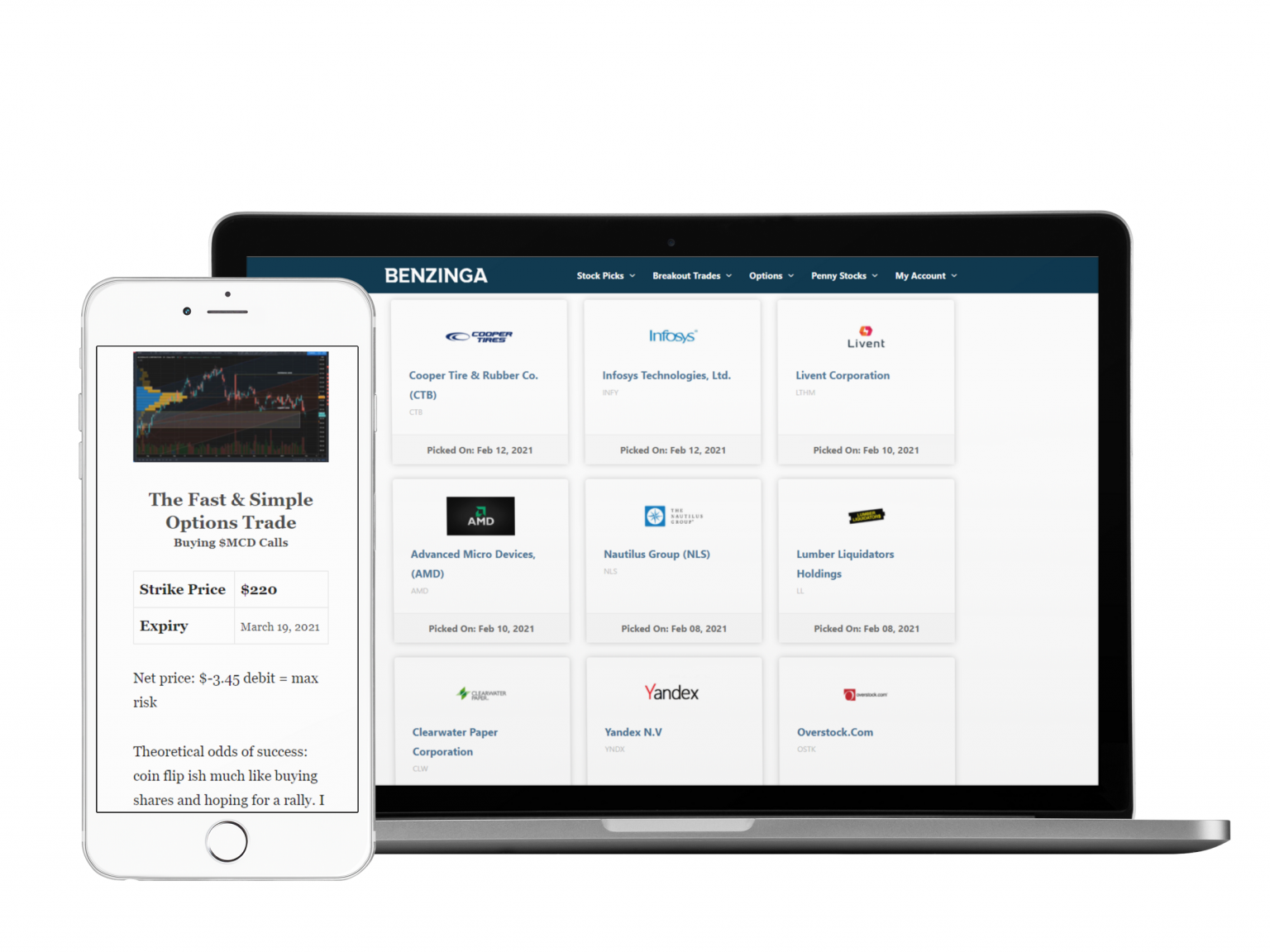

Prime Brokerage Accounts for Choices on Reddit

With regards to buying and selling choices, selecting the best brokerage account is essential. With quite a few choices obtainable, Reddit customers typically share their experiences, professionals, and cons, serving to to make an knowledgeable resolution. On this part, we’ll discover the highest brokerage accounts for choices buying and selling, highlighting their options, buyer suggestions, and the benefits and drawbacks of every.

TD Ameritrade

TD Ameritrade is a well-established brokerage agency providing a variety of providers, together with choices buying and selling. Its platform supplies superior instruments and analysis capabilities, making it a preferred alternative amongst skilled merchants. In accordance with Reddit customers, TD Ameritrade’s buyer assist is responsive and educated, with some customers praising its in depth academic sources. Nonetheless, others have reported excessive commissions and charges for sure providers.

- Superior buying and selling platform with real-time knowledge and evaluation instruments

- Complete analysis capabilities, together with analyst stories and scores

- Responsive buyer assist and in depth academic sources

- Excessive commissions and charges for sure providers

Robinhood

Robinhood is a well-liked brokerage agency identified for its user-friendly interface and low charges. Its commission-free buying and selling mannequin has made it a favourite amongst particular person traders and possibility merchants. Reddit customers reward Robinhood’s ease of use and aggressive pricing, however some have criticized its restricted analysis capabilities and lack of superior buying and selling instruments.

- Fee-free buying and selling for shares, choices, and ETFs

- Consumer-friendly interface with cellular app and net platform

- Aggressive pricing with no account charges or upkeep prices

- Restricted analysis capabilities and no superior buying and selling instruments

Constancy

Constancy is a good brokerage agency providing a variety of providers, together with choices buying and selling. Its platform supplies superior instruments and analysis capabilities, making it a preferred alternative amongst skilled merchants. In accordance with Reddit customers, Constancy’s buyer assist is educated and responsive, with some customers praising its in depth academic sources. Nonetheless, others have reported excessive commissions and charges for sure providers.

- Superior buying and selling platform with real-time knowledge and evaluation instruments

- Complete analysis capabilities, together with analyst stories and scores

- Responsive buyer assist and in depth academic sources

- Excessive commissions and charges for sure providers

E*TRADE

E*TRADE is a well-established brokerage agency providing a variety of providers, together with choices buying and selling. Its platform supplies superior instruments and analysis capabilities, making it a preferred alternative amongst skilled merchants. In accordance with Reddit customers, E*TRADE’s buyer assist is educated and responsive, with some customers praising its in depth academic sources. Nonetheless, others have reported excessive commissions and charges for sure providers.

- Superior buying and selling platform with real-time knowledge and evaluation instruments

- Complete analysis capabilities, together with analyst stories and scores

- Responsive buyer assist and in depth academic sources

- Excessive commissions and charges for sure providers

Safety Concerns for Choices Buying and selling

Choices buying and selling, whereas probably profitable, carries with it a large number of dangers that have to be navigated with warning. Because the saying goes, “with nice energy comes nice duty,” and on this context, the facility to control costs and capitalize on volatility have to be tempered with a deep consciousness of the related perils.

Dangers related to choices buying and selling embody limitless potential losses, time decay, volatility, liquidity dangers, and the potential for catastrophic losses in adversarial market situations. Moreover, leverage can amplify each beneficial properties and losses, making it a double-edged sword for merchants.

Limitless Potential Losses

The potential for limitless losses is a elementary facet of choices buying and selling, significantly when coping with bare or uncovered choices positions. With limitless potential losses, small deviations in market costs or unexpected occasions can lead to important monetary losses. This danger underscores the significance of sturdy place sizing and the implementation of efficient danger administration methods.

Time Decay

Time decay refers back to the inherent lack of worth in choices contracts over time, because the expiration date approaches. As time elapses, the choices’ worth decreases as a result of decreased chance of train or task. This phenomenon highlights the necessity for merchants to watch and adapt their methods to altering market situations, somewhat than relying solely on static positions.

Volatility

Volatility is a important danger think about choices buying and selling, as it might considerably influence the worth of choices contracts. Elevated volatility can result in elevated losses, whereas decreased volatility can lead to decreased beneficial properties. Efficient danger administration methods should keep in mind the dealer’s danger tolerance, market evaluation, and a radical understanding of volatility metrics.

Liquidity Dangers

Liquidity dangers come up when there’s inadequate market exercise or an absence of patrons or sellers to accommodate a commerce. This example can result in important value deviations, making it difficult to execute trades or liquidate positions. To mitigate liquidity dangers, merchants ought to keep a deep understanding of market situations, have interaction with respected brokers, and implement diversified buying and selling methods.

Place Sizing and Cease-Loss Orders

Efficient place sizing and the implementation of stop-loss orders are essential parts of danger administration in choices buying and selling. By limiting the scale of every commerce, merchants can mitigate potential losses within the occasion of adversarial market actions. In conjunction, stop-loss orders allow merchants to robotically shut positions when predetermined value ranges are reached, thereby containing losses.

Managing Threat and Maximizing Potential Returns

Threat administration, whereas important, shouldn’t be mutually unique with maximizing potential returns. Merchants should steadiness these competing goals by implementing a mix of methods that cater to their danger tolerance, market evaluation, and buying and selling goals. Efficient merchants frequently consider and refine their approaches to optimize danger administration and maximize returns.

Key Methods for Managing Threat

-

Setting clear buying and selling goals and danger tolerance

serves as a basis for knowledgeable decision-making, enabling merchants to adapt their methods in accordance with evolving market situations.

-

Monitoring market information, developments, and volatility

permits merchants to determine potential alternatives and regulate their positions accordingly, thereby minimizing publicity to adversarial market actions.

-

Implementing stop-loss orders

supplies a important security internet, enabling merchants to comprise potential losses and keep a secure danger profile.

-

Using diversified buying and selling methods

can assist merchants unfold danger, capitalize on alternatives, and adapt to altering market situations.

Evaluating Brokerage Accounts for Choices: Charges and Commissions

When venturing into the realm of choices buying and selling, probably the most important elements to contemplate is the brokerage account’s charges and commissions. These prices can considerably influence your general buying and selling expertise and profitability. On this dialogue, we’ll delve into the variations in charges and commissions between numerous brokerage accounts, explaining the best way to calculate the overall value of buying and selling with every account and figuring out essentially the most cost-effective choices buying and selling account.

Charge Buildings: A Advanced Array of Prices

Brokerage accounts’ payment buildings may be intricate, comprising numerous prices, resembling commissions, administration charges, and different bills. Every account might have its distinctive payment construction, making it important to understand the prices related to every buying and selling exercise.

- Commissions: Many brokerage accounts cost a fee for every commerce executed. This payment can range enormously relying on the buying and selling platform, account kind, and market situations.

- Administration charges: Some accounts might cost a administration payment, which is a recurring cost primarily based on the account steadiness or buying and selling exercise.

- Inactivity charges: Some accounts impose inactivity charges for accounts which have been inactive for a sure interval.

- Buying and selling charges: Extra buying and selling charges, resembling change charges, clearing charges, and regulatory charges, can also apply.

Understanding these payment buildings is essential to calculating the overall value of buying and selling with every account.

The Components: Calculating Whole Buying and selling Prices

The overall value of buying and selling may be calculated utilizing the next method:

Whole Value = Fee + Administration Charge + Inactivity Charge + Buying and selling Charges

This method supplies a complete image of the prices related to every commerce. Nonetheless, it’s important to notice that every dealer might have its distinctive payment construction, and the prices might change over time.

Evaluating Brokerage Accounts: A Actual-Life Instance

As an example the variations between brokerage accounts, let’s take into account a real-life situation. Suppose an choices dealer executes 10 trades monthly with a complete worth of $10,000. We’ll calculate the overall value of buying and selling for every account utilizing the method supplied earlier.

| Brokerage Account | Fee | Administration Charge | Inactivity Charge | Buying and selling Charges | Whole Value |

|---|---|---|---|---|---|

| Dealer A | $10 per commerce | 0.25% of account steadiness | $10 monthly | $5 per commerce | $125.50 |

| Dealer B | $5 per commerce | 0.10% of account steadiness | $0 monthly | $3 per commerce | $90.50 |

On this instance, Dealer B presents a cheaper possibility, with a complete value of $90.50 monthly in comparison with Dealer A’s $125.50.

The Most Value-Efficient Choices Buying and selling Account

After analyzing the charges and commissions of assorted brokerage accounts, we will determine essentially the most cost-effective choices buying and selling account primarily based on the next standards:

- Low or no fee charges

- No administration charges

- No inactivity charges

Whereas no brokerage account presents a very free service, some accounts might present extra engaging phrases than others. By understanding the payment buildings and calculating the overall value of buying and selling with every account, choices merchants could make knowledgeable selections and optimize their buying and selling expertise.

Organizing Choices Buying and selling Information and Efficiency

Within the realm of choices buying and selling, a well-organized monitoring system is akin to a talented navigator at sea, charting the course via treacherous waters. A dependable methodology for monitoring efficiency is crucial for making knowledgeable selections and maximizing earnings. The significance of monitoring choices buying and selling efficiency can’t be overstated.

Making a Spreadsheet for Monitoring Buying and selling Outcomes, Finest brokerage accounts for choices reddit

A spreadsheet is a perfect device for organizing choices buying and selling knowledge, providing a structured format for cataloging transactions and assessing efficiency. Start by establishing columns for important knowledge factors, such because the commerce date, image, expiration date, strike value, route (name or put), and ensuing revenue or loss. By populating these columns, you’ll be able to simply generate insights into your buying and selling exercise and determine patterns or areas for enchancment.

Listed here are some important columns to incorporate in your spreadsheet:

- Commerce date: Doc the date you initiated the commerce.

- Image: Document the inventory or index image.

- Expiration date: Word the expiration date of the choices contract.

- Strike value: Specify the strike value of the decision or put possibility.

- Course: Point out whether or not the commerce concerned a name or put possibility.

- End result: Quantify the revenue or loss ensuing from the commerce.

- Revenue/Loss share: Calculate the share of revenue or loss relative to the commerce’s preliminary worth.

As you populate your spreadsheet, you will start to see developments emerge, permitting you to refine your buying and selling technique and optimize your efficiency.

Analyzing Choices Buying and selling Information with Instruments and Software program

For a extra in-depth evaluation of your choices buying and selling efficiency, take into account incorporating specialised instruments and software program into your routine. These sources can present helpful insights into your buying and selling exercise, resembling:

- Chance evaluation: Calculate the chance of attaining a desired revenue or loss.

- Break-even evaluation: Decide the purpose at which your buying and selling outcomes grow to be worthwhile or breakeven.

- Volatility evaluation: Assess the uncertainty surrounding your buying and selling outcomes.

Some in style choices buying and selling platforms and software program embody:

TD Ameritrade’s Thinkorswim platform supplies superior analytics and technical instruments for analyzing choices buying and selling knowledge.

Interactive Brokers’ Dealer Workstation permits for complete evaluation and backtesting of buying and selling methods.

By leveraging these instruments and integrating them into your buying and selling routine, you will acquire a deeper understanding of your choices buying and selling efficiency and make knowledgeable selections to optimize your outcomes.

“A well-defined monitoring system is the spine of profitable choices buying and selling. By monitoring your efficiency and refining your technique, you’ll be able to unlock the complete potential of possibility buying and selling.”

Making a Buying and selling Technique for Choices on a Brokerage Account

![[OC] I wrote a script to keep track of the stocks and options that ... Best brokerage accounts for options reddit](https://storage.googleapis.com/assets.options.ai/images/Options-AI-Best-Broker-Options-Trading.gif)

On the earth of choices buying and selling, having a well-crafted technique is akin to charting a course via uncharted waters. It serves as a guiding mild, illuminating the trail to worthwhile trades and shielding towards the perils of uncertainty. By cultivating a buying and selling technique, choices merchants can tame the wild beast of volatility, harnessing its energy to gasoline their monetary endeavors.

A buying and selling technique for choices buying and selling sometimes includes a mix of technical evaluation, market developments, and danger administration. It is like developing a sturdy edifice, with strong foundations, a sturdy framework, and a eager eye for market nuances. Merchants should navigate the intricate net of market dynamics, teasing out patterns, developments, and anomalies that may inform their funding selections. By doing so, they’ll distill the market’s essence, extracting helpful insights that inform their buying and selling actions.

Making a Technique Based mostly on Technical Evaluation and Market Tendencies

To create an efficient buying and selling technique, choices merchants ought to start by learning the market’s technical panorama. This includes analyzing charts, figuring out patterns, and charting developments. Market contributors can use numerous technical indicators, resembling shifting averages, Bollinger Bands, and relative power index (RSI), to glean insights about market momentum and route.

- Chart patterns: Acknowledge acquainted patterns, resembling triangles, flags, and head-and-shoulders formations, which may sign impending value actions.

- Pattern evaluation: Determine the underlying development, whether or not it is upward, downward, or sideways, and perceive the way it might influence your trades.

- Indicators: Make the most of technical indicators to gauge market momentum, volatility, and sentiment.

Market developments, too, play an important function in shaping a buying and selling technique. By analyzing macroeconomic indicators, information occasions, and sentiment shifts, merchants can anticipate market fluctuations and regulate their methods accordingly. This holistic method allows merchants to remain attuned to the market’s rhythms, making knowledgeable selections that place them for achievement.

Widespread Buying and selling Methods for Choices

Choices merchants make use of numerous methods to navigate the complicated market panorama. A few of these methods are well-known and revered, whereas others are much less in style however no much less efficient.

- Lined calls: Promoting calls on current shares to generate premium earnings whereas limiting losses.

- Straddles: Shopping for calls and places on the identical inventory to revenue from value actions in both route.

- Spreads: Shopping for and promoting choices with totally different strike costs or expiration dates to handle danger and maximize returns.

By mastering these methods and integrating them right into a complete buying and selling plan, choices merchants can successfully harness the facility of choices buying and selling, navigating the market’s complexities with confidence and precision.

Embracing Threat Administration

No buying and selling technique is full with out a sturdy danger administration framework. This includes setting clear revenue targets, stop-loss ranges, and place sizing parameters to make sure that trades stay aligned with broader market goals. Choices merchants should additionally stay vigilant, repeatedly monitoring market situations and adjusting their methods as wanted to keep away from losses and maximize beneficial properties.

“Threat administration shouldn’t be a static idea; it is a dynamic, iterative course of that requires merchants to remain versatile and adaptive within the face of adjusting market situations.”

By embracing danger administration as an integral element of their buying and selling technique, choices merchants can safeguard their investments, mitigate losses, and construct a robust basis for long-term success.

Final Recap

In conclusion, discovering one of the best brokerage account for choices buying and selling on Reddit requires cautious consideration of a number of elements, together with charges, commissions, and margin necessities. By selecting a good and safe platform, you will be effectively in your option to success on the planet of choices buying and selling.

Steadily Requested Questions: Finest Brokerage Accounts For Choices Reddit

What’s the finest brokerage account for choices buying and selling on Reddit?

One of the best brokerage account for choices buying and selling on Reddit is a matter of private desire and buying and selling type. Some in style choices embody Robinhood, TD Ameritrade, and E*TRADE.

How do I select the fitting brokerage account for choices buying and selling?

When selecting a brokerage account for choices buying and selling, take into account elements resembling charges, commissions, margin necessities, buyer assist, technical evaluation instruments, and cellular apps.

What are the dangers related to choices buying and selling?

The dangers related to choices buying and selling embody the potential for important losses, volatility, and leverage. To mitigate these dangers, take into account setting stop-loss orders and place sizing.

How do I monitor my choices buying and selling efficiency?

To trace your choices buying and selling efficiency, think about using spreadsheet software program resembling Excel or Google Sheets. You can even use on-line instruments and software program for analyzing choices buying and selling knowledge.

What’s a buying and selling technique for choices?

A buying and selling technique for choices includes figuring out your objectives, setting a funds, and creating a plan for coming into and exiting trades. Think about using technical evaluation and market developments to tell your technique.