Greatest automobile insurance coverage in colorado – Greatest automobile insurance coverage in Colorado units the stage for this enthralling narrative, providing readers a glimpse right into a story that’s wealthy intimately and brimming with originality from the outset.

Within the Centennial State, drivers are continuously in search of probably the most dependable auto insurance coverage to protect them from unexpected monetary repercussions. Whether or not you reside in bustling Denver or tranquil Colorado Springs, you are probably conscious of the important significance of sustaining a sound automobile insurance coverage coverage to safeguard towards accidents, theft, or different unlucky occasions. This complete information will stroll you thru the intricacies of automobile insurance coverage in Colorado, from the assorted coverage sorts to the elements influencing your premiums, guaranteeing that you simply make an knowledgeable choice when selecting the most effective automobile insurance coverage supplier in your wants.

Varieties of Automobile Insurance coverage Insurance policies in Colorado

Within the state of Colorado, residents have a wide range of automobile insurance coverage choices to select from, every providing distinct ranges of safety and monetary safety. With so many insurance policies to contemplate, it may be overwhelming to find out which one most closely fits your wants. On this part, we’ll discover the principle forms of automobile insurance coverage insurance policies accessible in Colorado, together with their advantages and downsides.

Legal responsibility Insurance coverage Insurance policies

Legal responsibility insurance coverage is a must have for all drivers in Colorado. One of these coverage protects you financially within the occasion of an accident, paying for damages to others’ property and medical bills for injured events. There are two important forms of legal responsibility insurance coverage: Bodily Harm Legal responsibility (BIL) and Property Harm Legal responsibility (PDL).

– Bodily Harm Legal responsibility (BIL): Covers medical bills and misplaced wages for injured events in an accident.

– Property Harm Legal responsibility (PDL): Covers damages to different folks’s property, comparable to their autos or buildings.

A normal legal responsibility coverage in Colorado contains the next necessities:

– Minimal BIL protection of $25,000 per individual and $50,000 per accident.

– Minimal PDL protection of $15,000.

Collision and Complete Insurance coverage Insurance policies

Collision insurance coverage covers damages to your personal automobile within the occasion of an accident, no matter who’s at fault. Complete insurance coverage, alternatively, covers damages to your automobile from non-accident-related occasions, comparable to theft, vandalism, or pure disasters.

– Collision Insurance coverage: Pays for damages to your automobile within the occasion of an accident.

– Complete Insurance coverage: Covers damages to your automobile from non-accident-related occasions.

Full Protection Insurance coverage Insurance policies

Full protection insurance coverage insurance policies bundle collectively legal responsibility, collision, and complete insurance coverage, providing probably the most complete safety in your automobile and funds.

– Full Protection Insurance coverage: Contains legal responsibility, collision, and complete insurance coverage, offering most safety in your automobile and funds.

Different Varieties of Automobile Insurance coverage Insurance policies in Colorado

There are additionally different forms of automobile insurance coverage insurance policies accessible in Colorado, together with:

– Private Harm Safety (PIP): Covers medical bills for you and your passengers within the occasion of an accident.

– Uninsured/Underinsured Motorist Protection: Covers damages to your automobile within the occasion of an accident with an uninsured or underinsured driver.

– Rental Automobile Protection: Covers rental automobile bills whereas your automobile is being repaired.

– Roadside Help: Offers emergency companies, comparable to towing and tire modifications, that can assist you get again on the street.

By understanding the principle forms of automobile insurance coverage insurance policies accessible in Colorado, you can also make an knowledgeable choice about which coverage most closely fits your wants and supplies the appropriate stage of safety for you and your funds.

Comparability of Automobile Insurance coverage Suppliers in Colorado

In Colorado, deciding on the appropriate automobile insurance coverage supplier is essential for safeguarding your automobile and monetary property. With quite a few insurance coverage firms working within the state, selecting the one which greatest meets your wants might be overwhelming. That will help you make an knowledgeable choice, we’ll examine a number of the high automobile insurance coverage suppliers in Colorado, together with their options, advantages, costs, and protection choices.

Essential Automobile Insurance coverage Suppliers in Colorado

The next are a number of the most well-known automobile insurance coverage suppliers in Colorado:

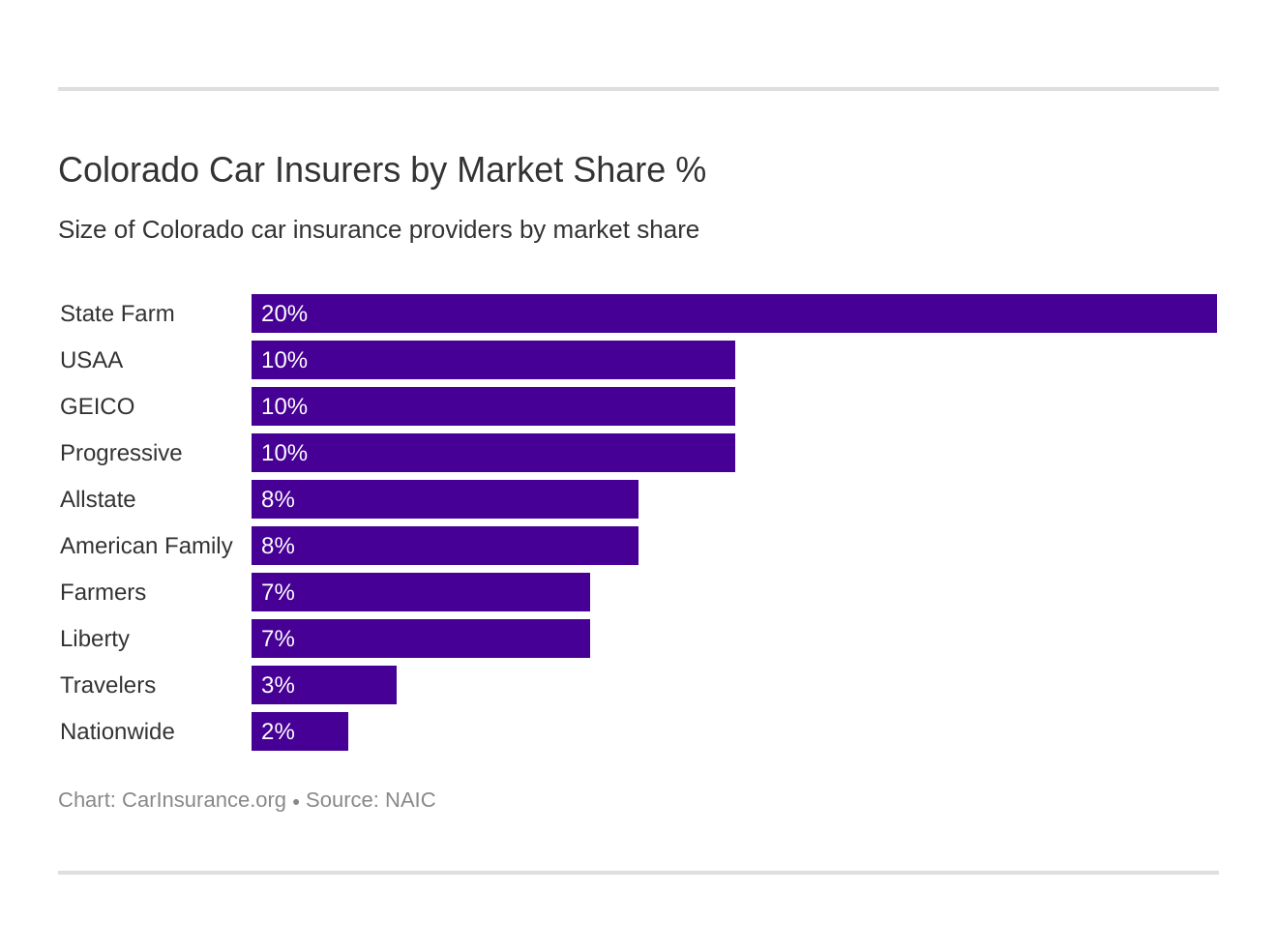

- Geico: Geico is a well-liked automobile insurance coverage supplier that gives inexpensive charges and a wide range of protection choices. They’re identified for his or her complete protection, together with roadside help and rental automobile reimbursement.

- State Farm: State Farm is likely one of the largest automobile insurance coverage suppliers in america, providing a variety of protection choices and reductions. In addition they present 24/7 buyer help and a cellular app for policyholders.

- Allstate: Allstate is one other well-established automobile insurance coverage supplier that gives a wide range of protection choices, together with legal responsibility, collision, and complete protection. In addition they present a rewards program for secure driving.

- Progressive: Progressive is a automobile insurance coverage supplier that gives inexpensive charges and a wide range of protection choices, together with customized protection packages and reductions for bundling a number of insurance policies.

- Erie: Erie is a regional automobile insurance coverage supplier that gives aggressive charges and a variety of protection choices, together with roadside help and rental automobile reimbursement.

The significance of selecting a dependable automobile insurance coverage supplier in Colorado can’t be overstated. With quite a few choices accessible, it’s important to analysis and examine totally different suppliers to seek out the one which most closely fits your wants and price range. By doing so, you may guarantee that you’ve got satisfactory protection in case of an accident or different sudden occasions.

Comparability of Protection Choices and Costs

This is a comparability of the protection choices and costs supplied by the principle automobile insurance coverage suppliers in Colorado:

| Supplier | Legal responsibility Protection | Complete Protection | Common Annual Premium | |

|---|---|---|---|---|

| Geico | $50,000 per individual, $100,000 per accident | $500 deductible | $500 deductible | $1,044 |

| State Farm | $50,000 per individual, $100,000 per accident | $500 deductible | $500 deductible | $1,234 |

| Allstate | $50,000 per individual, $100,000 per accident | $500 deductible | $500 deductible | $1,342 |

| Progressive | $50,000 per individual, $100,000 per accident | $500 deductible | $500 deductible | $1,044 |

| Erie | $50,000 per individual, $100,000 per accident | $500 deductible | $500 deductible | $984 |

When deciding on a automobile insurance coverage supplier, it is important to contemplate elements comparable to protection choices, costs, and customer support. By doing so, you may guarantee that you’ve got satisfactory safety in your automobile and monetary property.

Reductions and Rewards Packages

Many automobile insurance coverage suppliers provide reductions and rewards packages to encourage secure driving and policyholder loyalty. A few of the commonest reductions and rewards packages embrace:

- Bundling a number of insurance policies: Many automobile insurance coverage suppliers provide reductions for bundling a number of insurance policies, comparable to dwelling and auto insurance coverage.

- Protected driving rewards: Some automobile insurance coverage suppliers provide rewards for secure driving, comparable to decreased premiums or cashback.

- Good scholar reductions: Some automobile insurance coverage suppliers provide reductions for college students who preserve good grades.

- Army reductions: Some automobile insurance coverage suppliers provide reductions for army personnel and their households.

When deciding on a automobile insurance coverage supplier, it is important to contemplate reductions and rewards packages that may provide help to get monetary savings in your premiums. By profiting from these packages, you may hold your premiums low and guarantee that you’ve got satisfactory protection in your automobile and monetary property.

Buyer Service and Claims Course of

The customer support and claims technique of a automobile insurance coverage supplier can play a major function in figuring out the standard of service they provide. Some automobile insurance coverage suppliers are identified for his or her wonderful customer support and streamlined claims course of, whereas others could also be slower to reply to claims or have extra sophisticated processes.

When deciding on a automobile insurance coverage supplier, it is important to contemplate the customer support and claims course of. By doing so, you may guarantee that you’ve got a easy and environment friendly expertise in case of an accident or different sudden occasions.

Selecting the Greatest Automobile Insurance coverage in Colorado: A Information

With regards to discovering the appropriate automobile insurance coverage in Colorado, there are a number of elements to contemplate. With so many insurance coverage suppliers accessible, it may be overwhelming to find out which one is the most effective match in your wants. On this information, we’ll stroll you thru the important thing elements to contemplate and supply efficient methods for locating the most effective automobile insurance coverage in Colorado.

Components to Think about: Protection

Protection is an important facet of automobile insurance coverage. In Colorado, drivers are required to have a minimal of $25,000 in bodily damage legal responsibility per individual, $50,000 in bodily damage legal responsibility per accident, and $15,000 in property harm legal responsibility per accident. Nevertheless, it is important to contemplate the forms of protection you want, together with:

- Legal responsibility protection: This covers damages to different folks or property in an accident for which you’re at fault.

- Collision protection: This covers damages to your automobile within the occasion of a collision, no matter fault.

- Complete protection: This covers damages to your automobile in instances comparable to theft, vandalism, or pure disasters.

- Private damage safety (PIP) protection: This covers medical bills for you and your passengers within the occasion of an accident.

It is important to find out the extent of protection you want primarily based in your monetary state of affairs, driving historical past, and automobile worth.

Components to Think about: Price

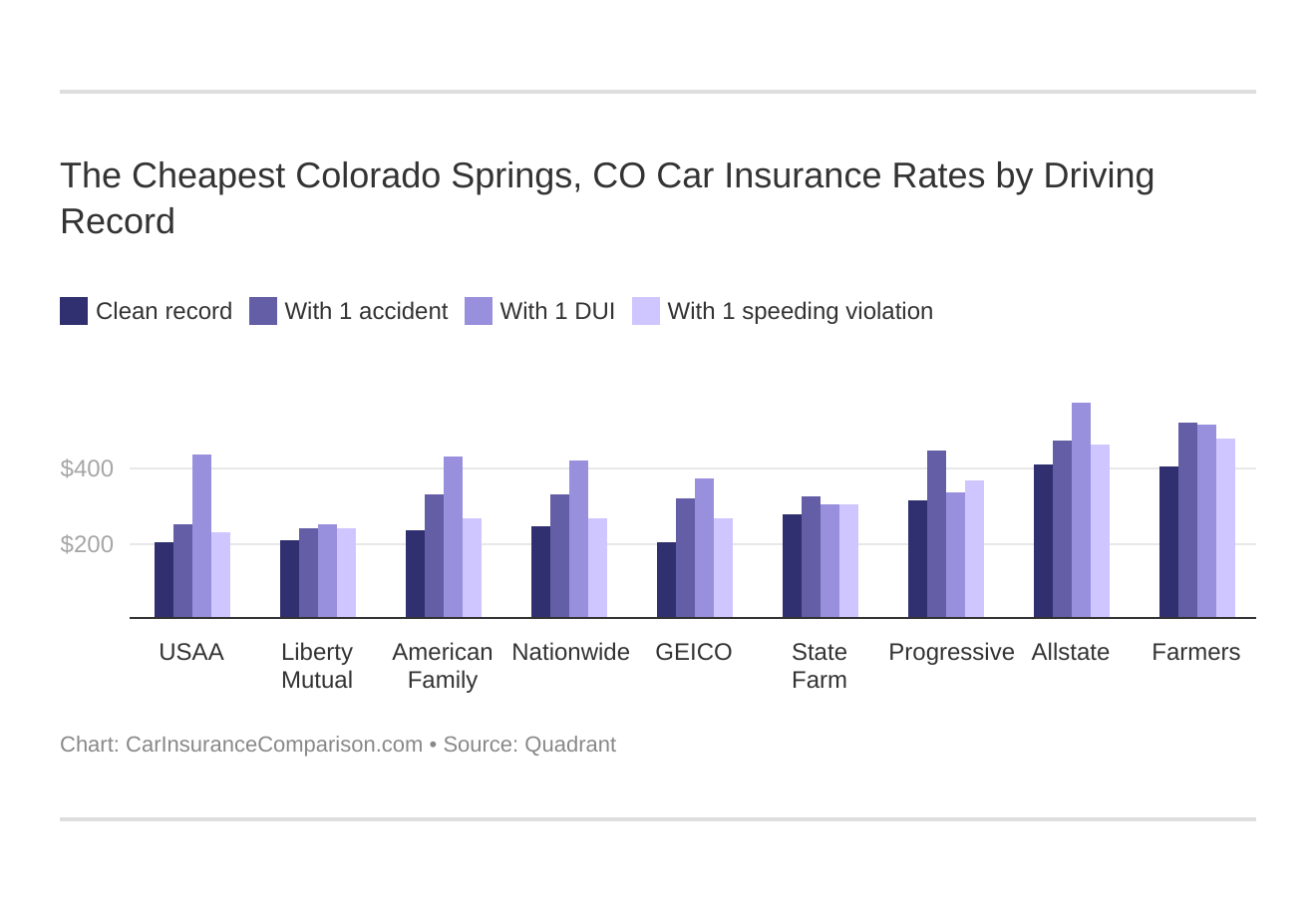

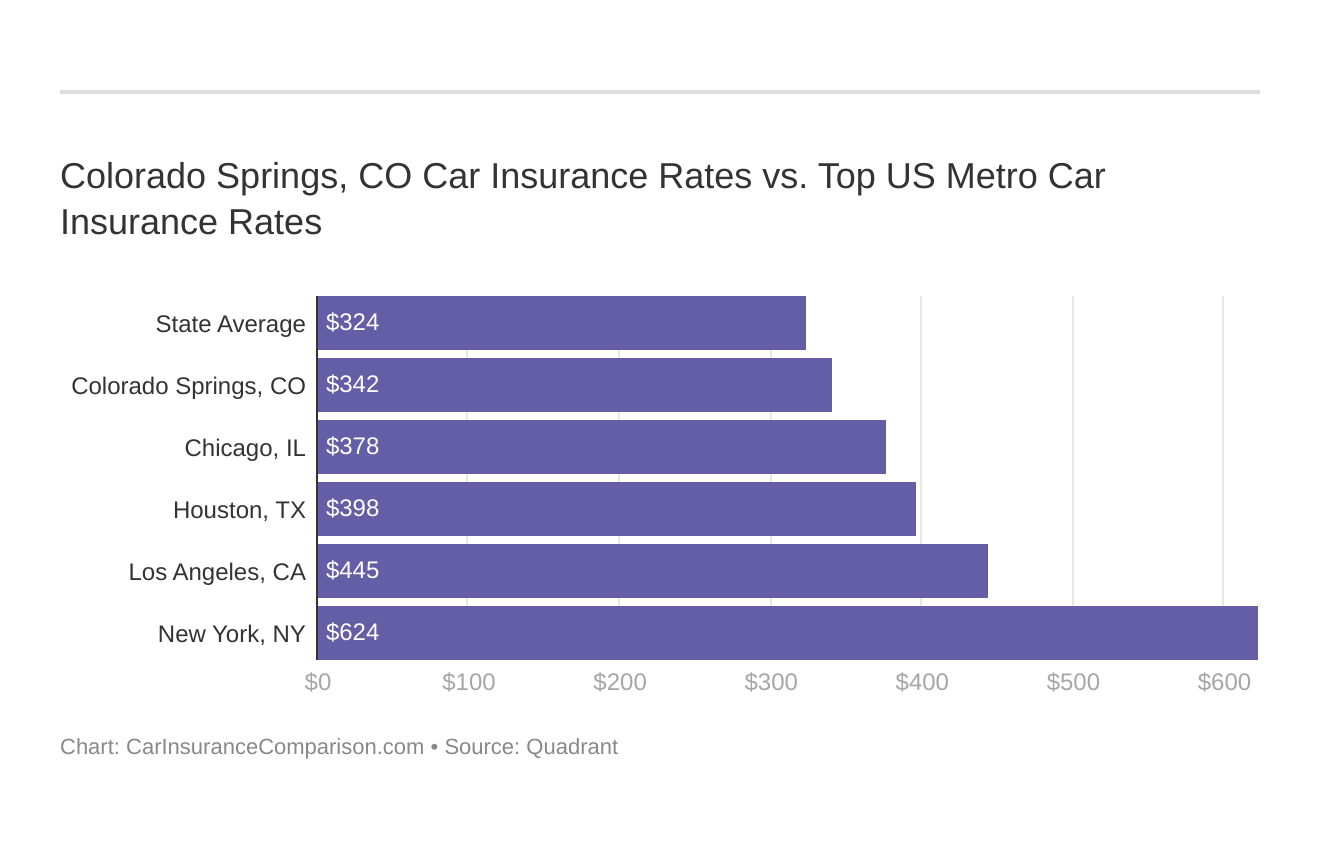

Price is a important consider selecting automobile insurance coverage. Colorado drivers can anticipate to pay a median of $1,500 per yr for automobile insurance coverage, though costs can differ considerably relying on elements comparable to:

- Age: Youthful drivers are likely to pay extra for automobile insurance coverage.

- Driving historical past: Drivers with a clear driving document are likely to pay much less for automobile insurance coverage.

- Car kind: Luxurious vehicles are typically dearer to insure.

- Location: Drivers dwelling in city areas are likely to pay extra for automobile insurance coverage.

It is important to buy round and examine costs from numerous insurance coverage suppliers to seek out the most effective deal.

Components to Think about: Buyer Service

Customer support is an often-overlooked facet of automobile insurance coverage. Nevertheless, it is important to decide on an insurance coverage supplier with a repute for wonderful customer support, together with:

- Claims course of: Search for suppliers with an easy and environment friendly claims course of.

- Buyer help: Select a supplier with 24/7 buyer help.

- Evaluation scores: Verify on-line evaluate websites to find out a supplier’s repute for customer support.

By contemplating these elements, you can also make an knowledgeable choice about which automobile insurance coverage supplier is the most effective match in your wants.

Efficient Methods for Discovering the Greatest Automobile Insurance coverage in Colorado

Listed below are some efficient methods for locating the most effective automobile insurance coverage in Colorado:

Analysis and Evaluate Insurance coverage Suppliers

It is important to analysis and examine insurance coverage suppliers to find out which one provides the most effective mixture of protection, price, and customer support. Think about using on-line instruments to match charges and protection choices.

Ask for Suggestions

Ask mates, household, or coworkers for suggestions on automobile insurance coverage suppliers. Private referrals might be a good way to discover a dependable supplier.

Learn Opinions and Rankings

Verify on-line evaluate websites, comparable to Shopper Reviews or J.D. Energy, to find out a supplier’s repute for customer support and claims course of.

Organizing Automobile Insurance coverage Data with an HTML Desk

In Colorado, discovering the most effective automobile insurance coverage might be overwhelming because of the quite a few choices accessible. To simplify this course of, it is important to arrange automobile insurance coverage info in a transparent and concise method. This may be achieved by making a responsive HTML desk to match automobile insurance coverage choices.

Making a responsive HTML desk means that you can categorize and examine automobile insurance coverage info successfully. A well-designed desk helps to visualise the info, making it simpler to establish the most effective automobile insurance coverage in your wants.

The Significance of Utilizing Columns to Categorize Automobile Insurance coverage Data

Utilizing columns in an HTML desk to categorize automobile insurance coverage info is essential for a number of causes. Firstly, it means that you can examine totally different insurance coverage suppliers and their companies side-by-side, making it simpler to establish the best choice. Secondly, it allows you to concentrate on particular facets of the insurance coverage coverage, comparable to protection, worth, and customer support.

Making a Pattern HTML Desk to Evaluate Automobile Insurance coverage Choices

This is an instance of a responsive HTML desk to match automobile insurance coverage choices in Colorado:

| Supplier | Protection | Worth | Buyer Service |

|---|---|---|---|

| State Farm | Full protection, together with legal responsibility and complete | $1,200 per yr | 4.5/5 stars on evaluate web sites |

| Geico | Primary protection, together with legal responsibility | $900 per yr | 4.2/5 stars on evaluate web sites |

| Allstate | Full protection, together with legal responsibility and complete | $1,500 per yr | 4.1/5 stars on evaluate web sites |

On this instance, the desk has 4 columns: Supplier, Protection, Worth, and Buyer Service. Every row represents a special insurance coverage supplier, and the columns present a transparent and concise overview of every supplier’s companies and pricing.

Examples of Automobile Insurance coverage Suppliers in Colorado with Distinctive Options

With regards to selecting the best automobile insurance coverage supplier in Colorado, it is important to contemplate the distinctive options that every firm provides. Whereas worth and protection are essential elements, further options comparable to 24/7 customer support, accident forgiveness, and rental automobile protection could make a major distinction in your insurance coverage expertise.

Geico’s 24/7 Buyer Service

Geico is likely one of the most well-known automobile insurance coverage suppliers in Colorado, and for good cause. Their 24/7 customer support is top-notch, permitting policyholders to succeed in a consultant at any time of day or night time. This function is especially helpful for people who want help with their coverage or have questions on their protection.

Take, for instance, Sarah, a busy working mother who lives in Denver. She was concerned in a fender bender on her solution to work one morning and wanted to report the incident to her insurance coverage firm. Because of Geico’s 24/7 customer support, she was capable of attain a consultant who guided her by the method and helped her get again on the street very quickly.

State Farm’s Accident Forgiveness

State Farm is one other main automobile insurance coverage supplier in Colorado that gives accident forgiveness, a singular function that may be a game-changer for drivers who’re concerned in accidents. This function signifies that when you’re concerned in a lined accident, your insurance coverage charges will not go up – even when you’re at fault.

As an illustration, John, a younger driver from Boulder, was concerned in a minor accident on his means dwelling from faculty. Because of State Farm’s accident forgiveness, his insurance coverage charges did not improve, and he was capable of proceed driving with out worrying concerning the monetary implications of the accident.

USAA’s Rental Automobile Protection

USAA is a well-liked alternative for army members and their households, and for good cause. Their rental automobile protection is likely one of the greatest within the enterprise, providing policyholders a spread of choices for alternative or rental autos within the occasion of an accident or theft.

Think about, for instance, Emily, a army partner who was concerned in a automobile accident whereas driving her household to a deployment ceremony. Because of USAA’s rental automobile protection, she was capable of hire a alternative automobile that was just like her personal, permitting her to proceed her day by day routine with out interruption.

Liberty Mutual’s New Automobile Substitute, Greatest automobile insurance coverage in colorado

Liberty Mutual is one other automobile insurance coverage supplier in Colorado that gives a singular function – new automobile alternative. This function signifies that in case your automobile is totaled in an accident, Liberty Mutual will substitute it with a brand-new automobile of the identical make and mannequin.

Take, for instance, Michael, a proud proprietor of a brand-new automobile from Aurora. Because of Liberty Mutual’s new automobile alternative, he was capable of get a brand-new automobile of the identical make and mannequin if his automobile was totaled in an accident.

Remaining Wrap-Up

As you navigate the complicated panorama of automobile insurance coverage in Colorado, do not forget that selecting the right supplier is an important choice that may have far-reaching penalties in your pockets and your peace of thoughts. By fastidiously contemplating your protection choices, understanding the elements that influence your premiums, and staying knowledgeable concerning the numerous coverage sorts, you may place your self for long-term monetary stability and safety.

Finally, your aim ought to be to discover a automobile insurance coverage supplier that not solely provides complete protection but additionally supplies distinctive customer support, aggressive pricing, and a repute for reliability. By doing so, you may benefit from the freedom of the open street, understanding that you simply’re protected against the sudden and that your monetary future is safe.

Questions and Solutions

What’s the minimal automobile insurance coverage protection required in Colorado?

The minimal automobile insurance coverage protection required in Colorado is 25/50/15, which incorporates legal responsibility protection of $25,000 for bodily damage or dying per individual, $50,000 for bodily damage or dying per accident, and $15,000 for property harm per accident.

How do I qualify for automobile insurance coverage reductions in Colorado?

You possibly can qualify for automobile insurance coverage reductions in Colorado by bundling a number of insurance policies, driving safely, finishing a defensive driving course, being a scholar, or having a superb credit score rating.

What’s the common automobile insurance coverage fee in Colorado?

The common automobile insurance coverage fee in Colorado varies relying on a number of elements, together with your age, driving document, and automobile kind. Nevertheless, in keeping with the Colorado Division of Insurance coverage, the typical automobile insurance coverage fee in Colorado is round $1,300 per yr.

Can I cancel my automobile insurance coverage coverage in Colorado at any time?

No, you may’t cancel your automobile insurance coverage coverage in Colorado at any time. Nevertheless, you may cancel your coverage by giving written discover to your insurance coverage supplier. The discover interval varies relying in your coverage kind and should vary from 30 to 60 days.