Greatest bank cards for eating – Kicking off with the world of bank cards for eating, this opening paragraph is designed to captivate readers, setting the tone for an goal and academic assessment of the highest choices. With the rise of cashback and rewards bank cards, eating fanatics can now take pleasure in their favourite meals whereas incomes beneficial factors and rebates.

From cashback, rewards, and factors to assertion credit and eating perks, we’ll break down the important thing advantages and options of prime bank cards for eating. Whether or not you favor tremendous eating, quick meals, or ethnic delicacies, we’ll cowl the very best choices to your particular eating preferences.

Understanding the Greatest Credit score Playing cards for Eating

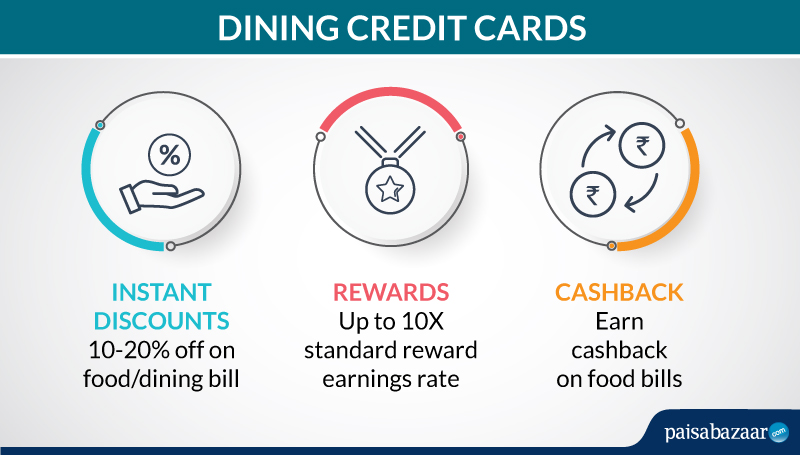

Relating to eating out, bank cards might be an effective way to earn rewards, get monetary savings, and luxuriate in unique perks. However with so many choices obtainable, it may be overwhelming to decide on the very best bank card to your eating wants. On this part, we’ll discover the first advantages of utilizing a bank card for eating, the components to contemplate when selecting a card, and the variations between cashback, rewards, and factors.

Main Advantages of Utilizing a Credit score Card for Eating

Utilizing a bank card for eating can supply a number of advantages, together with:

-

• Earn rewards or cashback on eating purchases, which can assist offset the price of meals or save for future experiences.

• Take pleasure in unique perks, similar to birthday rewards or particular reductions, which may improve the eating expertise.

• Construct credit score or earn rewards for each greenback spent on eating, which might be redeemed for future use.

• Obtain particular affords or unique entry to occasions, which might be an effective way to strive new eating places or experiences.

• Get insurance coverage or safety on purchases, which may present peace of thoughts when eating out.

• Monitor spending and keep inside funds, which can assist handle funds and make good eating selections.

The advantages of utilizing a bank card for eating can differ relying on the kind of card and the issuer. Some playing cards supply rewards or cashback on particular varieties of eating purchases, similar to tremendous eating or takeout. Others could supply unique perks, similar to free delivery or loyalty rewards. When selecting a bank card for eating, think about the next components:

Elements to Take into account When Selecting a Credit score Card for Eating

When selecting a bank card for eating, think about the next components:

• Annual charge: Some eating bank cards include an annual charge, which may vary from $50 to $500 or extra. Take into account whether or not the advantages and rewards provided are price the associated fee.

• Reward construction: Search for playing cards that provide rewards or cashback on particular varieties of eating purchases, similar to tremendous eating or takeout. Take into account the share of rewards provided and any limits on rewards earnings.

• Unique perks: Some bank cards supply unique perks, similar to free delivery or loyalty rewards. Take into account whether or not these perks align along with your eating habits and preferences.

• Insurance coverage or safety: Some bank cards supply insurance coverage or safety on purchases, which may present peace of thoughts when eating out. Take into account whether or not this is a vital characteristic for you.

• APR: Take into account the APR of the cardboard, in addition to any curiosity fees or charges related to curiosity.

• Credit score rating: Search for bank cards that cater to completely different credit score scores, together with these for truthful credit score or unfavorable credit ratings.

There are numerous several types of bank cards obtainable for eating, and the suitable card for you’ll rely in your particular person wants and preferences. Take into account the components talked about above and search for playing cards that align along with your eating habits and targets.

Cashback, Rewards, and Factors: Understanding the Distinction

Relating to bank cards for eating, cashback, rewards, and factors are sometimes used interchangeably. Nevertheless, these phrases check with several types of incentives and advantages. Cashback refers to a share of your buy quantity returned to you within the type of an announcement credit score or rewards. Rewards check with factors, miles, or different advantages earned on purchases, which might be redeemed for future use. Factors check with particular rewards or advantages earned on purchases, which might be redeemed for items or companies.

For instance, a card could supply 2% cashback on eating purchases as much as $1,000 and 1% cashback thereafter. Which means that you earn 2% cashback on the primary $1,000 spent on eating, and 1% cashback on any quantity spent above $1,000.

When selecting a bank card for eating, think about the kind of incentives and advantages provided and the way they align along with your wants and preferences.

Forms of Credit score Playing cards for Eating: Greatest Credit score Playing cards For Eating

For many who savor the flavors of life, there is a world past mere sustenance. Eating is an artwork, a sensory expertise that transcends the mundane. And, as we discover the realm of bank cards for eating, we discover that every sort caters to a singular aspect of our gastronomical escapades.

Cashback Credit score Playing cards for Eating

A delicate but rewarding possibility, cashback bank cards supply a return on each greenback spent. For many who dine often, a 2-3% cashback on eating purchases can add up, making it a worthy consideration. The important thing options of those playing cards embody a reasonable cashback share, no rotating classes, and sometimes a decrease annual charge, sometimes round $0-$95. For example, the Citi Double Money Card supplies a 2% cashback on all purchases, with no spending limits or classes.

- The Citi Double Money Card is a flexible possibility, preferrred for many who desire a easy, easy cashback rewards program.

- The Wells Fargo Propel American Categorical Card affords 3% cashback within the eating class, in addition to a $0 annual charge for the primary yr, making it a sexy alternative for many who dine often.

- The Capital One QuicksilverOne Money Rewards Credit score Card supplies a 1.5% cashback on all purchases and a $39 annual charge.

Journey Rewards Credit score Playing cards for Eating

Those that roam the world, savoring flavors from each nook, will discover solace in journey rewards bank cards. These playing cards typically reward eating purchases with factors redeemable for flights, lodges, and different journey bills. The important thing options embody the next incomes potential in choose classes, no overseas transaction charges, and travel-related advantages like airport lounge entry. For example, the Chase Sapphire Most well-liked Card affords 2X factors on eating and journey purchases, with a $95 annual charge.

- The Chase Sapphire Reserve Card affords 3X factors on eating and journey purchases, together with a $300 journey credit score and airport lounge entry.

- The Capital One Enterprise Rewards Credit score Card supplies 2X miles on all purchases, with no overseas transaction charges and travel-related advantages.

- The Barclays Arrival Plus World Elite Mastercard affords 2X miles on all purchases, with no overseas transaction charges and travel-related advantages.

Signal-up Bonus Credit score Playing cards for Eating

For many who crave the joys of attempting new eating places, sign-up bonus bank cards supply a sexy incentive. These playing cards typically present a beneficiant bonus when the cardholder meets a minimal spend requirement inside a specified timeframe. The important thing options embody a considerable sign-up bonus, a reasonable incomes potential, and a variable annual charge. For example, the Chase Sapphire Most well-liked Card affords a 60,000-point bonus after spending $4,000 within the first 3 months, with a $95 annual charge.

Some sign-up bonus bank cards could include a excessive annual charge and spending necessities, so it is important to assessment the phrases and situations earlier than making use of.

Eating Rewards and Advantages

On the earth of bank cards, eating rewards supply a pleasant expertise for many who like to dine out. These rewards are designed to profit from your eating habits, offering you with advantages that vary from assertion credit to bonus factors, and cashback redemption choices.

The idea of tiered rewards is an important facet of bank cards for eating. Tiered rewards methods categorize rewards into completely different ranges, the place the upper the extent, the extra vital the rewards. For example, a card could have three ranges of rewards: primary, premium, and elite. As you accumulate extra factors or spend a specific amount, you’ll be able to transfer up the tiers, unlocking higher rewards and advantages. This method encourages customers to extend their spending or accumulate factors, resulting in better rewards.

Assertion Credit and Their Worth

Assertion credit are a preferred type of eating rewards, as they instantly offset your invoice. Think about receiving $20 again for each $1,000 you spend at a taking part restaurant. This may add up shortly, making it a beneficial profit for frequent diners. Assertion credit can be utilized at numerous eating places, together with high-end institutions and informal eateries, making it a flexible reward.

Bonus Factors and Cashback Redemption Choices, Greatest bank cards for eating

Bonus factors and cashback redemption choices are one other important facet of eating rewards. Bonus factors might be earned for particular purchases, similar to ordering takeout or attempting new eating places. These factors might be redeemed for assertion credit, reward playing cards, and even journey perks. Cashback redemption choices, alternatively, let you earn a share of your buy again as money or credit score.

Listed here are some real-life eventualities the place bank card eating rewards had been useful or helpful:

- Your favourite restaurant affords a particular promotion via your bank card. You earn 10x factors on each greenback spent, and after accumulating 50,000 factors, you’ll be able to redeem a $500 assertion credit score.

- You are planning a romantic dinner at a high-end restaurant. Your bank card affords a ten% reward on each buy over $200. You earn $20 in rewards, which can be utilized in the direction of your invoice or redeemed for a present card.

- You are a foodie who loves attempting new eating places. Your bank card affords 5x factors on each greenback spent at taking part eating places. You accumulate factors shortly and redeem them for assertion credit or cashback.

Credit score Card Eating Perks and Extras

Within the realm of bank cards, eating perks and extras are the icing on the cake. They elevate the expertise, making it extra gratifying and rewarding. These advantages can vary from concierge companies to journey insurance coverage, guaranteeing that customers get essentially the most out of their eating experiences.

Relating to bank card eating choices, supplementary perks play a big function. These perks could make or break the expertise, turning it right into a memorable one. In addition they function a distinguishing issue between bank card issuers, setting them other than each other.

Allow us to delve deeper into the world of bank card eating perks and extras, and uncover what they’ve to supply.

Concierge Providers

Concierge companies are a luxurious provided by some bank cards. They supply customers with unique entry to high-end companies and experiences. Think about having a private assistant at your beck and name, making reservations on the most sought-after eating places, and arranging personal cooking lessons with famend cooks.

Concierge companies is usually a game-changer for foodies and people who worth comfort. They get rid of the necessity for analysis and planning, permitting customers to concentrate on the enjoyment of tremendous eating. Whether or not it is a special day or a spontaneous determination, concierge companies could make it occur.

Some bank cards supply unique concierge companies, whereas others could require a charge for these companies. It is important to analysis and perceive the phrases and situations earlier than making a call.

Journey Insurance coverage

Journey insurance coverage is one other profit provided by some bank cards. It supplies customers with monetary safety within the occasion of surprising occasions, similar to journey cancellations, medical emergencies, or baggage loss.

Journey insurance coverage is usually a lifesaver for vacationers. It affords peace of thoughts, permitting customers to concentrate on the expertise somewhat than worrying about unexpected circumstances. Some bank cards additionally supply extra advantages, similar to protection for journey actions or journey delays.

Relating to journey insurance coverage, it is important to grasp the protection and the phrases of the coverage. This can assist customers make knowledgeable selections and keep away from any potential pitfalls.

Advantages of Pairing a Credit score Card with a Eating Loyalty Program

Pairing a bank card with a eating loyalty program is usually a profitable mixture. Loyalty packages supply rewards for frequent prospects, similar to free meals, unique reductions, or precedence reservations.

By combining a bank card with a loyalty program, customers can earn rewards and advantages at a sooner fee. This may result in vital financial savings and a extra gratifying eating expertise. Some bank cards additionally supply loyalty program-specific rewards, making it much more attractive to pair the 2 collectively.

When selecting a bank card, it is important to contemplate the loyalty program it affords. Analysis the rewards and advantages, and perceive how they align with eating preferences.

Greatest Practices for Maxing Out Credit score Card Eating Rewards

Within the pursuit of culinary delights, we frequently overlook the chance to maximise our bank card rewards. Eating out is usually a deal with, but it surely will also be an opportunity to earn beneficial factors or cashback. To profit from your bank card eating rewards, observe these skilled suggestions.

Understanding Credit score Card Phrases and Situations

Studying the tremendous print is important to profiting from your bank card rewards. Familiarize your self along with your card’s phrases and situations to grasp the rewards construction, redemption choices, and any potential restrictions. Take note of classes, spending limits, and bonus rewards to make sure you’re utilizing your card strategically. Bear in mind, a transparent understanding of your card’s options will provide help to maximize your earnings.

Know thy card, know thy rewards

Signal-up Bonus Methods

Do not overlook the sign-up bonus when selecting a bank card. These bonuses might be substantial, providing a big enhance to your rewards complete. Take into account your spending habits and select a card with a bonus that aligns along with your wants. Be ready to satisfy the minimal spending requirement inside the specified timeframe to qualify for the bonus.

- Select a card with a sign-up bonus that fits your spending habits.

- Meet the minimal spending requirement inside the specified timeframe.

- Preserve monitor of your spending to make sure you meet the bonus necessities.

Rotating Classes for Most Rewards

Rotating classes can assist you maximize your rewards earnings. Many bank cards supply elevated rewards in particular classes, similar to eating, journey, or groceries. Reap the benefits of these rotating classes to earn extra factors or cashback in your purchases. Plan your spending accordingly to make sure you’re utilizing the suitable card for the suitable transaction.

- Keep knowledgeable about rotating classes and their schedules.

- Select the cardboard with the very best rewards within the present class.

- Plan your spending to align with the rotating classes.

Bonus Rewards and Limitations

Pay attention to bonus rewards limitations, similar to tiered rewards or spending caps. Perceive the rewards construction to make sure you’re incomes the utmost rewards attainable. Take into account the 5/24 rule, which can have an effect on your potential to earn sign-up bonuses on sure playing cards.

| Bonus Rewards Limitations | Instance |

|---|---|

| Tiered Rewards | A card affords 3% rewards on eating purchases as much as $1,000 per 30 days, then 1% on subsequent purchases. |

| Spending Caps | A card affords 5% rewards on gasoline purchases as much as $2,000 per quarter, then 1% on subsequent purchases. |

| 5/24 Rule | You are restricted to incomes sign-up bonuses on 5 bank cards inside a 24-month interval. |

Remaining Evaluation

After reviewing the highest bank cards for eating, you will be well-equipped to make an knowledgeable determination that fits your wants and preferences. Bear in mind to at all times learn the phrases and situations and perceive easy methods to maximize your rewards and advantages.

Skilled Solutions

What’s the major good thing about utilizing a bank card for eating?

The first advantages of utilizing a bank card for eating embody incomes cashback, rewards, and factors in your purchases, in addition to doubtlessly receiving assertion credit and different perks.

How do I select the very best bank card for eating?

When selecting a bank card for eating, think about components similar to cashback share, reward classes, and annual charge, in addition to the kind of eating rewards and advantages provided.

What are the variations between cashback, rewards, and factors in bank cards for eating?

Cashback, rewards, and factors are all varieties of rewards that may be earned on bank card purchases. Cashback is often a share of your buy quantity, whereas rewards and factors might be redeemed for particular merchandise or journey.