With Greatest Egg debt consolidation on the forefront, it is time to break away from the cycle of debt and take management of your monetary future. This complete information will stroll you thru the method of debt consolidation, highlighting the advantages, forms of loans, and methods for fulfillment.

Greatest Egg debt consolidation is a course of that enables people to mix a number of money owed right into a single mortgage with a decrease rate of interest and a single month-to-month fee. This will help simplify funds, scale back stress, and lower your expenses on curiosity expenses.

Learn how to Select the Greatest Egg Debt Consolidation Mortgage

Selecting the most effective debt consolidation mortgage generally is a daunting activity, particularly with the quite a few choices accessible available in the market. Nevertheless, with a transparent understanding of the important thing components to think about, you can also make an knowledgeable choice that fits your monetary wants. On this part, we are going to information you thru the method of choosing the right debt consolidation mortgage in your Egg debt.

Key Elements to Take into account

When deciding on a debt consolidation mortgage, there are a number of key components to think about. These components will aid you decide the most effective mortgage possibility in your Egg debt and make sure that you take advantage of your monetary state of affairs. The important thing components to think about embrace:

- Mortgage phrases: Perceive the mortgage time period, which is the length for which you’ll need to repay the mortgage. An extended mortgage time period could end in decrease month-to-month funds, however you’ll find yourself paying extra in curiosity over the lifetime of the mortgage.

- Rate of interest: The rate of interest on the mortgage can considerably influence the overall value of the mortgage. A decrease rate of interest can prevent a whole lot and even hundreds of {dollars} in curiosity funds over the lifetime of the mortgage.

- Charges and expenses: Perceive the varied charges and expenses related to the mortgage, together with origination charges, late fee charges, and prepayment charges.

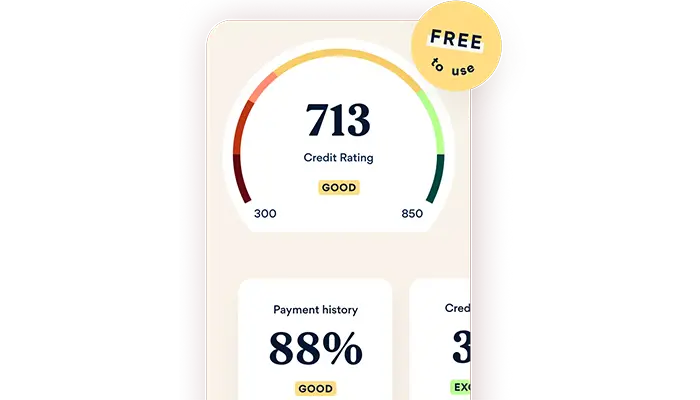

- Credit score rating: Your credit score rating can have an effect on the rate of interest you qualify for and the mortgage phrases provided to you.

- Lender popularity: Select a good lender with a powerful monitor report of customer support and monetary stability.

Understanding Curiosity Charges and Mortgage Phrases

Rates of interest and mortgage phrases are two crucial components to think about when evaluating a debt consolidation mortgage. The rate of interest on a mortgage determines how a lot curiosity you’ll need to pay on the mortgage, whereas the mortgage time period determines how lengthy you need to repay the mortgage. When evaluating rates of interest and mortgage phrases, think about the next:

- Examine apples to apples: When evaluating rates of interest and mortgage phrases, guarantee that you’re evaluating loans with comparable traits.

- Take into account the overall value of the mortgage: Whereas a decrease rate of interest could appear to be a greater deal, it is important to think about the overall value of the mortgage, together with charges and expenses.

- Calculate the APR: The APR (Annual Proportion Charge) is a extra correct illustration of the rate of interest on a mortgage, because it takes into consideration components like origination charges and compounding curiosity.

Understanding Charges and Costs

Charges and expenses are a vital side of debt consolidation loans. Understanding the varied charges and expenses related to the mortgage will help you make an knowledgeable choice and keep away from pointless bills. When evaluating charges and expenses, think about the next:

- Origination charges: Origination charges are charged by the lender once you originate the mortgage.

- Late fee charges: Late fee charges are charged once you miss a fee or pay the mortgage late.

- Prepayment charges: Prepayment charges are charged once you repay the mortgage forward of schedule.

Selecting the Proper Lender

Choosing the proper lender is essential when deciding on a debt consolidation mortgage. When evaluating lenders, think about the next:

- Credit score rating: Take into account the lender’s minimal credit score rating requirement and the influence of your credit score rating on the mortgage phrases provided.

- Lender popularity: Select a good lender with a powerful monitor report of customer support and monetary stability.

- Rate of interest competitors: Examine charges amongst a number of lenders to make sure you’re getting the most effective deal.

DIY Egg Debt Consolidation Methods

When coping with a number of money owed, consolidating them right into a single mortgage can simplify your monetary state of affairs and doubtlessly scale back your general curiosity funds. DIY debt consolidation methods permit you to take management of your funds with out involving a 3rd occasion. One efficient method for consolidating money owed is the snowball methodology.

The Snowball Methodology for Debt Consolidation

The snowball methodology includes prioritizing your money owed based mostly on their balances, reasonably than their rates of interest. This implies paying off your smallest debt first, whereas making minimal funds on the others. As soon as the smallest debt is paid off, you may direct the identical sum of money in the direction of the following debt, and so forth.

- Make an inventory of your money owed, together with their balances and rates of interest.

- Organize the listing from the smallest debt to the most important.

- Pay the minimal fee on all money owed besides the smallest one.

- Apply as a lot cash as attainable in the direction of the smallest debt.

- As soon as the smallest debt is paid off, repeat the method with the following debt on the listing.

This method may be motivating, as you may shortly see progress and be capable to remove smaller money owed, which will help you construct momentum and keep dedicated to your debt consolidation technique.

Significance of Budgeting in Debt Consolidation

Budgeting is the muse of any profitable debt consolidation technique. It means that you can monitor your earnings and bills, establish areas the place you possibly can in the reduction of, and allocate your sources successfully. A well-crafted finances will allow you to make knowledgeable selections about how you can handle your debt and make progress in the direction of your targets.

- Observe your earnings and bills for a month or two to get a transparent image of your monetary state of affairs.

- Determine areas the place you possibly can in the reduction of on pointless bills.

- Allocate your sources in the direction of your debt consolidation targets.

- Often overview and alter your finances to make sure you’re on monitor.

A superb finances must be versatile and take into consideration any modifications in your earnings or bills. It should additionally aid you keep away from overspending and take advantage of your cash.

Pattern Funds Template for Debt Consolidation, Greatest egg debt consolidation

This is a primary finances template you should use as a place to begin in your debt consolidation efforts. Keep in mind to regulate the classes and percentages to fit your particular person wants.

| Class | Month-to-month Funds Allocation |

| — | — |

| Earnings | 100% |

| Important Bills | 50% (housing, utilities, meals, transportation) |

| Non-Important Bills | 20% (leisure, hobbies, journey) |

| Debt Reimbursement | 15% (minimal funds and debt consolidation) |

| Financial savings | 5% (emergency fund, long-term financial savings) |

| Miscellaneous | 10% (items, subscriptions, surprising bills) |

This template ought to offer you a superb place to begin for managing your funds and making progress in the direction of your debt consolidation targets. Keep in mind to usually overview and alter your finances to make sure you’re on monitor.

Keep in mind, budgeting is a course of, and it could take a while to get it proper. Be affected person, keep dedicated, and you will be in your approach to debt freedom.

Egg Debt Consolidation Mortgage vs. Credit score Counseling

In terms of managing debt, two widespread choices are debt consolidation loans and credit score counseling. Whereas each will help alleviate monetary stress, they serve totally different functions and cater to totally different wants. On this part, we’ll delve into the advantages and downsides of every possibility, serving to you resolve which one is best for you.

Predominant Variations Between Debt Consolidation Loans and Credit score Counseling

Whereas debt consolidation loans and credit score counseling each goal to assist people handle their debt, they function in distinct methods. A debt consolidation mortgage includes taking out a brand new mortgage to repay present money owed, usually with a decrease rate of interest and a single month-to-month fee. Credit score counseling, alternatively, includes working with a credit score counselor to create a finances, negotiate with collectors, and develop a plan to repay money owed.

Debt Consolidation Mortgage

A debt consolidation mortgage generally is a good possibility for individuals who:

- Have a number of money owed with excessive rates of interest:

- Are struggling to maintain monitor of a number of funds:

- Want an easier, extra manageable fee schedule:

- Wish to doubtlessly lower your expenses on curiosity:

With a debt consolidation mortgage, you possibly can mix a number of money owed into one mortgage with a decrease rate of interest and a single month-to-month fee. This could make it simpler to handle your funds and keep on high of funds. Nevertheless, it is important to notice {that a} debt consolidation mortgage could not handle the underlying monetary points that led to the buildup of debt within the first place.

Credit score Counseling

Credit score counseling generally is a good possibility for individuals who:

- Need assistance making a finances and managing funds:

- Are struggling to pay payments and meet monetary obligations:

- Wish to handle the foundation causes of debt accumulation:

- Need assistance negotiating with collectors:

Credit score counseling includes working with a credit score counselor to create a customized finances, negotiate with collectors, and develop a plan to repay money owed. Credit score counseling generally is a extra complete method to managing debt, because it addresses the underlying monetary points and gives instruments and sources to assist people get again on monitor.

When to Select Credit score Counseling Over a Debt Consolidation Mortgage

In some circumstances, credit score counseling could also be a greater possibility than a debt consolidation mortgage. For example:

- Once you’re struggling to pay payments and meet monetary obligations:

- Once you need assistance making a finances and managing funds:

- Once you wish to handle the foundation causes of debt accumulation:

- Once you need assistance negotiating with collectors:

Credit score counseling can present the help and steering you have to get again on monitor and handle the underlying monetary points that led to the buildup of debt.

When to Select a Debt Consolidation Mortgage Over Credit score Counseling

In some circumstances, a debt consolidation mortgage could also be a greater possibility than credit score counseling. For example:

- When you have got a number of money owed with excessive rates of interest:

- Once you want an easier, extra manageable fee schedule:

- Once you wish to doubtlessly lower your expenses on curiosity:

- Once you want a fast repair to repay money owed:

A debt consolidation mortgage can present a quicker, extra easy resolution to paying off money owed. Nevertheless, it is important to make sure that the mortgage rate of interest is decrease than the unique debt rates of interest, and which you can afford the month-to-month funds.

In the end, the Determination is Yours

Each debt consolidation loans and credit score counseling may be efficient instruments for managing debt. The hot button is to grasp your monetary state of affairs, establish your wants, and select the choice that finest aligns together with your targets. Take into account your monetary historical past, earnings, bills, money owed, and credit score rating when deciding which possibility is best for you.

Further Charges and Costs in Egg Debt Consolidation Loans: Greatest Egg Debt Consolidation

Egg debt consolidation loans may be an efficient approach to handle and scale back debt, but it surely’s important to grasp the potential charges and expenses related to these loans. Some lenders could cost extra charges that may enhance the general value of the mortgage. On this part, we’ll focus on the forms of charges related to debt consolidation loans and supply recommendations on how you can keep away from pointless charges and expenses.

Kinds of Charges Related to Debt Consolidation Loans

There are a number of forms of charges that debtors could encounter when taking out a debt consolidation mortgage. These charges can embrace:

- Origination charges: These charges are charged by the lender for processing and approving the mortgage. Origination charges can vary from 1% to five% of the mortgage quantity.

- Prepayment charges: Some lenders could cost a charge for paying off the mortgage early. Prepayment charges generally is a share of the excellent stability or a flat charge.

- Late fee charges: Debtors who miss funds could also be charged a late charge, which might vary from $25 to $35.

- Annual charges: Some debt consolidation loans could include an annual charge, which might vary from 1% to five% of the mortgage quantity per 12 months.

- Steadiness switch charges: If the borrower is transferring present balances to a brand new mortgage, some lenders could cost a stability switch charge.

These charges can add up shortly and enhance the general value of the mortgage. It is important for debtors to rigorously overview the phrases and situations of the mortgage earlier than signing up.

Learn how to Keep away from Pointless Charges and Costs

To keep away from pointless charges and expenses, debtors ought to rigorously overview the phrases and situations of the mortgage. Listed here are some ideas to remember:

- Learn the positive print: Rigorously overview the mortgage settlement and perceive all of the charges related to the mortgage.

- Examine charges and charges: Store round and evaluate charges and charges from totally different lenders to seek out the most effective deal.

- Search for zero-fee loans: Some lenders provide zero-fee loans, which might save debtors cash in the long term.

- Keep away from long-term loans: Lengthy-term loans could include greater charges and expenses, so think about shorter-term loans as a substitute.

By rigorously reviewing the phrases and situations of the mortgage and evaluating charges and charges, debtors can keep away from pointless charges and expenses and lower your expenses in the long term.

Lenders with Low or No Charges

Some lenders provide low or no charges on their debt consolidation loans. Listed here are a number of examples:

“LendingClub, for instance, doesn’t cost origination charges, prepayment charges, or late fee charges.” – LendingClub

| Lender | Origination Charge | Prepayment Charge | Late Cost Charge |

|---|---|---|---|

| LendingClub | 0% | 0% | $0 |

| SoFi | 0% | $0 | $25 |

| Payoff | 0% | $0 | $0 |

These lenders provide low or no charges on their debt consolidation loans, which might save debtors cash in the long term. It is important for debtors to analysis and evaluate lenders to seek out the most effective deal.

Final Recap

In conclusion, Greatest Egg debt consolidation is a strong device for people trying to take management of their funds and obtain monetary freedom. By understanding the choices accessible and making an knowledgeable choice, you possibly can say goodbye to debt stress and howdy to a brighter monetary future.

Key Questions Answered

What’s Greatest Egg debt consolidation?

Greatest Egg debt consolidation is a course of that mixes a number of money owed right into a single mortgage with a decrease rate of interest and a single month-to-month fee.

How does debt consolidation work?

Debt consolidation includes taking out a single mortgage to repay a number of money owed, usually with a decrease rate of interest and a single month-to-month fee.

What are the advantages of debt consolidation?

The advantages of debt consolidation embrace simplifying funds, decreasing stress, and saving cash on curiosity expenses.

Can I consolidate debt with a poor credit score rating?

Sure, some lenders provide debt consolidation loans to people with poor credit score scores, however you could face greater rates of interest and charges.

How lengthy does debt consolidation take?

The size of debt consolidation varies relying on the mortgage phrases, rate of interest, and fee schedule.