As greatest journey insurance coverage offers trip-horizon.information takes middle stage, this opening passage beckons readers right into a world crafted with good information, guaranteeing a studying expertise that’s each absorbing and distinctly unique. Journey insurance coverage is an important side of journey planning, offering monetary safety in opposition to unexpected occasions equivalent to journey cancellations, medical emergencies, or journey delays. Whether or not you are an adventurous backpacker or a cautious household traveler, having the correct journey insurance coverage coverage could make all of the distinction in your journey.

The significance of journey insurance coverage can’t be overstated, particularly when touring to international locations. A very good journey insurance coverage coverage can assist cowl medical bills, evacuate you to a hospital, and even present a refund for journey cancellations because of unexpected circumstances.

Understanding Journey Insurance coverage Offers

Touring might be an exhilarating expertise, however it’s additionally a expensive one. Between flights, lodging, and actions, the bills can rapidly add up. That is the place journey insurance coverage is available in – a lifesaver in your pockets and your peace of thoughts. With the correct protection, you will be shielded from sudden occasions, equivalent to journey cancellations, medical emergencies, and misplaced or stolen baggage.

Sorts of Journey Insurance coverage

There are a number of varieties of journey insurance coverage out there, every catering to completely different wants and budgets. By understanding the choices, you may select the one which most closely fits your necessities.

Single-Journey Journey Insurance coverage

The one-trip coverage is designed for vacationers taking a one-time journey. It supplies protection for a selected journey, overlaying occasions equivalent to journey cancellations, medical emergencies, and journey delays. Single-trip insurance policies are perfect for these embarking on a one-time journey, equivalent to a honeymoon or a solo journey.

- The coverage sometimes covers journey cancellations, interruptions, and delays.

- It might additionally present medical emergency protection, together with evacuation and repatriation.

- Some insurance policies could embrace journey interruption insurance coverage, which covers unexpected circumstances like flight cancellations or pure disasters.

Annual Journey Insurance coverage

Annual journey insurance coverage is a cheaper choice for frequent vacationers. It supplies protection for a complete yr, making it best for many who take a number of journeys inside a 12-month interval. Annual insurance policies sometimes cowl the identical occasions as single-trip insurance policies, however with prolonged advantages equivalent to protection for enterprise journeys and extra lodging.

Backpacker Journey Insurance coverage

Backpacker journey insurance coverage is designed for budget-conscious vacationers, sometimes specializing in fundamental protection for occasions like medical emergencies and journey cancellations. These insurance policies typically embrace advantages like 24/7 help and travel-related insurance coverage. Backpacker insurance policies are perfect for these on a decent funds searching for the minimal needed protection.

Key Options to Think about

When selecting a journey insurance coverage coverage, a number of key options needs to be thought of. These embrace:

* Protection Limits: Decide the utmost quantity the coverage will cowl in case of an emergency.

* Pre-Current Medical Circumstances: Examine if the coverage covers pre-existing medical situations and if you must disclose them.

* Geographical Restrictions: Make sure the coverage covers your meant vacation spot(s).

* Coverage Extra: Perceive the surplus quantity you will have to pay in case of a declare.

* Coverage Period: Select a coverage that aligns along with your journey period.

* Premiums: Evaluate costs and advantages amongst completely different suppliers.

* Claims Course of: Perceive learn how to file a declare and the processing time.

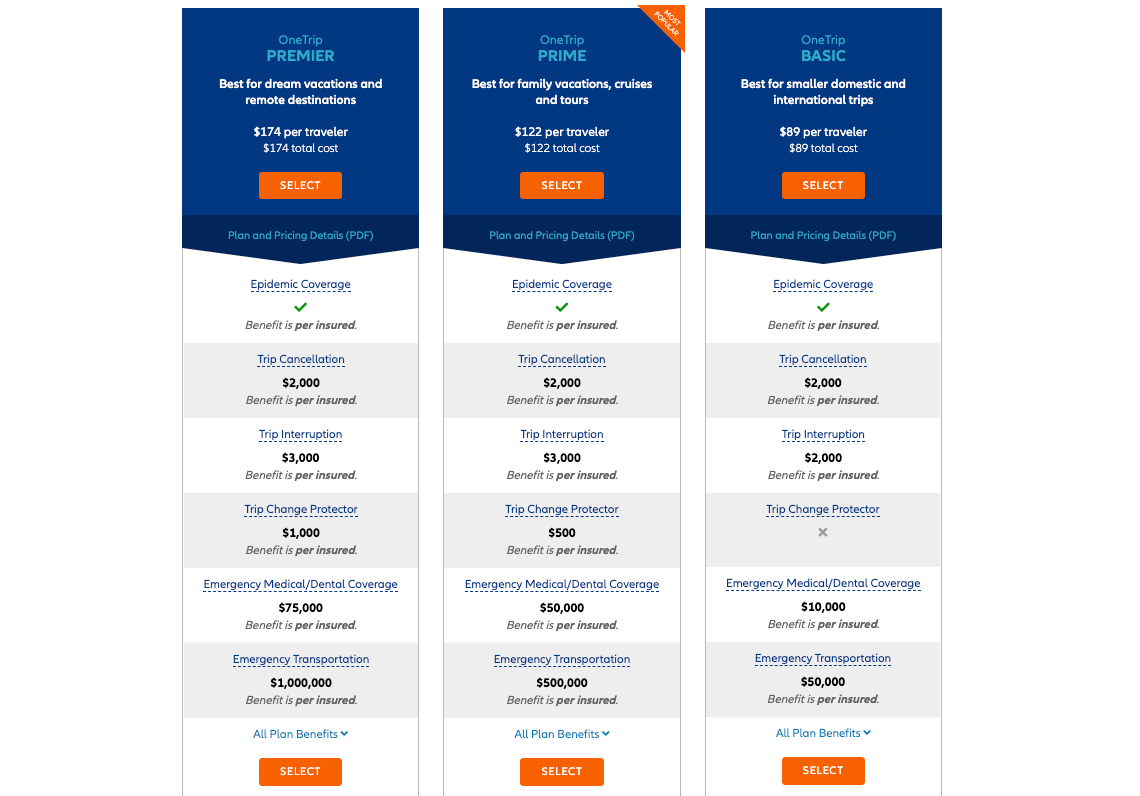

Coverage Comparability

When weighing the professionals and cons of every journey insurance coverage sort, contemplate the options listed above. For instance, for those who’re a frequent traveler, an annual coverage is likely to be the most suitable choice, whereas a single-trip coverage caters to these on one-time adventures. Be sure you learn evaluations and evaluate coverage options to make an knowledgeable determination that fits your wants and funds.

Options of Finest Journey Insurance coverage Offers

With regards to touring, it is important to have the correct insurance coverage protection to make sure a easy and stress-free journey. Journey insurance coverage insurance policies can range broadly when it comes to their options, advantages, and protection limits. To make an knowledgeable determination, you must perceive what to search for in a journey insurance coverage coverage. Here is a rundown of the important options to think about.

Protection Limits

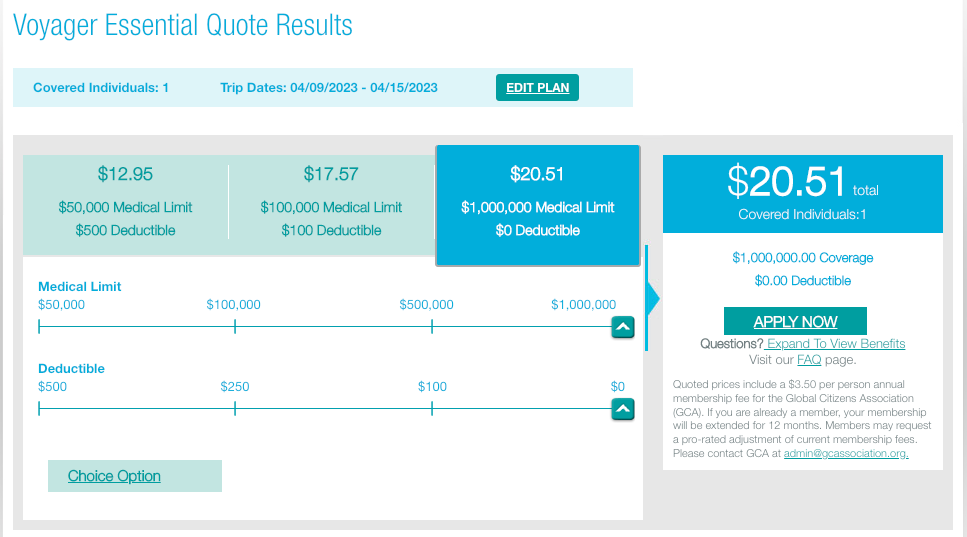

Protection limits are a vital side of journey insurance coverage. They decide the utmost quantity your insurer can pay out within the occasion of a declare. Usually, protection limits are expressed as a single restrict or a mixed single restrict (CSL). As an example, a coverage may need a medical protection restrict of $1 million, whereas additionally having a legal responsibility restrict of $500,000. When selecting a coverage, contemplate the next elements to find out your protection wants:

- Size and kind of journey: Lengthy-haul journeys, journey actions, or stays in areas with excessive medical prices could require larger protection limits.

- Pre-existing medical situations: If in case you have a pre-existing medical situation, it’s possible you’ll want larger protection limits or particular protection for that situation.

- Age and occupation: Older vacationers or these with demanding occupations could require larger protection limits or specialised protection.

Think about the next instance for instance the significance of protection limits:

Think about you are on a visit to the USA and endure a extreme snowboarding accident. In case your coverage has a medical protection restrict of $500,000, however your medical prices exceed that quantity, it’s possible you’ll be caught with sudden bills.

Extra and Deductibles

Excesses and deductibles are quantities you have to pay out-of-pocket earlier than your insurance coverage protection kicks in. These might be expressed as a set quantity or a share of the declare. As an example, a coverage may need a $500 extra for medical claims. When selecting a coverage, contemplate the next elements to find out your extra and deductible wants:

- Frequency of claims: If you happen to anticipate to make frequent claims, the next extra or deductible could cut back your premiums.

- Declare sorts: Sure declare sorts, equivalent to medical claims, could require decrease excesses or deductibles to make sure well timed entry to medical consideration.

- Threat tolerance: If you happen to’re snug with larger out-of-pocket bills, it’s possible you’ll go for decrease excesses or deductibles.

Think about the next instance for instance the influence of excesses and deductibles:

Think about you are on a visit and your baggage is misplaced or stolen. In case your coverage has a $200 extra for baggage claims, you will have to pay that quantity earlier than your insurance coverage protection kicks in.

24/7 Emergency Help, Finest journey insurance coverage offers trip-horizon.information

24/7 emergency help is a vital characteristic of journey insurance coverage. This service supplies help and steering in emergencies, equivalent to medical evacuations, pure disasters, or journey disruptions. When selecting a coverage, contemplate the next elements to find out your emergency help wants:

- Vacation spot: Vacationers visiting high-risk locations or participating in journey actions could require entry to 24/7 emergency help.

- Language obstacles: Vacationers who do not converse the native language could profit from help with communication and navigation.

- Pre-existing medical situations: Vacationers with pre-existing medical situations could require specialised help or emergency medical evacuation.

Think about the next instance for instance the significance of 24/7 emergency help:

Think about you are on a visit to a distant space and endure a extreme allergic response. In case your coverage does not present 24/7 emergency help, it’s possible you’ll battle to search out well timed medical consideration.

The way to Select the Proper Journey Insurance coverage

When embarking on a journey, securing the right journey insurance coverage is as essential as packing the correct clothes for the vacation spot. A coverage that matches your wants can present monetary reassurance, cowl sudden medical bills, and let you concentrate on exploration reasonably than worrying about journey disruptions.

Understanding Your Journey Wants

Earlier than choosing a journey insurance coverage coverage, it is important to evaluate your journey necessities. This includes contemplating the period of your journey, the actions you propose to interact in, the vacation spot, and naturally, your funds. Every of those elements performs a big function in figuring out the sort and stage of protection you want.

- A visit lasting weeks versus one which’s only a few days considerably differs when it comes to protection, because the latter often does not require prolonged sickness or harm advantages.

- Participating in high-risk actions equivalent to skydiving or deep-sea diving would require insurance policies that cowl journey sports activities, which are sometimes dearer than insurance policies for normal leisure actions.

- Locations have completely different ranges of medical care and emergency response providers, impacting the necessity for complete medical protection.

- An individual with pre-existing medical situations may have insurance policies with extra strong well being protections, which could not be reasonably priced for everybody.

Designing the Superb Coverage

Designing the Superb Coverage

The method of designing the best journey insurance coverage coverage includes a number of steps. Right here, you will contemplate your journey necessities, the extent of danger related along with your journey, and your funds. This may assist you to create a coverage that not solely covers the necessities but in addition caters to your particular wants.

- Journey Period: Calculate the fee based mostly on the size of your journey. An extended journey typically requires larger premiums.

- Actions: If you happen to plan to interact in high-risk actions, regulate your coverage accordingly to make sure ample protection, together with journey sports activities.

- Vacation spot: Think about the vacation spot’s entry to medical care, the price of medical remedy, and emergency response providers. This might result in extra complete protection for areas with insufficient medical amenities.

- Funds: Set a funds in your insurance coverage premiums and steadiness it with the protection you want, together with deductible ranges.

Issue Affecting Premiums

A number of elements can considerably influence your journey insurance coverage premiums. Understanding these elements will assist you to tailor your coverage to your particular wants whereas conserving your prices down.

| Issue | Description | Potential Influence on Premium |

|---|---|---|

| Age | The older you might be, the upper your premiums. | >10% |

| Vacation spot | Journey to a high-risk space or one with insufficient medical amenities can improve premiums. | >20% |

| Well being Circumstances | Pre-existing medical situations could require extra complete protection and better premiums. | >30% |

| Actions | Participating in high-risk actions like journey sports activities can considerably improve premiums. | >50% |

Widespread Misconceptions about Journey Insurance coverage

Journey insurance coverage is an important part of any journey, however many vacationers maintain misconceptions about what it covers and the way it works. By understanding the widespread misconceptions, you may make knowledgeable choices when choosing the correct insurance coverage coverage in your subsequent journey. Misconceptions typically come up from a lack of expertise concerning the varieties of protection out there and the variations between varied insurance policies.

Journey Insurance coverage vs. Journey Help

Journey insurance coverage and journey help are sometimes confused with each other because of their related names, however they serve distinct functions.

Journey insurance coverage supplies monetary safety in opposition to unexpected occasions, cancellations, and journey interruptions. It reimburses you for lined bills, equivalent to medical emergencies, journey cancellations, or missed connections. Insurance coverage insurance policies typically have situations, exclusions, and limitations that dictate what is roofed and what’s not.

Journey help, however, affords help and sources throughout your journey. It may possibly embrace providers like 24/7 emergency hotlines, journey recommendation, and medical referrals. Whereas journey help doesn’t present monetary compensation, it affords worthwhile help and steering to mitigate the influence of sudden occasions.

In distinction, journey help is commonly included in the price of your journey as a part of your airline package deal or a journey providers bundle. Because of this if you buy your flights or lodging, you may additionally be receiving entry to journey help advantages.

Sudden Occasions vs. Deliberate Actions

One other false impression about journey insurance coverage is that it supplies protection for all sorts of occasions, together with these which are deliberate or unexpected.

Whereas journey insurance coverage typically covers sudden occasions, it sometimes doesn’t cowl deliberate actions, equivalent to snowboarding, scuba diving, or taking part in journey sports activities. These actions might be expensive to cowl individually, and lots of insurance coverage suppliers supply particular insurance policies or riders that improve the protection limits for particular actions.

The excellence between sudden occasions and deliberate actions might be essential when choosing the correct journey insurance coverage coverage. If you happen to plan to interact in journey actions, it’s possible you’ll have to buy further protection to make sure that you’re absolutely protected.

- Journey insurance coverage typically doesn’t cowl deliberate actions or high-risk sports activities, which require separate protection.

- Journey help supplies help and sources throughout your journey, however doesn’t supply monetary compensation.

- Distinguishing between sudden occasions and deliberate actions is vital when selecting the best journey insurance coverage coverage.

- Some insurance coverage suppliers supply particular insurance policies or riders that improve protection limits for particular actions.

Organizing Your Journey Paperwork with Journey-Horizon.Data

Efficient journey planning includes meticulous group, and this extends to your journey paperwork as nicely. With Journey-Horizon.Data, you may streamline the method, guaranteeing that you’ve all the required paperwork prepared if you want them. On this phase, we’ll discover strategies for organizing your journey paperwork digitally and bodily, and talk about how utilizing journey insurance coverage documentation can help in journey preparation.

Digital Group Strategies

There are a number of digital instruments and strategies that may assist you to preserve your journey paperwork so as. Think about using a cloud-based storage system, equivalent to Google Drive or Dropbox, to retailer digital copies of your paperwork. This manner, you may entry them from anyplace, and so they will not get misplaced or broken. It’s also possible to use apps like Evernote or OneNote to arrange your paperwork into folders and tags, making it straightforward to search out what you want.

Bodily Group Strategies

For bodily paperwork, a journey pockets or organizers generally is a lifesaver. These sometimes have separate compartments for passports, visas, journey insurance coverage paperwork, and different important paperwork. It’s also possible to use a folder or binder to retailer your bodily paperwork, making it straightforward to hold them with you. Think about using a file organizer or a pouch with compartments to maintain your paperwork neatly organized.

Important Paperwork for a Journey

There are a number of important paperwork that you must all the time carry with you when touring. These embrace your passport, visa, journey insurance coverage paperwork, driver’s license or ID card, and any required visas or journey permits. Do not forget to incorporate copies of your medical health insurance card, if relevant, and your journey itinerary. It is also a good suggestion to make digital copies of those paperwork and depart a duplicate with a trusted buddy or member of the family in case of an emergency.

Utilizing Journey Insurance coverage Documentation for Journey Preparation

Journey insurance coverage documentation can play a vital function in making ready in your journey. By having a complete journey insurance coverage coverage, you will be protected in opposition to sudden occasions equivalent to journey cancellations, medical emergencies, or baggage loss. Be sure you assessment your coverage paperwork fastidiously, noting any situations, exclusions, and limitations. This may assist you to perceive what’s and is not lined, guaranteeing that you just’re adequately ready for any potential points that will come up throughout your journey.

Extra Suggestions for Organizing Journey Paperwork

Along with the above strategies, listed below are some further suggestions to bear in mind:

- Make digital copies of your paperwork and retailer them securely on-line.

- Depart a duplicate of your itinerary and journey paperwork with a trusted buddy or member of the family.

- Carry a bodily copy of your vital paperwork, equivalent to your passport and driver’s license.

- Preserve your paperwork organized and simply accessible, utilizing a journey pockets or folder.

- Overview your journey insurance coverage coverage paperwork fastidiously, noting any situations, exclusions, and limitations.

Getting ready for an Journey with Journey-Horizon.Data Journey Insurance coverage: Finest Journey Insurance coverage Offers Journey-horizon.information

Buying journey insurance coverage is a vital step in your pre-trip planning journey. With the correct insurance coverage, you will be protected in opposition to sudden occasions, permitting you to concentrate on making unforgettable recollections. At Journey-Horizon.Data, we have got you lined with top-notch journey insurance coverage offers that cater to your distinctive wants.

Obligatory Paperwork and Well being Info

Earlier than embarking in your journey, collect the required paperwork and replace your well being info to make sure a seamless journey expertise. Guarantee you’ve the next:

* Legitimate journey paperwork, together with your passport, visa (if required), and photocopies of important pages

* A duplicate of your medical health insurance card or details about any pre-existing medical situations

* Contact info in your emergency contacts again dwelling

Pre-Journey Guidelines Desk

Here is a complete desk outlining the important steps to think about earlier than your journey:

| Exercise | Period | Value | Notes |

|---|---|---|---|

| Buying Journey Insurance coverage | Earlier than reserving your flight | Round $50-$100 per particular person | Get a quote on Journey-Horizon.Data and select the plan that fits your wants |

| Checking Journey Necessities | Earlier than reserving your flight | Analysis visa necessities, vaccinations, and well being paperwork wanted in your vacation spot | |

| Updating Well being Info | Earlier than reserving your flight | Inform your airline and journey insurance coverage supplier about any pre-existing medical situations | |

| Gathering Important Paperwork | Earlier than departure | Value of photocopies and journey adapters | Be sure you have all needed paperwork, together with your passport, visa, and medical health insurance card |

Suggestions for a Clean Pre-Journey Planning Expertise

To make sure a stress-free pre-trip planning course of:

* Analysis your vacation spot and keep knowledgeable about native situations, climate forecasts, and well being alerts

* Plan your itinerary forward of time and create a practical schedule

* Examine the expiration dates of your passport, visa, and journey paperwork

* Do not hesitate to succeed in out to Journey-Horizon.Data for steering on journey insurance coverage and pre-trip planning

Keep in mind, with Journey-Horizon.Data, you may journey with confidence, understanding you are protected and ready for any sudden occasions that will come up throughout your journey.

Wrap-Up

In conclusion, greatest journey insurance coverage offers trip-horizon.information affords a complete information that can assist you navigate the world of journey insurance coverage. From understanding the several types of journey insurance coverage insurance policies to selecting the best one in your wants, this text has lined all of it. Whether or not you are a seasoned traveler or a first-timer, this info will assist you to make knowledgeable choices and luxuriate in a hassle-free journey.

Questions and Solutions

What’s the distinction between single-trip and annual journey insurance coverage?

Single-trip journey insurance coverage covers you for a selected journey, whereas annual journey insurance coverage covers you for a number of journeys inside a yr.

How do I do know which sort of journey insurance coverage to decide on?

Think about your journey frequency, journey period, and funds to find out whether or not single-trip or annual journey insurance coverage is greatest for you.

Can I buy journey insurance coverage after making a reserving?

No, it is advisable to buy journey insurance coverage earlier than making a reserving or not less than inside 24-48 hours of creating a deposit.

What’s the goal of journey insurance coverage documentation?

Journey insurance coverage documentation is important for submitting claims and accessing 24/7 emergency help providers.

Can I cancel my journey insurance coverage coverage at any time?

Insurance policies could have cancellation charges or penalties, so it is important to assessment the high-quality print earlier than buying.