Greatest Banks for Nonprofits units the stage for this enthralling narrative, providing readers a glimpse right into a story that’s wealthy intimately and brimming with originality from the outset. The advanced tapestry of nonprofit monetary wants is meticulously woven right into a coherent narrative, exploring how completely different banks cater to those necessities and the significance of partnering with a financial institution that understands the distinctive monetary calls for of nonprofit entities.

The intricate dance between nonprofit organizations and their monetary companions is superbly illustrated, highlighting the varieties of banking providers supplied by prime banks for nonprofits, together with money administration, funding, and credit score amenities. The narrative expertly navigates the important options of a complete banking partnership for nonprofits, figuring out the advantages of working with a financial institution that has a powerful observe report of supporting the nonprofit sector.

Overview of Greatest Banks for Nonprofits

With regards to managing funds for non-profit organizations, partnering with a financial institution that understands their distinctive monetary necessities is essential. Non-profit organizations have distinct monetary wants that differ from these of for-profit companies, and a financial institution that caters to those wants may also help them obtain their objectives extra effectively. Listed below are some key features to contemplate when evaluating banks for non-profit partnerships.

Monetary Wants of Nonprofit Organizations

Non-profit organizations have numerous monetary necessities that adjust relying on their measurement, kind, and mission. Some might require specialised banking providers reminiscent of grants administration, donor reporting, and fund accounting, whereas others may have fundamental checking and financial savings accounts.

- Grants Administration: Nonprofits might obtain grants from numerous sources, and managing these funds effectively is essential. Banks that provide complete grant administration providers may also help non-profits observe grant awards, monitor bills, and guarantee compliance with grant necessities.

- Donor Reporting: Nonprofits depend on donations to assist their missions, and correct reporting is important for sustaining donor belief. Banks that present donor reporting providers may also help non-profits observe donations, generate experiences, and keep up-to-date with donor exercise.

- Fund Accounting: Nonprofits usually handle a number of funds, and correct accounting is significant for monetary stability. Banks that provide fund accounting providers may also help non-profits observe fund balances, reconcile accounts, and make knowledgeable funding choices.

Significance of Specialised Banking Providers

A financial institution that understands the monetary wants of non-profit organizations can present specialised banking providers that cater to their distinctive necessities. Some advantages of partnering with a financial institution that gives specialised banking providers for non-profits embody:

- Streamlined monetary administration: Specialised banking providers may also help non-profits streamline their monetary administration processes, liberating up workers to concentrate on their core mission.

- Improved donor relationships: Correct and well timed donor reporting may also help non-profits construct belief with their donors and keep sturdy relationships.

- Enhanced monetary stability: Complete grant administration and fund accounting providers may also help non-profits guarantee monetary stability and make knowledgeable funding choices.

Banks That Cater to Non-Revenue Organizations

A number of banks cater to the monetary wants of non-profit organizations, offering specialised banking providers and tailor-made options. Some notable banks that provide banking providers for non-profits embody:

- Financial institution of America: Recognized for its complete banking providers for non-profits, Financial institution of America affords grant administration, donor reporting, and fund accounting providers.

- Chase Financial institution: Chase Financial institution supplies specialised banking providers for non-profits, together with grants administration, donor reporting, and monetary administration.

- Wells Fargo: Wells Fargo affords a variety of banking providers for non-profits, together with grants administration, donor reporting, and fund accounting.

High Banks for Nonprofits within the US

Choosing the fitting financial institution to your nonprofit group is essential for environment friendly monetary administration and progress. Every financial institution affords a singular set of options and advantages tailor-made to the precise wants of nonprofits. By choosing the proper financial institution, you may optimize your monetary operations, broaden your attain, and create an enduring influence in your group.

Key Options of High Banks for Nonprofits

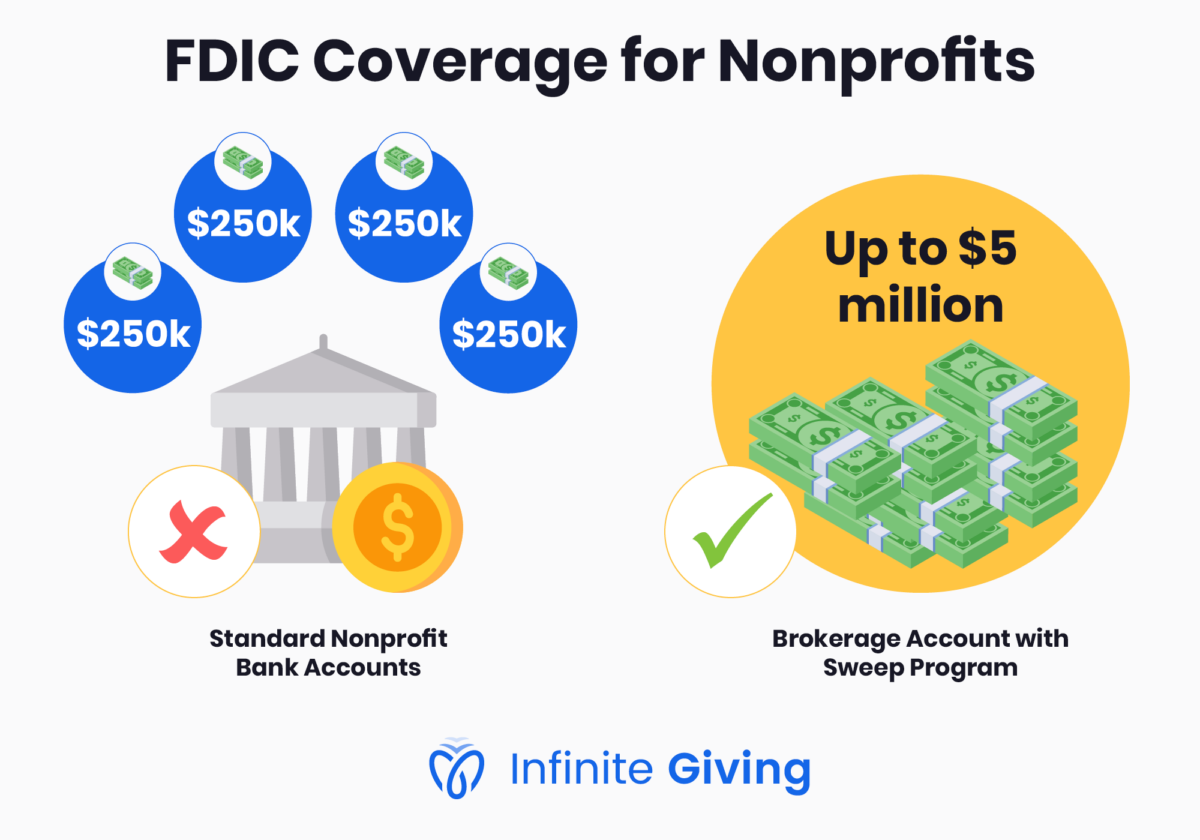

When evaluating one of the best banks for nonprofits within the US, a number of key options turn into important. This consists of charges and fees, money administration instruments, funding choices, and group involvement. These options are essential in guaranteeing that your nonprofit’s monetary wants are met whereas selling monetary inclusivity and empowerment.

| Financial institution Title | Charges and Fees | Money Administration Instruments | Funding Choices | Neighborhood Involvement |

|---|---|---|---|---|

| Financial institution of America Nonprofit Banking | Restricted or no month-to-month upkeep charges | Actual-time reporting and transaction monitoring | Aggressive rates of interest on financial savings and funding accounts | Monetary literacy packages for underserved communities |

| Wells Fargo Nonprofit Banking | No month-to-month upkeep charges on enterprise checking accounts | Superior money administration instruments, together with on-line banking | Diversified funding choices, together with social influence investing | Philanthropic initiatives and group improvement packages |

| U.S. Financial institution Nonprofit Banking | No month-to-month upkeep charges on enterprise checking accounts | Actual-time money administration and cost providers | Aggressive rates of interest on financial savings and funding accounts | Monetary literacy packages and group improvement initiatives |

| Citi Basis | Restricted or no charges on enterprise deposits | Superior money administration instruments, together with on-line banking | Funding choices centered on social and environmental influence | Neighborhood improvement packages and monetary inclusion initiatives |

| KeyBank Nonprofit Enterprise Banking | No month-to-month upkeep charges on enterprise checking accounts | Actual-time money administration and cost providers | Aggressive rates of interest on financial savings and funding accounts | Neighborhood improvement packages and philanthropic initiatives |

Distinctive Worth Proposition of Every Financial institution

Every financial institution has its distinctive worth proposition, making them appropriate for several types of nonprofit organizations. As an example, Financial institution of America Nonprofit Banking affords restricted or no month-to-month upkeep charges, making it a beautiful choice for small or start-up nonprofits. Then again, Wells Fargo Nonprofit Banking supplies superior money administration instruments and diversified funding choices, making it a most popular alternative for bigger nonprofits. Finally, the selection of financial institution is determined by the precise wants and objectives of the nonprofit group.

Suitability for Completely different Kinds of Nonprofit Organizations

The suitability of every financial institution for several types of nonprofit organizations is determined by a number of components, together with their measurement, monetary wants, and group involvement objectives. As a normal guideline, smaller nonprofits might desire banks with restricted or no charges, reminiscent of Financial institution of America Nonprofit Banking. Bigger nonprofits might profit from banks with superior money administration instruments and diversified funding choices, reminiscent of Wells Fargo Nonprofit Banking. Finally, the selection of financial institution is determined by the precise wants and objectives of the nonprofit group.

Nonprofit-Pleasant Banks by Class: Greatest Banks For Nonprofits

Many nonprofits function in particular sectors, reminiscent of environmental conservation, healthcare, and training, and banks that cater to those teams can provide tailor-made services and products. These specialised banks can present useful assist to nonprofits by understanding their distinctive wants and challenges.

Environmental Organisations

Banks that target serving environmental nonprofits have developed services and products that assist these organizations obtain their mission. As an example,

TD Environmental Options

affords a variety of monetary services and products designed particularly for environmental teams. Some key options of those merchandise embody:

- Sustainable Funding Choices: These embody socially accountable funding portfolios and influence investments that assist environmentally-friendly tasks.

- Specialised Lending: TD Environmental Options supplies versatile mortgage choices for environmental nonprofits to fund tasks that promote sustainability and conservation.

- Donation and Fundraising Help: The financial institution affords professional advisory providers and revolutionary options for environmental nonprofits to lift funds and handle their funds successfully.

Healthcare Suppliers, Greatest banks for nonprofits

Banks that cater to healthcare suppliers provide a variety of monetary services and products tailor-made to fulfill the distinctive wants of those organizations. For instance,

Financial institution of America’s Nonprofit Banking Options

supplies monetary instruments and assist to assist healthcare nonprofits handle their funds and obtain their objectives. Some key options of those providers embody:

- Streamlined Fee Providers: Financial institution of America’s superior cost processing techniques allow healthcare nonprofits to handle affected person funds effectively and scale back administrative burdens.

- Personalized Banking Options: The financial institution affords specialised banking options that cater to the distinctive wants of healthcare nonprofits, together with checking and financial savings accounts tailor-made to their particular necessities.

- Skilled Advisory Providers: Financial institution of America’s staff of specialists supplies steering on monetary planning, budgeting, and fundraising to assist healthcare nonprofits navigate advanced monetary challenges.

Training Establishments

Banks that serve training establishments provide a variety of services and products designed to fulfill the precise wants of those organizations. As an example,

JPMorgan Chase’s Training Banking Options

supplies monetary instruments and assist to assist instructional nonprofits handle their funds and obtain their objectives. Some key options of those providers embody:

- Specialised Lending: JPMorgan Chase affords versatile mortgage choices for training nonprofits to fund tasks that promote training and studying.

- Funding Administration: The financial institution supplies professional funding administration providers to training nonprofits, serving to them develop their endowments and obtain long-term monetary objectives.

- Donation and Fundraising Help: JPMorgan Chase affords professional advisory providers and revolutionary options for training nonprofits to lift funds and handle their funds successfully.

Sustainable Banking Practices for Nonprofits

Sustainable banking practices have turn into more and more vital for nonprofits in recent times. As organizations concentrate on making a optimistic influence on society and the surroundings, they’re searching for banking companions that share their values. Banks that prioritize sustainable practices will not be solely contributing to the long-term well being of the planet but additionally supporting the mission-driven work of nonprofits.

1. Socially Accountable Investing

For nonprofits, investing in socially accountable funds is a approach to make sure that their monetary assets are aligned with their mission and values. Socially accountable investing (SRI) includes deciding on investments which have a optimistic influence on society and the surroundings, whereas avoiding those who hurt the planet or communities. This method may also help nonprofits obtain their objectives whereas additionally contributing to the higher good.

- The SRI motion has grown considerably in recent times, with belongings beneath administration exceeding $10 trillion globally.

- By investing in SRI funds, nonprofits can assist firms that prioritize environmental sustainability, human rights, and social justice.

- SRI funds usually exclude firms concerned in actions reminiscent of fossil gasoline extraction, tobacco manufacturing, or arms manufacturing.

2. Environmental Stewardship

Banks that prioritize environmental stewardship are dedicated to decreasing their very own environmental footprint whereas supporting their purchasers’ sustainability efforts. This consists of initiatives reminiscent of renewable vitality investments, inexperienced buildings, and waste discount packages.

“Investing in environmental sustainability is important for making a more healthy planet and supporting the long-term success of our purchasers.”

- Some banks provide inexperienced mortgage choices that present financing for renewable vitality tasks or vitality effectivity upgrades.

- Others present environmental influence assessments to assist purchasers perceive the environmental implications of their enterprise choices.

- Multinational companies reminiscent of IKEA and Unilever have partnered with banks to create inexperienced financing packages that assist sustainable agriculture and renewable vitality improvement.

3. Neighborhood Improvement

Neighborhood improvement is a key facet of sustainable banking practices for nonprofits. Banks that prioritize group improvement concentrate on supporting native financial progress, selling monetary inclusion, and fostering social cohesion.

- Some banks provide group improvement monetary establishment (CDFI) certification, which acknowledges establishments that serve low-income and marginalized communities.

- CDFIs usually present loans and investments to small companies, cooperatives, and social enterprises in underserved communities.

- Neighborhood improvement initiatives can embody packages for reasonably priced housing, job coaching, and microfinance providers.

Some notable banks that prioritize sustainable banking practices for nonprofits embody Trillium Asset Administration, VanCity, and the Financial institution of America’s Impression Investing arm. When selecting a financial institution companion, nonprofits ought to search for establishments that align with their values and mission.

Case Research of Nonprofit-Financial institution Partnerships

For nonprofit organizations, discovering the fitting financial institution companion will be essential for attaining monetary stability and progress. Profitable partnerships between nonprofits and banks may also help organizations obtain their objectives, navigate advanced monetary techniques, and construct belief with their communities.

Constructing sturdy relationships with monetary establishments is significant for nonprofits. Banks can present entry to capital, professional monetary recommendation, and different assets that may assist organizations maintain and broaden their work. In return, nonprofit organizations can provide banks the chance to contribute to the group, improve their model popularity, and adjust to regulatory necessities.

Examples of Profitable Nonprofit-Financial institution Partnerships

Listed below are some examples of profitable nonprofit-bank partnerships within the US:

| Nonprofit Title | Financial institution Companion | Objectives and Goals | Challenges | Outcomes |

|---|---|---|---|---|

| United Method of Metro Chicago | JPMorgan Chase | To offer monetary training and asset-building packages to low-income households | Tight budgets and restricted assets | Profitable program implementation, elevated monetary literacy, and asset progress amongst contributors |

| Neighborhood First Fund | KeyBank | To offer reasonably priced housing and group improvement loans to low-income households | Excessive demand for loans, restricted funding | Improve in reasonably priced housing items, improved group improvement outcomes |

| Women Inc. | Financial institution of America | To offer monetary training and mentorship packages to women from under-resourced communities | Problem in reaching a big viewers, restricted assets | Elevated monetary literacy and confidence amongst contributors, improved educational and profession outcomes |

Key Components Contributing to Success

A number of components contributed to the success of those partnerships. They embody:

- Shared Objectives and Goals: Each companions should have clear and aligned objectives that profit them and the group.

- Belief and Communication: Constructing belief and sustaining open communication channels is important for profitable partnerships.

- Collaborative Strategy: Each companions should be prepared to collaborate, share assets, and leverage one another’s experience.

- Flexibility and Adaptability: Partnerships require flexibility and flexibility to deal with rising challenges and alternatives.

By analyzing these case research, nonprofits and banks can higher perceive the important thing parts obligatory for profitable partnerships and work collectively to realize their shared objectives.

Final Phrase

The dialogue of greatest banks for nonprofits culminates in a complete exploration of the highest banks within the US, their distinctive worth propositions, and suitability for several types of nonprofit organizations. The narrative concludes by underscoring the significance of sustainable banking practices for nonprofits, socially accountable investing, environmental stewardship, and group improvement. By analyzing profitable nonprofit-bank partnerships and providing a guidelines of important components for nonprofits to contemplate when deciding on a financial institution, this narrative empowers readers to navigate the advanced world of nonprofit banking with confidence.

Well-liked Questions

What are the important options of a complete banking partnership for nonprofits?

The important options of a complete banking partnership for nonprofits embody payment financial savings, money administration instruments, and devoted account managers. This partnership requires a financial institution that has a powerful observe report of supporting the nonprofit sector.

How do banks cater to the distinctive monetary calls for of nonprofit entities?

Banks cater to the distinctive monetary calls for of nonprofit entities by providing specialised monetary options, together with money administration, funding, and credit score amenities. Additionally they present a variety of banking providers tailor-made to the precise wants of nonprofit organizations.

What are the advantages of working with a financial institution that has a powerful observe report of supporting the nonprofit sector?

The advantages of working with a financial institution that has a powerful observe report of supporting the nonprofit sector embody entry to a variety of monetary providers, professional recommendation, and a deep understanding of nonprofit monetary wants.

How do nonprofit organizations choose one of the best financial institution for his or her wants?

Nonprofit organizations choose one of the best financial institution for his or her wants by contemplating a variety of things, together with charges, providers, and group involvement. They need to additionally consider and examine completely different banking choices to find out one of the best match for his or her group.