Finest Purchase Credit score Card Credit score Rating Necessities is an important side to know for these seeking to apply for Finest Purchase bank cards. The narrative unfolds in a compelling and distinctive method, drawing readers right into a story that guarantees to be each participating and uniquely memorable.

The importance of credit score rating can’t be overstated in terms of Finest Purchase bank cards. Your credit score rating performs a major function in figuring out the approval of your bank card utility and the rate of interest you may be charged. The next credit score rating can result in decrease rates of interest, increased credit score limits, and extra rewards and advantages. However, a decrease credit score rating can lead to increased rates of interest, decrease credit score limits, and fewer rewards and advantages.

Finest Purchase Credit score Card Credit score Rating Necessities

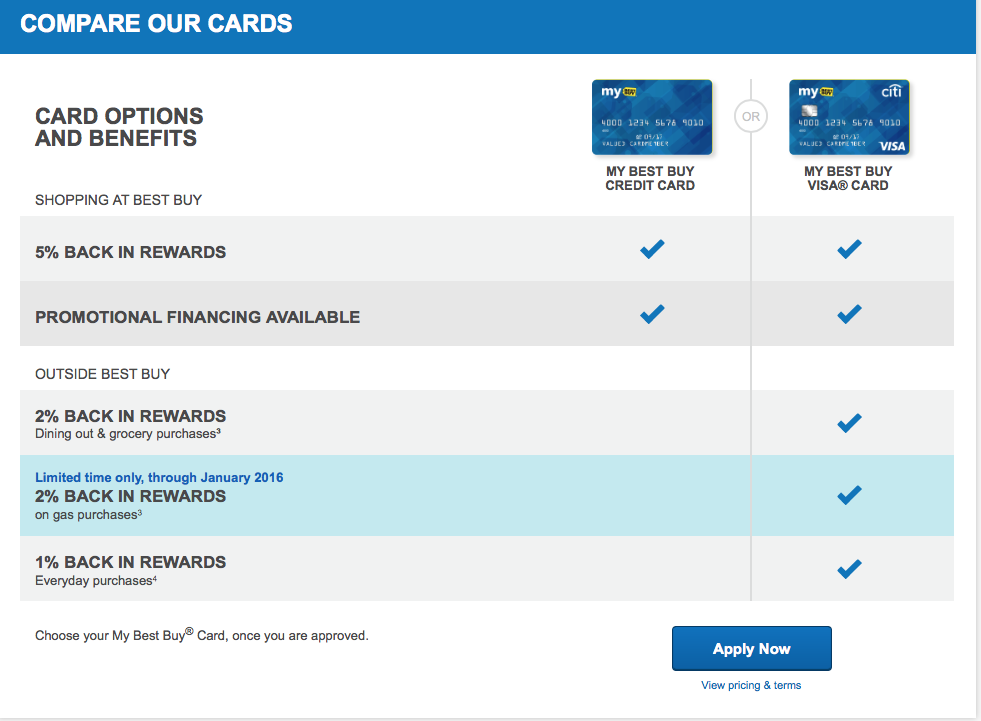

Finest Purchase provides a variety of bank cards, every with its personal set of necessities and phrases. Relating to credit score rating, understanding the minimal necessities for various Finest Purchase bank cards is crucial to make sure approval and favorable phrases.

Minimal Credit score Rating Necessities for Finest Purchase Credit score Playing cards

The minimal credit score rating necessities for Finest Purchase bank cards differ primarily based on the kind of card and the issuer. Usually, the necessities vary from 620 to 850, which corresponds to a Honest to Glorious credit score rating. Here is a comparability of the minimal credit score rating necessities for various Finest Purchase bank cards:

- The Finest Purchase Credit score Card, issued by Citibank, requires a minimal credit score rating of 620.

- The Finest Purchase Visa Credit score Card, additionally issued by Citibank, has a minimal credit score rating requirement of 650.

- The My Finest Purchase Visa Credit score Card, which provides 5% rewards on purchases, requires a minimal credit score rating of 700.

It is value noting that whereas these are the minimal credit score rating necessities, having the next credit score rating can result in higher approval charges and extra favorable rates of interest.

The Influence of Credit score Rating on Credit score Card Approval and Curiosity Charges

Your credit score rating performs a major function in figuring out whether or not you may be accredited for a bank card and what rates of interest you may be supplied. A very good credit score rating can result in:

- Higher approval charges: If in case you have a excessive credit score rating, you are extra prone to get accredited for a bank card with favorable phrases.

- Decrease rates of interest: A very good credit score rating can result in decrease rates of interest, making it simpler to repay your steadiness with out accumulating high-interest fees.

- Increased rewards charges: Some bank cards supply increased rewards charges for customers with good credit score scores.

How you can Examine Credit score Rating Stories and Dispute Errors

Checking your credit score rating report commonly might help you determine errors and take corrective motion. You may get hold of your credit score rating report from the three main credit score bureaus: Equifax, Experian, and TransUnion. When you discover any errors, you’ll be able to dispute them with the credit score bureau and doubtlessly enhance your credit score rating.

In response to the Honest Credit score Reporting Act, you’ll be able to request a free credit score report from every of the three main credit score bureaus every year.

To verify your credit score rating report, observe these steps:

- Go to the web site of the credit score bureau (Equifax, Experian, or TransUnion) and observe the prompts to request a credit score report.

- Evaluation your report fastidiously, searching for any errors or inaccuracies.

- Dispute any errors by contacting the credit score bureau and offering documentation to assist your claims.

Enhancing Your Credit score Rating for Finest Purchase Credit score Playing cards

To enhance your credit score rating and turn into eligible for Finest Purchase bank cards, take into account the next methods. Sustaining a very good credit score rating can even open doorways to higher mortgage charges, decrease rates of interest, and elevated monetary flexibility.

Enhancing your credit score rating in a brief interval requires dedication and self-discipline. It is important to know the components that have an effect on your credit score rating and work on enhancing them. Listed here are some efficient strategies to enhance your credit score rating in a brief interval:

Credit score Utilization

Your credit score utilization ratio is the share of obtainable credit score getting used. Preserve this ratio under 30% for optimum credit score scores. For instance, you probably have a credit score restrict of $1,000, attempt to hold your steadiness under $300.

Goal for a credit score utilization ratio under 30% to exhibit accountable credit score administration to lenders.

- Repay high-interest money owed to scale back your credit score utilization ratio.

- Make on-time funds to take care of a very good cost historical past.

- Keep away from making use of for a number of bank cards in a brief interval, as this could negatively have an effect on your credit score rating.

Fee Historical past

Fee historical past accounts for 35% of your credit score rating. Late funds can considerably decrease your credit score rating, so be certain that to pay your payments on time.

Late funds can lead to broken credit score scores and elevated debt prices.

- Arrange computerized funds to make sure well timed funds.

- Monitor your credit score accounts to detect potential late funds.

- Repay any excellent money owed to stop late funds.

Credit score Age

The longer you’ve got a credit score account open, the higher it’s on your credit score rating. Nonetheless, closing outdated accounts will be counterproductive.

Closing outdated accounts can shorten your credit score historical past, negatively impacting your credit score rating.

- Preserve outdated accounts open to take care of a protracted credit score historical past.

- Keep away from making use of for bank cards or different credit score merchandise unnecessarily.

- Contemplate protecting a low steadiness on older accounts to point out accountable credit score use.

Credit score Combine

A various mixture of credit score can positively affect your credit score rating. This consists of bank cards, loans, and different credit score merchandise.

A various mixture of credit score might help enhance your credit score rating by demonstrating accountable credit score administration.

- Diversify your credit score combine by making use of for various kinds of credit score.

- Make well timed funds to take care of a very good credit score historical past.

- Keep away from accumulating an excessive amount of debt, as this could negatively affect your credit score rating.

Credit score Monitoring Companies

Credit score monitoring companies might help you observe your credit score report and detect potential errors or fraud. This may be particularly useful for Finest Purchase bank card candidates who wish to keep a very good credit score rating.

Often monitoring your credit score report might help determine errors or fraud, permitting you to take corrective motion and keep a very good credit score rating.

- Join credit score monitoring companies to trace your credit score report.

- Evaluation your credit score report commonly to detect potential errors.

- Dispute any errors or discrepancies present in your credit score report.

Managing Debt and Credit score Utilization

Managing debt and credit score utilization is essential for sustaining a very good credit score rating. Listed here are some suggestions that will help you handle your debt and credit score utilization:

Sustaining a low credit score utilization ratio and paying off money owed might help enhance your credit score rating and keep monetary flexibility.

- Prioritize debt compensation by specializing in high-interest money owed first.

- Make on-time funds to take care of a very good cost historical past.

- Keep away from accumulating an excessive amount of debt, as this could negatively affect your credit score rating.

Frequent Credit score Rating Myths and Misconceptions About Finest Purchase Credit score Playing cards

As we proceed our dialogue on Finest Purchase bank cards, it is important to deal with frequent myths and misconceptions surrounding credit score scores and their affect on credit score approval. Many customers are unaware of the misconceptions about credit score scores, which might result in inaccurate assumptions and potential monetary penalties.

One frequent false impression is that credit score scores are the identical as credit score experiences. Whereas credit score experiences include details about a person’s credit score historical past, credit score scores are numerical values that characterize a abstract evaluation of that historical past. Credit score scores, such because the FICO rating, calculate a credit score rating primarily based on components like cost historical past, credit score utilization, and credit score age.

Delusion 1: Paying down debt will all the time enhance your credit score rating , Finest purchase bank card credit score rating

Paying down debt can actually result in improved credit score utilization and, subsequently, the next credit score rating. Nonetheless, this isn’t all the time the case. For instance, you probably have a protracted credit score historical past with a low credit score utilization ratio, focusing solely on paying down debt might not essentially enhance your credit score rating.

Delusion 2: Closing outdated accounts will enhance your credit score utilization ratio

Closing outdated accounts may very well hurt your credit score utilization ratio and credit score rating. If you shut outdated accounts, the credit score utilization ratio in your remaining accounts might enhance, as you’ve got fewer accounts to unfold your debt throughout. This may negatively affect your credit score rating.

Delusion 3: Checking your credit score rating will decrease your credit score rating

Happily, checking your personal credit score rating doesn’t negatively affect your credit score rating. In actual fact, checking your personal credit score rating is taken into account a mushy inquiry, versus a tough inquiry, which is triggered by a lender reviewing your credit score report if you apply for credit score.

Delusion 4: You might want to have an ideal credit score rating to get accredited for a Finest Purchase bank card

Whereas having a excessive credit score rating can enhance your possibilities of approval, an ideal credit score rating shouldn’t be a requirement. Many customers with decrease credit score scores can nonetheless be accredited for a Finest Purchase bank card, however they might face increased rates of interest or stricter phrases.

Penalties of Inaccurate Credit score Rating Data

Inaccurate credit score rating data can result in a variety of penalties, together with:

- Affecting your credit score approval possibilities and the rates of interest you qualify for

- Shedding out on bank card provides or being accredited for decrease credit score limits

- Overpaying for bank cards attributable to increased rates of interest or charges

- Struggling to qualify for loans or mortgages

Defending Your Credit score Rating Knowledge When Making use of for Finest Purchase Credit score Playing cards

To guard your credit score rating information when making use of for Finest Purchase bank cards, observe the following tips:

- Monitor your credit score report commonly to make sure it is correct and up-to-date

- Use on-line assets to verify your credit score rating totally free or at a low price

- Keep away from making use of for a number of bank cards in a brief interval, as this could result in a number of exhausting inquiries

- Be cautious of phishing scams or identification theft when making use of for credit score on-line

- Rigorously evaluation the phrases and circumstances of your bank card utility to know the rates of interest and charges concerned

By avoiding these frequent credit score rating myths and misconceptions, you can also make knowledgeable selections about managing your credit score and making use of for Finest Purchase bank cards. Bear in mind to all the time evaluation your credit score report and rating commonly to make sure accuracy and benefit from your monetary scenario.

In response to the Client Monetary Safety Bureau, one in 5 customers has an error on their credit score report that may have an effect on their credit score rating.

Concluding Remarks: Finest Purchase Credit score Card Credit score Rating

In conclusion, understanding the Finest Purchase Credit score Card Credit score Rating Necessities is crucial for anybody seeking to apply for Finest Purchase bank cards. The next credit score rating can result in extra advantages and rewards, whereas a decrease credit score rating can lead to fewer advantages and better rates of interest. By monitoring your credit score rating commonly and taking steps to enhance it, you can also make knowledgeable selections about your bank card utility and obtain your monetary objectives.

Regularly Requested Questions

Q: What’s the minimal credit score rating required for a Finest Purchase bank card utility?

The minimal credit score rating required for a Finest Purchase bank card utility varies relying on the kind of card you are making use of for. Usually, a credit score rating of 650 or increased is required for approval.

Q: How does my credit score rating have an effect on the rate of interest on my Finest Purchase bank card?

The next credit score rating can result in decrease rates of interest in your Finest Purchase bank card, whereas a decrease credit score rating can lead to increased rates of interest.

Q: Can I enhance my credit score rating earlier than making use of for a Finest Purchase bank card?

Sure, you’ll be able to enhance your credit score rating by paying your payments on time, protecting your credit score utilization ratio low, and monitoring your credit score report for errors.

Q: How do I verify my credit score rating report and dispute errors?

You may verify your credit score rating report by contacting the three main credit score reporting companies (Equifax, Experian, and TransUnion) and disputing errors by offering documentation to assist your claims.

Q: What are the advantages of getting a excessive credit score rating for Finest Purchase bank card holders?

A excessive credit score rating can result in decrease rates of interest, increased credit score limits, and extra rewards and advantages in your Finest Purchase bank card.