As finest automotive insurance coverage in Wisconsin takes middle stage, it is important to know the correct insurance policies and firms to guard your car and pockets.

When looking for automotive insurance coverage in Wisconsin, customers typically face a dilemma: getting one of the best protection on the lowest value. With quite a few insurance coverage suppliers and complicated coverage particulars, it is no marvel folks do not know the place to start out.

Understanding Finest Automobile Insurance coverage in Wisconsin

When looking for one of the best automotive insurance coverage in Wisconsin, it is important to grasp the minimal insurance coverage necessities and evaluate charges supplied by main corporations. On this article, we’ll discover the important thing points of automotive insurance coverage in Wisconsin, together with the minimal necessities, advantages of complete insurance coverage, and components that have an effect on premiums.

Minimal Automobile Insurance coverage Necessities in Wisconsin

In accordance with the Wisconsin Division of Transportation, drivers are required to have a minimum of the next minimal insurance coverage protection:

- Bodily Harm Legal responsibility (BIL): $25,000 per individual and $50,000 per accident

- Property Injury Legal responsibility (PDL): $10,000

- Uninsured Motorist (UM): $25,000 per individual and $50,000 per accident (non-obligatory)

Drivers ought to guarantee they meet these minimal necessities to keep away from fines and penalties.

Evaluating Automobile Insurance coverage Charges in Wisconsin

Main automotive insurance coverage corporations in Wisconsin embrace State Farm, Allstate, Geico, and Progressive. To match charges, contemplate the next components:

- Age and driving expertise

- Location, together with metropolis and zip code

- Driving historical past, together with accidents and tickets

- Car sort and make

- Protection limits and deductibles

For instance, a 30-year-old driver with a clear driving file and a mid-range car might pay round $1,500 per yr for full protection, whereas a 65-year-old driver with a DUI conviction and a high-end car might pay round $3,000 per yr.

Advantages of Complete Automobile Insurance coverage in Wisconsin

Complete automotive insurance coverage gives safety in opposition to non-collision-related losses, resembling theft, vandalism, and pure disasters. In Wisconsin, complete protection may be particularly useful because of the state’s excessive threat of extreme climate occasions, together with tornadoes and floods.

Careless driving is the main reason behind accidents in Wisconsin, leading to important injury to automobiles. Complete insurance coverage can assist offset the prices of accidents by masking damages past collision-related losses.

Components Affecting Automobile Insurance coverage Premiums in Wisconsin

Automobile insurance coverage premiums in Wisconsin can fluctuate based mostly on varied components, together with:

- Age: Youthful drivers are inclined to pay larger premiums as a consequence of their larger threat of accidents.

- Location: Drivers dwelling in city areas with excessive crime charges and visitors congestion are inclined to pay larger premiums.

- Fleet possession: Driving a big or high-performance car can considerably improve premiums.

- Driving historical past: A historical past of accidents, tickets, and different traffic-related incidents can result in larger premiums.

For example, a driver dwelling in Milwaukee with a rushing ticket and a mid-range car might pay round 20% extra for automotive insurance coverage in comparison with a driver in Madison with a clear file.

Kinds of Automobile Insurance coverage Insurance policies in Wisconsin

In Wisconsin, drivers have varied choices in terms of automotive insurance coverage insurance policies. These choices cater to completely different wants and preferences, making certain that each driver can select a coverage that fits their price range and safety necessities. Understanding the various kinds of insurance policies is essential in making an knowledgeable resolution.

Legal responsibility Insurance coverage

Legal responsibility insurance coverage is the minimal required insurance coverage protection in Wisconsin. It protects you from monetary losses for those who trigger an accident and are held answerable for damages or accidents. Legal responsibility insurance coverage has two major elements: bodily harm legal responsibility and property injury legal responsibility. The protection limits for legal responsibility insurance coverage in Wisconsin are as follows:

- Bodily harm legal responsibility: $25,000 per individual and $50,000 per accident

- Property injury legal responsibility: $10,000

For instance, for those who trigger an accident and the opposite driver suffers $30,000 in medical bills, your legal responsibility insurance coverage will cowl as much as $25,000, leaving you accountable for the remaining $5,000.

Collision Insurance coverage

Collision insurance coverage covers damages to your car within the occasion of an accident, no matter who’s at fault. It is an important protection for drivers who prioritize defending their car’s worth. Collision insurance coverage protection limits differ relying on the coverage, however a typical most restrict is the precise money worth (ACV) of your car.

Private Harm Safety (PIP)

Private harm safety (PIP) insurance coverage covers medical bills and misplaced wages for you and your passengers within the occasion of an accident, no matter who’s at fault. PIP insurance coverage is obligatory in Wisconsin, and the minimal protection restrict is $10,000.

| Coverage Sort | Protection Limits | Options | Situation Examples |

|---|---|---|---|

| Legal responsibility | – $25,000 per individual and $50,000 per accident for bodily harm | – Protects you from monetary losses for those who trigger an accident | – Causes an accident and the opposite driver suffers medical bills |

| Collision | – Precise money worth (ACV) of your car | – Covers damages to your car within the occasion of an accident | – Causes an accident leading to damages to your car |

| Private Harm Safety (PIP) | – $10,000 minimal protection restrict | – Covers medical bills and misplaced wages for you and your passengers | – Concerned in an accident and requires medical consideration |

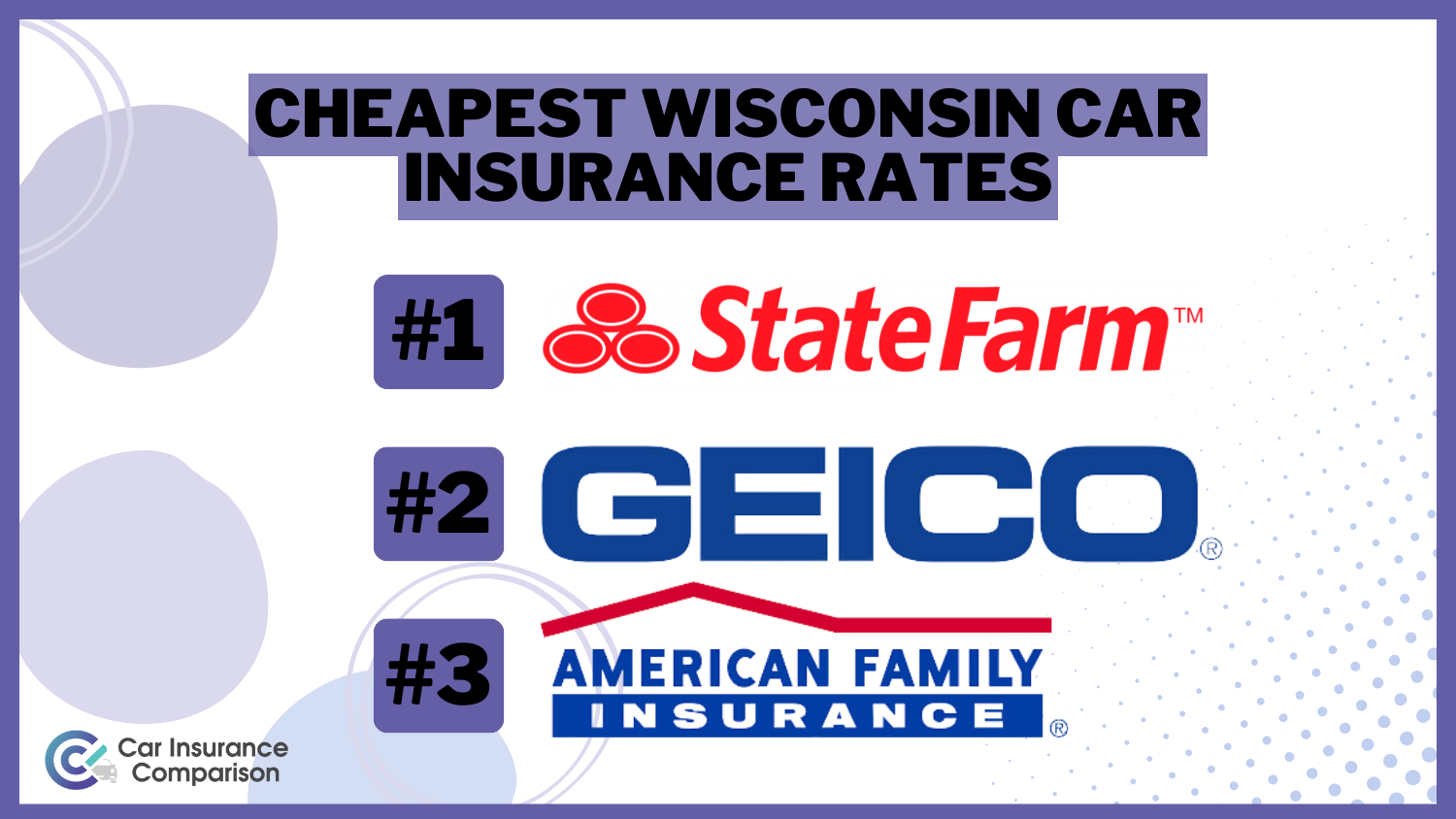

Automobile Insurance coverage Firms in Wisconsin: Finest Automobile Insurance coverage In Wisconsin

With regards to automotive insurance coverage in Wisconsin, you’ve got quite a few choices to select from. With a number of corporations vying for your online business, choosing the correct one is usually a time-consuming and complicated process. On this part, we are going to give you a complete assessment of high automotive insurance coverage corporations in Wisconsin, their scores, customer support, claims course of, and reductions supplied.

High-Rated Automobile Insurance coverage Firms in Wisconsin

There are a number of top-rated automotive insurance coverage corporations in Wisconsin that provide glorious protection and repair. These corporations are well-established and have a robust presence within the state. Let’s take a better have a look at a few of them:

- State Farm

- Allstate

- Geico

- America Household Insurance coverage

- Erie Insurance coverage

Every of those corporations has its distinctive strengths and weaknesses. For instance, State Farm is thought for its in depth community of brokers and 24/7 buyer help. Allstate, alternatively, presents a variety of reductions, together with for good drivers, college students, and army personnel. Geico is acknowledged for its user-friendly on-line platform and reasonably priced charges. America Household Insurance coverage is thought for its customized service and versatile cost plans. Erie Insurance coverage, regardless of being comparatively smaller, boasts a singular enterprise mannequin that enables it to supply low charges and glorious customer support.

Automobile Insurance coverage Charges in Wisconsin

The charges for automotive insurance coverage in Wisconsin differ relying on a number of components, together with age, driving historical past, location, and protection degree. Listed here are some examples of common automotive insurance coverage charges in Wisconsin for various age teams:

| Age Group | Common Annual Fee |

|---|---|

| 20-24 years previous | $1,500-$2,000 |

| 25-34 years previous | $1,000-$1,500 |

| 35-44 years previous | $900-$1,300 |

| 45-54 years previous | $800-$1,200 |

| 55-64 years previous | $700-$1,100 |

| 65+ years previous | $600-$1,000 |

As you possibly can see, automotive insurance coverage charges in Wisconsin are inclined to lower with age. Nevertheless, different components resembling location and driving historical past can considerably influence charges.

Reductions Supplied in Wisconsin

Wisconsin automotive insurance coverage corporations provide varied reductions that may enable you to lower your expenses in your premiums. Listed here are a number of the commonest reductions:

- Good Driver Low cost: As much as 25% off for drivers with a clear driving file.

- Pupil Low cost: As much as 20% off for full-time college students with a great tutorial file.

- Navy Low cost: As much as 20% off for army personnel and veterans.

- Bundling Low cost: As much as 15% off for patrons who bundle dwelling and auto insurance coverage insurance policies.

- Multi-Car Low cost: As much as 10% off for patrons who insure a number of automobiles with the identical firm.

It is important to ask your insurance coverage supplier about these reductions and to make sure you’re eligible for them.

Buyer Help in Wisconsin

When looking for automotive insurance coverage in Wisconsin, buyer help is an important facet to think about. You wish to make sure that your insurance coverage supplier has a responsive and useful customer support staff that may help you with any questions or considerations you could have. Among the top-rated automotive insurance coverage corporations in Wisconsin provide 24/7 buyer help, together with:

- State Farm

- Geico

- Erie Insurance coverage

These corporations perceive the significance of customer support and attempt to supply glorious help to their prospects.

Submitting a Automobile Insurance coverage Declare in Wisconsin

Submitting a automotive insurance coverage declare in Wisconsin is usually a simple course of if in case you have the mandatory info and observe the proper steps. It’s important to inform your insurance coverage firm as quickly as potential after an accident to make sure well timed processing of your declare. By being ready and realizing what to anticipate, you possibly can navigate the claims course of with ease.

Understanding the Claims Course of in Wisconsin

The method of submitting a automotive insurance coverage declare in Wisconsin usually begins with gathering info and pictures of the accident. This contains being attentive to the date, time, location, and different related particulars of the incident. You must also alternate contact and insurance coverage info with the opposite events concerned. After gathering this info, it’s best to notify your insurance coverage firm and report the declare.

Gathering Data and Images, Finest automotive insurance coverage in wisconsin

When concerned in an accident, it’s essential to assemble as a lot info as potential. This contains taking pictures of the injury to your car, in addition to any accidents or property injury. You must also collect contact and insurance coverage info from the opposite celebration concerned. Having this info will make it simpler to finish the claims type and submit supporting paperwork to your insurance coverage firm.

- Collect details about the accident, together with the date, time, location, and different related particulars.

- Take pictures of the injury to your car and any accidents or property injury.

- Alternate contact and insurance coverage info with the opposite events concerned.

Notifying the Insurance coverage Firm and Reporting the Declare

After gathering the mandatory info, it’s best to notify your insurance coverage firm and report the declare. This usually entails calling your insurance coverage agent or filling out an internet declare type. Be ready to supply the knowledge you gathered earlier, together with pictures and witness statements if relevant.

- Notify your insurance coverage firm as quickly as potential after an accident.

- Report the declare through telephone or on-line declare type.

- Present all vital info, together with pictures and witness statements if relevant.

Finishing the Claims Type and Submitting Supporting Paperwork

Your insurance coverage firm will give you a claims type to finish, which is able to ask for detailed details about the accident, together with the circumstances main as much as the incident and any accidents or property injury. You must also submit any supporting paperwork, resembling police experiences, medical data, and restore estimates. Having all the mandatory info and paperwork will assist your insurance coverage firm course of your declare extra effectively.

- Full the claims type supplied by your insurance coverage firm.

- Submit any supporting paperwork, resembling police experiences, medical data, and restore estimates.

- Guarantee all vital info and paperwork are correct and full.

Following Up with the Insurance coverage Firm

After submitting your declare, it’s important to observe up along with your insurance coverage firm to examine on the standing of your declare. This may make sure that your declare is being processed promptly and that you just obtain any vital updates in regards to the standing of your declare.

- Examine the standing of your declare along with your insurance coverage firm.

- Ask about any extra info or paperwork required.

- Get an replace on any selections associated to your declare.

Do not be afraid to ask your insurance coverage firm for assist or clarification all through the claims course of. They’re there to help you in navigating the complexities of submitting a automotive insurance coverage declare in Wisconsin.

Final Phrase

In abstract, discovering one of the best automotive insurance coverage in Wisconsin requires thorough analysis and understanding of coverage choices, firm opinions, and obtainable reductions. By staying knowledgeable and making the correct decisions, it can save you cash, shield your self, and benefit from the open roads.

Fashionable Questions

Q: What’s the minimal automotive insurance coverage requirement in Wisconsin?

The state of Wisconsin requires drivers to hold a minimum of $25,000 in bodily harm legal responsibility protection and $10,000 in property injury legal responsibility protection.

Q: How do I qualify for a great driver low cost?

To qualify for a great driver low cost, you should haven’t any accidents or visitors violations in your driving file for a sure interval, normally 3-5 years.

Q: Can I file a automotive insurance coverage declare in Wisconsin on-line?

Q: What’s the distinction between complete and collision automotive insurance coverage?

Complete automotive insurance coverage covers injury to your car from occasions apart from a collision, resembling theft, vandalism, or pure disasters. Collision automotive insurance coverage covers injury to your car from a collision with one other car or object.