Finest firm to promote your life insurance coverage coverage to: navigating the advanced technique of promoting a life insurance coverage coverage might be daunting. Nonetheless, with the suitable information and instruments, you’ll find the proper purchaser and maximize your returns.

When contemplating promoting a life insurance coverage coverage, it is important to grasp the elements that affect its worth, reminiscent of give up fees and coverage riders. You additionally have to determine the traits of a reputable purchaser and discover the advantages of promoting to an organization that makes a speciality of life settlements.

Selecting the Proper Purchaser for Your Life Insurance coverage Coverage: Finest Firm To Promote Your Life Insurance coverage Coverage To

On the subject of promoting your life insurance coverage coverage, it is important to seek out the suitable purchaser. You wish to be sure that you get a good value to your coverage, and that the client is respected and reliable. On this article, we’ll discover the traits of a reputable life insurance coverage purchaser, and talk about the advantages of promoting to an organization that makes a speciality of life settlements.

Traits of a Credible Life Insurance coverage Purchaser

A reputable life insurance coverage purchaser ought to have a great status within the trade, clear enterprise practices, and a transparent understanding of the life insurance coverage market. They need to even have a confirmed monitor document of shopping for insurance policies and paying their shoppers promptly. When trying to find a purchaser, search for corporations which might be licensed and controlled by the related authorities, and which have a powerful monetary backing.

Firms that Commonly Buy Life Insurance coverage Insurance policies from People

There are a number of corporations that frequently buy life insurance coverage insurance policies from people. A few of these corporations embrace:

“Cash4Life” – a number one life settlements firm that buys insurance policies with face values starting from $50,000 to $50 million.

“Fairness Index Life” – an organization that buys insurance policies with face values starting from $100,000 to $5 million.

“Life Settlements LLC” – an organization that buys insurance policies with face values starting from $50,000 to $10 million.

Advantages of Promoting a Coverage to a Firm that Makes a speciality of Life Settlements

Promoting a coverage to an organization that makes a speciality of life settlements can have a number of advantages. These corporations usually have a deep understanding of the life insurance coverage market, and are capable of provide aggressive costs for insurance policies. In addition they have the assets and experience to deal with the advanced technique of promoting a coverage, making the method simpler and fewer nerve-racking for the proprietor.

Strategy of Promoting a Coverage to a Group of Buyers

Promoting a coverage to a bunch of buyers is usually a extra advanced course of than promoting to an organization that makes a speciality of life settlements. On this state of affairs, the coverage proprietor would usually work with a dealer or agent who would market the coverage to a bunch of buyers. The investor would then buy the coverage, and the coverage proprietor would obtain a lump sum cost.

High 5 Firms Identified for Buying Life Insurance coverage Insurance policies

Listed below are the highest 5 corporations identified for buying life insurance coverage insurance policies:

- Life Settlements LLC – an organization that buys insurance policies with face values starting from $50,000 to $10 million.

- Fairness Index Life – an organization that buys insurance policies with face values starting from $100,000 to $5 million.

- Cash4Life – a number one life settlements firm that buys insurance policies with face values starting from $50,000 to $50 million.

- Viatical Settlements, Inc. – an organization that buys insurance policies with face values starting from $50,000 to $20 million.

- Life Settlement Options – an organization that buys insurance policies with face values starting from $50,000 to $15 million.

These corporations have a confirmed monitor document of shopping for insurance policies and paying their shoppers promptly, making them dependable and reliable choices for coverage house owners trying to promote their insurance policies.

Evaluating the Supply for Your Life Insurance coverage Coverage

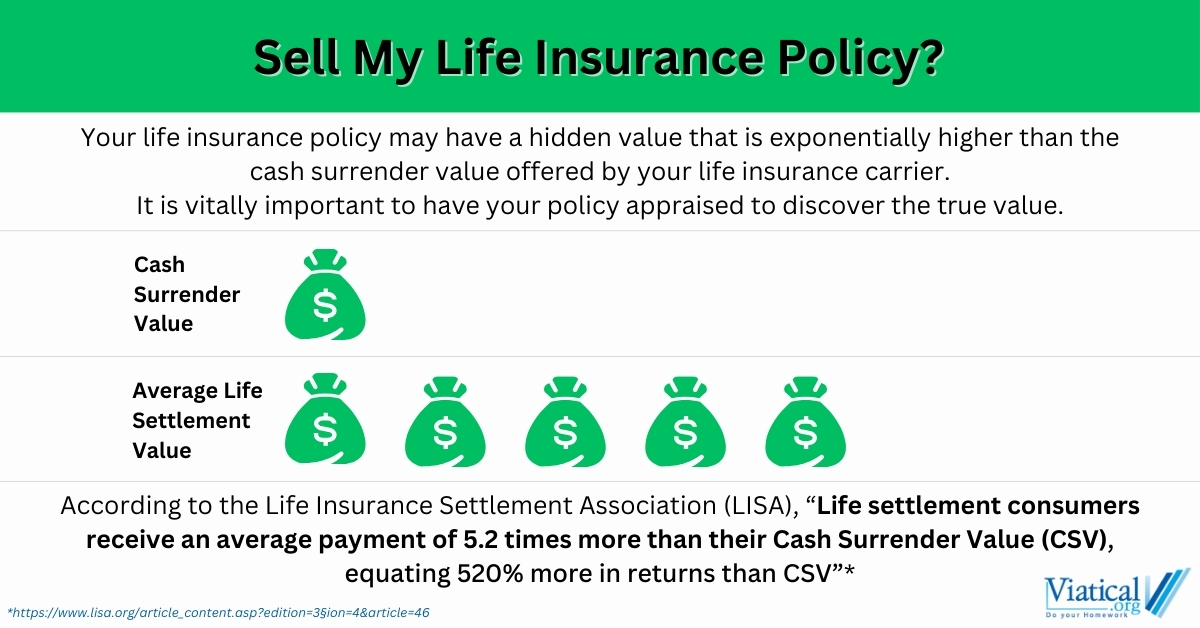

On the subject of promoting your life insurance coverage coverage, getting the suitable provide is usually a game-changer. That is the place evaluating the provide is available in – figuring out the coverage’s worth primarily based on its face quantity and money worth. Consider it like promoting a automotive; you wish to get the most effective value potential, proper? The method is analogous when promoting your life insurance coverage coverage.

To judge a suggestion, you must think about the face quantity and money worth of your coverage. The face quantity is the whole quantity paid out to your beneficiary whenever you move away, whereas the money worth is the quantity obtainable to you whilst you’re nonetheless alive. Firms will typically make you a suggestion primarily based on these two values.

Now, let’s speak about some situations the place the provide could be decrease or larger than anticipated. Think about you’ve got bought a coverage with a face quantity of $100,000 and a money worth of $20,000. An organization may give you $80,000 for the coverage, which looks like a great deal, however what when you might get $100,000 from one other firm? That is the place the analysis course of is available in – evaluating gives and discovering the most effective one for you.

Life Settlement Dealer: Securing a Honest Supply

A life settlement dealer performs a vital function in securing a good provide to your life insurance coverage coverage. Consider a dealer like a private purchasing assistant – they store round for the most effective gives and negotiate in your behalf. They’re going to assess your coverage’s worth and current you with a number of gives from totally different corporations. This manner, you may evaluate and distinction the gives to seek out the most effective one.

Evaluating Affords

So, how do you evaluate gives from totally different corporations? It isn’t simply concerning the face quantity and money worth; you must think about different elements like the corporate’s status, charges, and payout phrases.

On this desk, it is clear that Firm B is providing a better face quantity than Firm A, however Firm C is providing a decrease money worth. When deciding which firm to decide on, it is important to contemplate your particular person circumstances and priorities.

When evaluating a suggestion, keep in mind to contemplate the massive image, not simply the numbers. Ask your self if the provide aligns along with your monetary objectives and priorities.

Working with a Life Settlement Firm

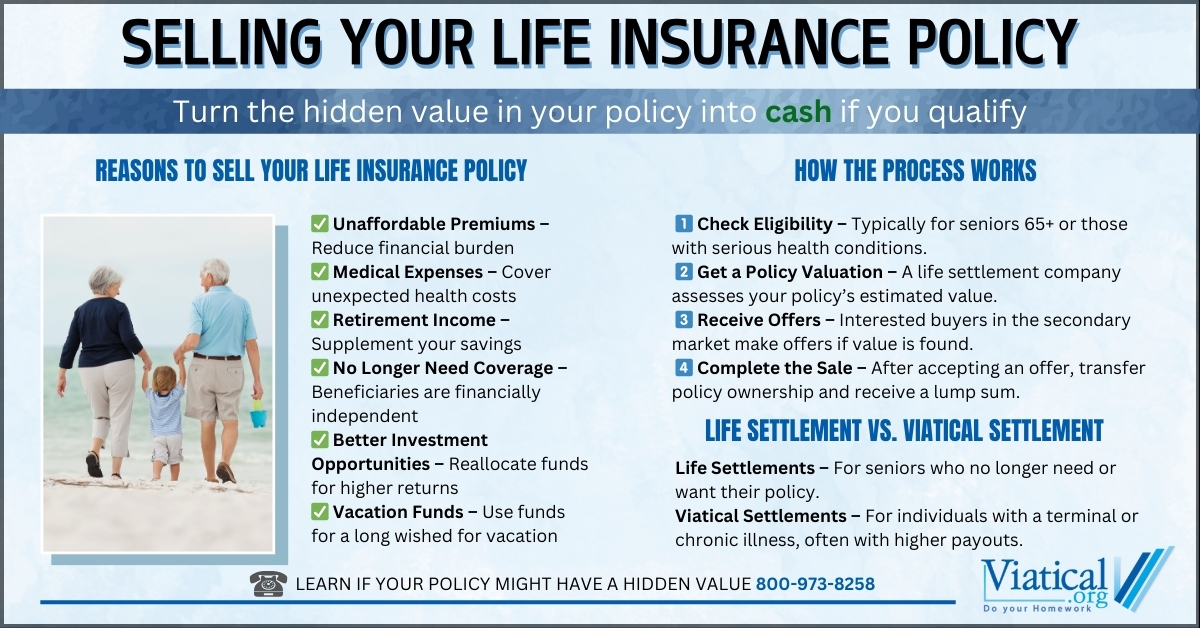

If you’re contemplating promoting your life insurance coverage coverage, one of many choices you may come throughout is working with a life settlement firm. These corporations focus on shopping for life insurance coverage insurance policies from people who are sometimes not in want of the protection or can not afford the premiums. Life settlement corporations can provide a lump sum cost in alternate for the coverage, which is usually a worthwhile useful resource for individuals who want the money.

The principle providers supplied by life settlement corporations embrace shopping for life insurance coverage insurance policies, evaluating the coverage’s worth, and facilitating the switch of possession. In addition they deal with the paperwork and negotiations with the coverage’s beneficiaries. When working with a life settlement firm, you may anticipate a easy and environment friendly course of, from preliminary session to last cost.

Strategy of Working with a Life Settlement Firm

The method of working with a life settlement firm is comparatively easy. This is a step-by-step overview of what you may anticipate:

- Preliminary Session: You may contact a life settlement firm and talk about your coverage particulars, together with its worth and your causes for eager to promote.

- Coverage Analysis: The life settlement firm will assess the coverage’s worth and decide whether or not it is appropriate for his or her portfolio.

- Negotiation: If the corporate is thinking about shopping for the coverage, they’re going to talk about the phrases of the sale with you, together with the cost quantity and any situations.

- Documentation: You may want to supply the mandatory documentation, such because the coverage paperwork and proof of identification.

- Switch of Possession: The life settlement firm will take possession of the coverage, and you may obtain the agreed-upon cost.

Examples of Life Settlement Firms, Finest firm to promote your life insurance coverage coverage to

Some notable life settlement corporations that you just may come throughout embrace:

- SettlementOne: A number one supplier of life settlement providers, SettlementOne gives a complete method to purchasing and promoting life insurance coverage insurance policies.

- Life Settlement Funding: This firm makes a speciality of offering liquidity to policyholders who want money rapidly, whereas additionally providing aggressive buy costs.

- Woodbridge Group of Firms: Woodbridge is a life settlement firm with a confirmed monitor document of shopping for and promoting life insurance coverage insurance policies.

Researching and Evaluating Life Settlement Firms

When researching and evaluating life settlement corporations, it is important to contemplate a number of elements, together with:

- Licensing and Registration: Guarantee the corporate is licensed and registered with the related regulatory our bodies.

- Popularity: Analysis the corporate’s status on-line and examine for any evaluations or testimonials.

- Credentials: Confirm the corporate’s credentials, together with any certifications or awards.

- Providers Supplied: Contemplate the precise providers supplied by the corporate, reminiscent of coverage analysis and switch of possession.

- Fee Phrases: Perceive the cost phrases, together with the quantity and any situations.

Evaluating a Life Settlement Firm’s Popularity and Credentials

This is a guidelines that can assist you consider a life settlement firm’s status and credentials:

“The important thing to a profitable life settlement is discovering a good and reliable associate.”

| Popularity and Credentials | Inquiries to Ask |

|---|---|

| Licenses and Registration | Is the corporate licensed and registered with the related regulatory our bodies? |

| Popularity | Have there been any unfavorable evaluations or complaints filed in opposition to the corporate? |

| Credentials | Are the corporate’s credentials clear, together with any certifications or awards? |

| Expertise | What number of years has the corporate been in enterprise, and what’s their monitor document? |

| Shopper Testimonials | Are there any testimonials or evaluations from glad shoppers? |

Alternate options to Promoting Your Life Insurance coverage Coverage

On the subject of life insurance coverage insurance policies, there are a number of alternate options to promoting your coverage. Whereas promoting your coverage is usually a profitable choice, it will not be the only option for everybody. On this part, we’ll discover some alternate options to promoting your life insurance coverage coverage, together with maintaining the coverage, borrowing in opposition to the coverage’s money worth, and surrendering the coverage.

Protecting Your Coverage

One different to promoting your life insurance coverage coverage is to maintain it. In the event you not want the protection or cannot afford the premiums, you may wish to think about maintaining the coverage. Nonetheless, this comes with some caveats. In the event you cancel your coverage, you could lose the protection you or your family members rely upon. You may additionally face give up fees, which might be steep relying on the coverage phrases. In the event you’re uncertain about canceling, it is a good suggestion to seek the advice of with a licensed insurance coverage skilled.

Borrowing Towards Your Coverage

One other different to promoting your life insurance coverage coverage is to borrow in opposition to its money worth. You probably have a coverage with a money worth element, you may often borrow cash from the insurance coverage firm. This is usually a handy option to entry a few of the worth you’ve got constructed up in your coverage. Nonetheless, it is important to grasp the rates of interest and charges related to coverage loans. Some insurance coverage corporations provide extra aggressive rates of interest than others, so it is a good suggestion to buy round.

-

Listed below are some examples of rates of interest supplied by totally different insurance coverage corporations for coverage loans:

– New York Life Insurance coverage Firm: 4% to six%

– Lincoln Nationwide Life Insurance coverage Firm: 4% to 7%

– Transamerica Life Insurance coverage Firm: 4% to eight% - Earlier than borrowing in opposition to your coverage, be certain that to assessment the phrases and situations rigorously. You might be required to pay again the mortgage, plus curiosity and charges, inside a sure timeframe. In the event you’re struggling to make funds, it might result in default and negatively influence your credit score rating.

Surrendering Your Coverage

Surrendering your life insurance coverage coverage may look like a sexy choice, however it’s typically not the only option. If you give up your coverage, you may usually lose the protection you or your family members rely upon. You may additionally face give up fees, which might be steep relying on the coverage phrases.

- The advantages of surrendering a coverage are often outweighed by the drawbacks. As an illustration, you may lose the tax advantages of the coverage, and you may additionally face penalties for early withdrawal.

- Nonetheless, there could also be some situations the place surrendering your coverage is sensible. For instance, when you’re terminally unwell or have a important sickness, you could possibly use your coverage as a supply of liquidity to pay for medical bills.

When contemplating any of those alternate options, it is important to weigh the professionals and cons rigorously. It is at all times a good suggestion to seek the advice of with a licensed insurance coverage skilled earlier than making any choices.

Final Recap

Finally, promoting a life insurance coverage coverage is usually a sensible monetary resolution, however it requires cautious consideration and planning. By working with a good life settlement firm and doing all of your analysis, you may guarantee a easy transaction and maximize your returns. Do not be afraid to ask questions and search skilled recommendation to get the most effective deal to your coverage.

FAQ Part

Q: What are give up fees, and the way do they have an effect on the sale of a life insurance coverage coverage?

A: Give up fees are charges imposed by insurance coverage corporations for cancelling a coverage earlier than its time period is up. These fees can considerably scale back the coverage’s worth and influence its sale.

Q: How do coverage riders affect the sale of a life insurance coverage coverage?

A: Coverage riders can improve the coverage’s worth and make it extra engaging to consumers. Widespread riders embrace unintended dying advantages, waiver of premium, and long-term care riders.

Q: What are the advantages of working with a life settlement firm to promote a life insurance coverage coverage?

A: Life settlement corporations might help you navigate the advanced promoting course of, determine potential consumers, and negotiate the most effective deal to your coverage.

Q: How do I analysis and evaluate life settlement corporations?

A: Analysis life settlement corporations by checking their status, credentials, and consumer evaluations. Evaluate their providers, charges, and gives to seek out the most effective match to your coverage.

Q: What are the professionals and cons of maintaining a life insurance coverage coverage versus promoting it?

A: Protecting a life insurance coverage coverage can present a dying profit to your beneficiaries, however promoting it may present money for dwelling bills or different monetary wants.

Q: How do I decide the worth of my life insurance coverage coverage?

A: The worth of your life insurance coverage coverage is set by its face quantity, money worth, and give up fees. Work with a life settlement dealer to find out the coverage’s worth and negotiate the most effective deal.

Q: What ought to I search for in a life settlement firm?

A: Search for a life settlement firm with a great status, skilled workers, and a confirmed monitor document of profitable coverage gross sales.