Greatest compound curiosity accounts units the stage for this enthralling narrative, providing readers a glimpse right into a story that’s wealthy intimately and brimming with originality. A compound curiosity account is a kind of financial savings account that earns curiosity on each the principal deposit and any accrued curiosity, creating a robust device for constructing wealth over time.

The idea of compound curiosity is deceptively easy but extremely highly effective. It really works by making use of curiosity to curiosity, leading to exponential development over time. This precept may be utilized to varied monetary targets, together with saving for retirement, a down fee on a home, or a toddler’s schooling. By using a compound curiosity account, people can speed up their financial savings and obtain monetary stability.

Forms of Compound Curiosity Accounts

Compound curiosity accounts are a well-liked technique to earn curiosity in your financial savings. They work by incomes curiosity on each the principal quantity and any accrued curiosity over time. On this part, we’ll talk about three widespread forms of compound curiosity accounts: certificates of deposit (CDs), financial savings accounts, and cash market accounts.

Certificates of Deposit (CDs), Greatest compound curiosity accounts

A certificates of deposit (CD) is a time deposit supplied by banks with a hard and fast rate of interest and maturity date. CDs are insured by the Federal Deposit Insurance coverage Company (FDIC) or the Nationwide Credit score Union Administration (NCUA), making them a low-risk funding. The principle advantages of CDs embrace:

- Fastened rate of interest: CDs supply a hard and fast rate of interest for a specified interval, which may be engaging to risk-averse buyers.

- Low danger: CDs are FDIC- or NCUA-insured, making them a secure and safe funding possibility.

- Liquidity: CDs sometimes have a brief to medium-term maturity, permitting you to entry your funds if wanted.

Nonetheless, CDs include some drawbacks:

- Penalty for early withdrawal: Withdrawing your cash earlier than the maturity date can lead to penalties or lack of curiosity.

- Rate of interest mounted on the time of deposit: If rates of interest rise after you deposit your cash, you might miss out on increased returns.

Financial savings Accounts

A financial savings account is a kind of deposit account supplied by banks and credit score unions. Financial savings accounts typically include a variable rate of interest and let you entry your cash at any time. The advantages of financial savings accounts embrace:

- Easy accessibility to funds: Financial savings accounts let you withdraw your cash at any time.

- Variable rate of interest: Financial savings accounts typically supply a aggressive rate of interest that may change over time.

- No penalty for early withdrawal: With a financial savings account, you possibly can entry your cash with out incurring penalties.

Nonetheless, financial savings accounts might also have some drawbacks:

- Variable rate of interest: Financial savings account rates of interest can fluctuate over time, probably leading to decrease returns.

- No FDIC insurance coverage above $250,000: Whereas financial savings accounts are sometimes FDIC-insured, the insurance coverage restrict is $250,000 per depositor, per insured financial institution.

Cash Market Accounts

A cash market account is a kind of financial savings account that sometimes requires the next minimal steadiness and affords a aggressive rate of interest. Cash market accounts typically include check-writing privileges and debit playing cards. The advantages of cash market accounts embrace:

- Greater rates of interest: Cash market accounts sometimes supply increased rates of interest than conventional financial savings accounts.

- Test-writing and debit card privileges: Cash market accounts typically include check-writing and debit card privileges, making it simple to entry your funds.

- No penalty for early withdrawal: With a cash market account, you possibly can entry your cash with out incurring penalties.

Nonetheless, cash market accounts might also have some drawbacks:

- Minimal steadiness necessities: Cash market accounts typically require the next minimal steadiness, which is usually a barrier for low-balance accounts.

- Rate of interest fluctuations: Cash market account rates of interest can fluctuate over time, probably leading to decrease returns.

Comparability of Compound Curiosity Accounts

When selecting a compound curiosity account, think about your monetary targets, danger tolerance, and liquidity wants.

| Account Sort | Fastened Curiosity Fee | Low Danger | Liquidity |

| — | — | — | — |

| CD | | | Brief to Medium-Time period |

| Financial savings Account | | | Straightforward Entry |

| Cash Market Account | | | Test-Writing and Debit Card Privileges |

Finally, the kind of compound curiosity account that is best for you is determined by your particular person monetary scenario and targets. Be sure you analysis and evaluate charges, phrases, and costs earlier than making a choice.

Greatest Compound Curiosity Accounts Accessible

Compound curiosity accounts supply people a novel technique to develop their financial savings over time, with the curiosity earned on the preliminary deposit and any accrued curiosity. By selecting the best account, you possibly can maximize your returns and obtain your long-term monetary targets. On this part, we are going to discover a number of the top-rated compound curiosity accounts accessible available in the market, evaluating their options, advantages, and buyer evaluations.

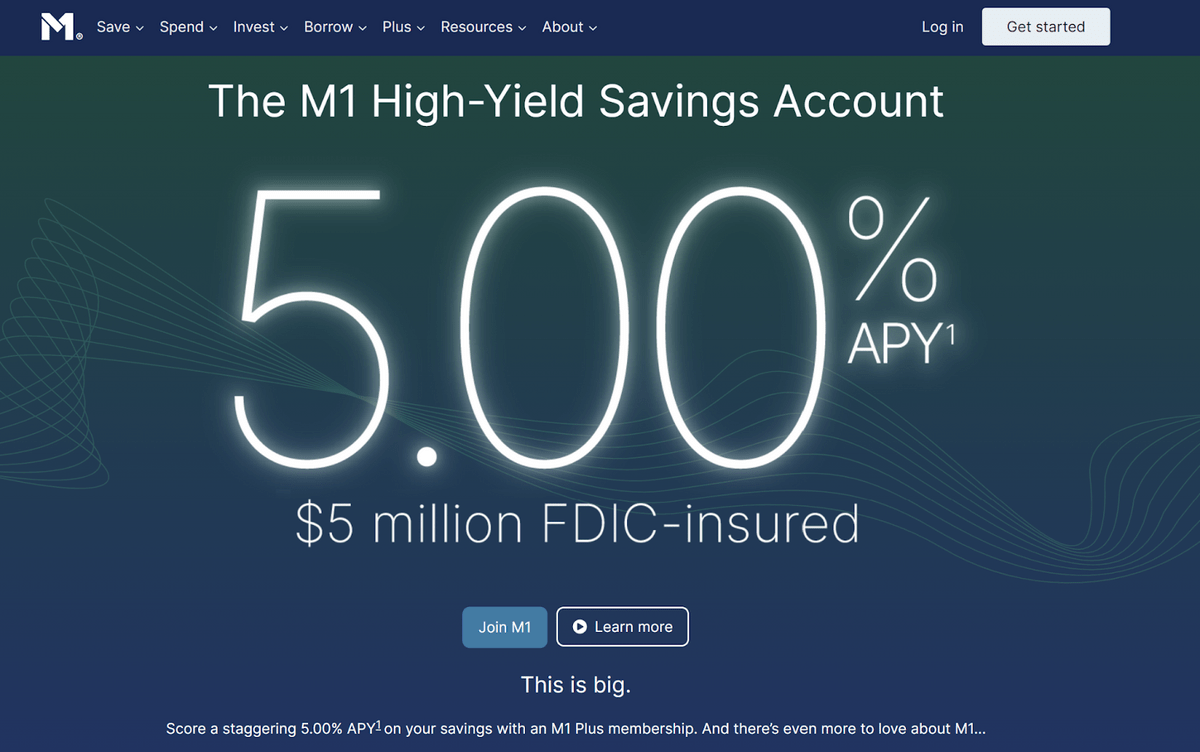

High-Rated Excessive-Yield Financial savings Accounts

Excessive-yield financial savings accounts are an excellent possibility for these looking for a low-risk, liquid financial savings possibility with aggressive rates of interest. The next accounts are among the many greatest available in the market, providing increased rates of interest than conventional financial savings accounts.

- Ally Financial institution On-line Financial savings Account

- Citibank Excessive Yield Financial savings Account

- Uncover On-line Financial savings Account

* Earn a aggressive rate of interest of two.20% APY with no minimal steadiness necessities

* Entry to over 43,000 ATM machines nationwide by way of the Allpoint community

* 24/7 buyer assist and on-line banking

“Ally Financial institution has been constantly one of many top-rated on-line banks when it comes to rates of interest, customer support, and costs.” – NerdWallet

* Earn a aggressive rate of interest of two.15% APY with no minimal steadiness necessities

* Entry to over 40,000 ATMs and 700 branches nationwide

* 24/7 buyer assist and on-line banking

“Citibank’s on-line banking platform is user-friendly and intuitive, making it simple to handle your accounts and monitor your spending.” – Forbes

* Earn a aggressive rate of interest of two.10% APY with no minimal steadiness necessities

* Entry to over 60,000 ATMs nationwide

* 24/7 buyer assist and on-line banking

“Uncover’s on-line financial savings account affords a high-yield rate of interest and no charges for withdrawals or ATM transactions.” – The Stability

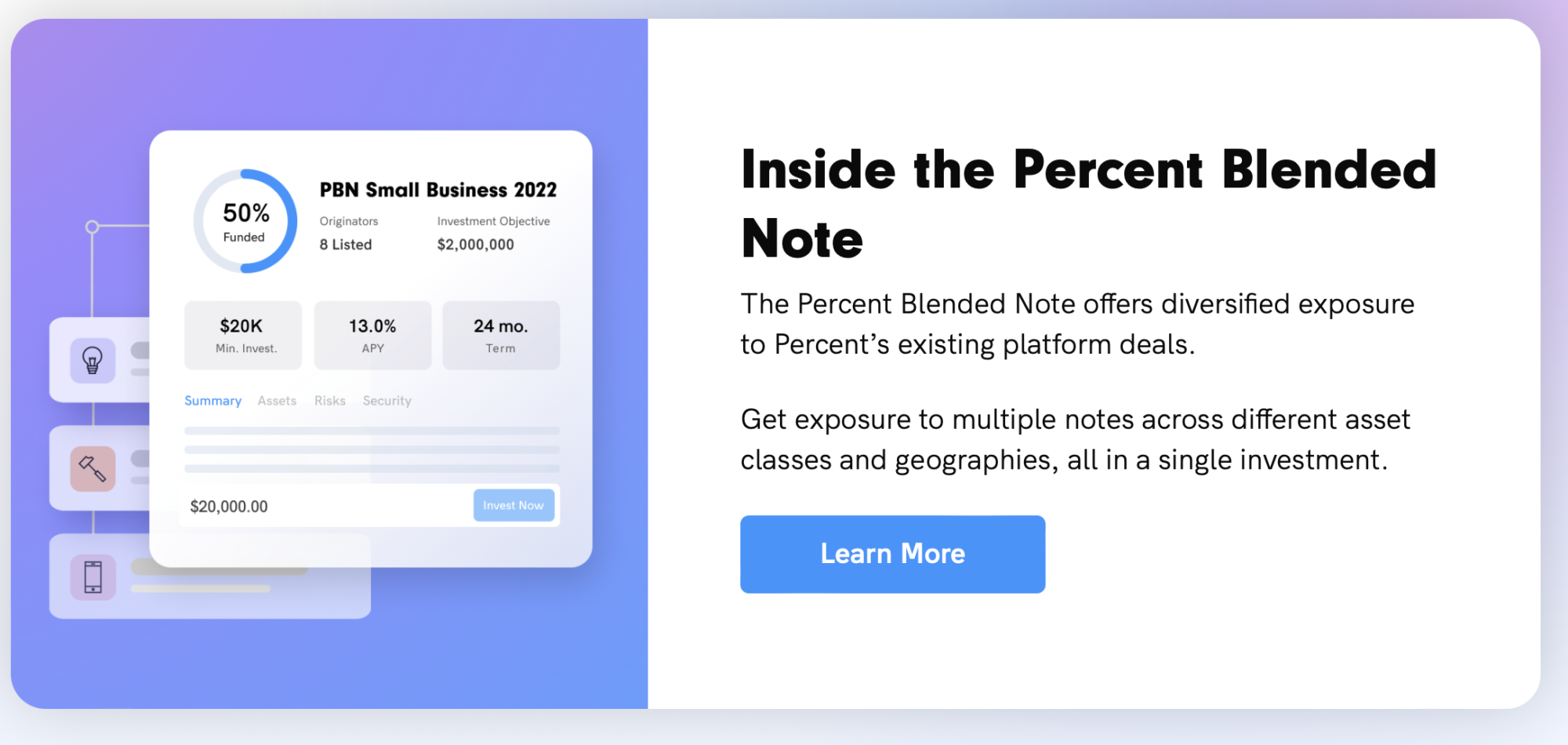

High-Rated Certificates of Deposit (CDs)

Certificates of deposit (CDs) are time deposits supplied by banks with mounted rates of interest and maturity dates. They have an inclination to supply increased rates of interest than conventional financial savings accounts, however require you to maintain your cash locked within the account for a specified interval.

- Citibank CD

- Ally Financial institution CD

- Financial institution of America CD

* Earn aggressive rates of interest starting from 2.25% APY to 4.00% APY relying on the time period

* Phrases starting from 3 months to five years

* 24/7 buyer assist and on-line banking

“Citibank’s CDs supply aggressive rates of interest and a spread of phrases to go well with totally different investor wants.” – Investopedia

* Earn aggressive rates of interest starting from 2.20% APY to 4.50% APY relying on the time period

* Phrases starting from 3 months to five years

* 24/7 buyer assist and on-line banking

“Ally Financial institution’s CDs supply high-yield rates of interest and versatile phrases, making them a sexy possibility for buyers.” – Bankrate

* Earn aggressive rates of interest starting from 2.15% APY to 4.25% APY relying on the time period

* Phrases starting from 3 months to five years

* 24/7 buyer assist and on-line banking

“Financial institution of America’s CDs supply aggressive rates of interest and a spread of phrases to go well with totally different investor wants.” – NerdWallet

High-Rated Cash Market Accounts

Cash market accounts supply a low-risk funding possibility with aggressive rates of interest and check-writing privileges. The next accounts are among the many greatest available in the market, providing increased rates of interest than conventional financial savings accounts.

- Ally Financial institution Cash Market Account

- Citibank Cash Market Account

- Uncover Cash Market Account

* Earn a aggressive rate of interest of two.05% APY with no minimal steadiness necessities

* Test-writing privileges and debit card entry

* 24/7 buyer assist and on-line banking

“Ally Financial institution’s cash market account affords high-yield rates of interest and versatile check-writing privileges.” – Bankrate

* Earn a aggressive rate of interest of two.00% APY with no minimal steadiness necessities

* Test-writing privileges and debit card entry

* 24/7 buyer assist and on-line banking

“Citibank’s cash market account affords aggressive rates of interest and a spread of checking and debit card choices.” – Investopedia

* Earn a aggressive rate of interest of two.00% APY with no minimal steadiness necessities

* Test-writing privileges and debit card entry

* 24/7 buyer assist and on-line banking

“Uncover’s cash market account affords high-yield rates of interest and versatile check-writing privileges.” – The Stability

When selecting a compound curiosity account, think about elements equivalent to rates of interest, charges, minimal steadiness necessities, and customer support. By doing all of your analysis and choosing the best account to your wants, you possibly can maximize your returns and obtain your long-term monetary targets.

Components to Take into account when Selecting a Compound Curiosity Account

With regards to choosing the best compound curiosity account, there are a number of key elements to contemplate. To maximise your returns and keep away from pointless charges, it is important to guage these elements fastidiously.

compound curiosity account ought to strike a steadiness between incomes curiosity, comfort, and adaptability. Listed here are some essential elements to contemplate when making your resolution.

Curiosity Charges

The rate of interest supplied by your compound curiosity account is a big issue to contemplate. It determines the speed at which your financial savings will develop over time. Evaluate the rates of interest supplied by totally different accounts to make sure you’re getting the very best deal. Search for accounts with aggressive charges, equivalent to high-yield financial savings accounts or certificates of deposit (CDs).

“Somewhat curiosity can add up over time. Even a 1% distinction in rates of interest can lead to important financial savings over the long run.”

- Excessive-yield financial savings accounts: These accounts supply increased rates of interest than conventional financial savings accounts, often within the vary of 1.50% to 2.50% APY.

- Certificates of Deposit (CDs): CDs supply mounted rates of interest for a specified time period, often starting from a couple of months to a number of years, with increased rates of interest for longer phrases.

Charges and Fees

Concentrate on any charges related along with your compound curiosity account, together with upkeep charges, switch charges, and overdraft charges. Some accounts might cost excessive charges, which might eat into your curiosity earnings. Select an account with low or no charges to maximise your returns.

- Upkeep charges: Many accounts cost a month-to-month upkeep price when you fail to satisfy a minimal steadiness requirement.

- Switch charges: Some accounts might cost a price for transferring funds out of the account or to a unique account.

Minimal Stability Necessities

Some compound curiosity accounts include minimal steadiness necessities, which might influence your curiosity earnings. When you fail to satisfy the minimal steadiness, you might be charged a price or miss out on curiosity earnings. Select an account with a low or no minimal steadiness requirement to make sure you can entry your funds when wanted.

- Checking account minimums: Some checking accounts require a minimal steadiness to keep away from charges or earn curiosity.

- Financial savings account minimums: Financial savings accounts might also have minimal steadiness necessities, though these are sometimes decrease than checking accounts.

Evaluating and Evaluating Accounts

To seek out the best compound curiosity account, it is important to match totally different choices and think about your monetary targets and desires. Consider elements equivalent to rates of interest, charges, and minimal steadiness necessities to make sure you’re getting the very best deal.

- Take into account your monetary targets: Whether or not you are saving for a short-term objective or long-term funding, select an account that aligns along with your goals.

- Evaluate rates of interest: Search for accounts with aggressive rates of interest to make sure you’re incomes the best returns.

Balancing Curiosity Earnings with Comfort and Flexibility

compound curiosity account ought to present a steadiness between incomes curiosity, comfort, and adaptability. Take into account the next elements to make sure you’re getting the best account to your wants.

- On-line banking and cell entry: Select an account with on-line banking and cell banking capabilities to simply entry and handle your funds.

- ATM entry: Take into account an account with a large community of ATMs to withdraw money when wanted.

Tax Implications of Compound Curiosity Accounts

Compound curiosity accounts may be influenced by tax legal guidelines, which can influence the general development of your financial savings. Tax implications may be advanced, so it is important to know how compound curiosity is taxed and its results in your financial savings.

Whenever you earn compound curiosity, the curiosity earned in your preliminary deposit can be taxed. This may create a scenario the place you might be taxed on the curiosity you earn on the curiosity, which may be increased than anticipated. This phenomenon is also known as a “tax on a tax” or “curiosity on curiosity.”

Taxation of Compound Curiosity

Compound curiosity is taken into account taxable revenue and have to be reported in your tax return. The tax implications of compound curiosity can fluctuate relying on the kind of account and the jurisdiction through which you reside. In the US, the Inside Income Service (IRS) considers compound curiosity to be taxed yearly, and you’ll obtain a Kind 1099-INT out of your monetary establishment on the finish of every yr reporting the curiosity revenue.

### Tax Implications for Totally different Forms of Accounts

* Taxable Accounts: Compound curiosity accounts equivalent to financial savings accounts, checking accounts, and certificates of deposit (CDs) are thought of taxable and topic to annual taxes.

* Tax-Deferred Accounts: Compound curiosity accounts equivalent to particular person retirement accounts (IRAs) and tax-deferred annuities can delay taxes till withdrawal.

* Tax-Free Accounts: Compound curiosity accounts equivalent to Roth IRAs and tax-free financial savings accounts can present tax-free development and withdrawal.

Methods for Minimizing Tax Legal responsibility

To attenuate your tax legal responsibility, think about the next methods:

* Tax-Loss Harvesting: Offset capital features by promoting securities at a loss to cut back tax legal responsibility.

* Tax-Deferred Accounts: Make the most of tax-deferred accounts equivalent to 401(okay), IRA, or tax-deferred annuities to delay taxes till withdrawal.

* Tax-Free Accounts: Make the most of tax-free financial savings accounts equivalent to Roth IRAs or tax-free financial savings accounts to supply tax-free development and withdrawal.

* Tax-Environment friendly Investing: Take into account tax-efficient funding methods equivalent to index funds or dividend-paying shares to reduce tax liabilities.

Examples of Tax-Free Compound Curiosity Accounts

Roth IRAs and tax-free financial savings accounts are two examples of tax-free compound curiosity accounts. These accounts permit for tax-free development and withdrawal, offering a tax-free supply of revenue in retirement.

###

-

Roth IRAs

A Roth IRA permits you to contribute after-tax {dollars}, and the funds develop tax-free. Withdrawals are tax-free in retirement, offering a tax-free supply of revenue.

-

tax-free Financial savings Accounts

A tax-free financial savings account permits you to earn tax-free curiosity in your deposits. Withdrawals are tax-free, and the funds should not topic to revenue tax.

Curiosity earned on curiosity is calculated as follows: Curiosity = Principal x Fee x Time, the place the speed is compounded yearly.

Compound Curiosity Account Administration Ideas: Greatest Compound Curiosity Accounts

Managing your compound curiosity account successfully is essential to maximizing your returns. By implementing a couple of easy methods, you possibly can optimize your account to earn increased curiosity and reduce charges. On this part, we’ll discover important ideas that will help you get probably the most out of your compound curiosity account.

Monitor and Alter Your Curiosity Fee

Often reviewing and adjusting your rate of interest could make a big influence in your compound curiosity earnings. Many compound curiosity accounts supply tiered rates of interest, which implies that increased balances earn increased rates of interest. By sustaining the next steadiness, you possibly can reap the benefits of increased rates of interest and earn extra curiosity.

- Preserve a file of your steadiness and rate of interest adjustments over time to trace your progress.

- Take into account consolidating accounts with decrease rates of interest right into a single account with the next rate of interest.

- Concentrate on any minimal steadiness necessities which will influence your rate of interest.

Take Benefit of Compound Curiosity Multipliers

Some compound curiosity accounts supply multipliers that may considerably increase your curiosity earnings. These multipliers can vary from 2x to 10x, relying on the account and the quantity invested. To profit from these multipliers, give attention to retaining your steadiness inside the eligible vary and make common contributions to maximise your curiosity earnings.

Compound curiosity multipliers can amplify your curiosity earnings by 2x to 10x, making them a sexy possibility for these looking for excessive returns.

Decrease Charges and Fees

Charges and expenses can eat into your compound curiosity earnings, decreasing your total returns. To keep away from pointless charges, think about the next methods:

- Perceive the price construction of your account, together with any upkeep charges, withdrawal charges, or account closure charges.

- Make common deposits to keep up a minimal steadiness and keep away from upkeep charges.

- Keep away from frequent withdrawals, as they might incur charges or penalties.

Take into account Ladder Investments and Periodic Rebalancing

Ladder investments and periodic rebalancing may also help you maximize your curiosity earnings and reduce danger. By dividing your funding into smaller, staggered investments, you possibly can reap the benefits of increased rates of interest and scale back your danger publicity.

| Ladder Funding Instance | Curiosity Fee | Funding Quantity |

|---|---|---|

| Funding 1: 3% for 12 months | 3.00% | $1,000 |

| Funding 2: 4% for twenty-four months | 4.00% | $2,000 |

| Funding 3: 5% for 36 months | 5.00% | $3,000 |

Maximize Your Tax Effectivity

Taxes can considerably influence your compound curiosity earnings. To attenuate your tax legal responsibility, think about the next methods:

- Reap the benefits of tax-deferred accounts, equivalent to 401(okay) or IRA, to delay taxes in your curiosity earnings.

- Take into account investing in tax-efficient automobiles, equivalent to municipal bonds or index funds.

- Seek the advice of with a tax skilled to optimize your funding technique and reduce taxes.

Last Ideas

In conclusion, greatest compound curiosity accounts supply a compelling alternative for people to construct wealth and obtain monetary stability. By understanding the idea of compound curiosity, forms of compound curiosity accounts, and elements to contemplate when selecting an account, readers could make knowledgeable choices and maximize their financial savings potential. Bear in mind to at all times think about rates of interest, charges, minimal steadiness necessities, and safety measures when choosing a compound curiosity account.

Compound curiosity accounts are a robust device for constructing wealth over time. By leveraging the ability of compound curiosity, people can obtain their monetary targets and luxuriate in long-term monetary safety.

Frequent Queries

What’s the minimal age requirement to open a compound curiosity account?

The minimal age requirement to open a compound curiosity account varies relying on the establishment and sort of account. Usually, people have to be not less than 18 years previous to open a compound curiosity account. Nonetheless, some establishments might supply minors accounts with grownup co-owners or custodians.

Can I withdraw funds from my compound curiosity account at any time?

Most compound curiosity accounts include withdrawal restrictions or penalties. Some accounts might require a minimal steadiness, whereas others might impose charges for early withdrawals. Earlier than opening an account, it is important to evaluate the phrases and situations to know the withdrawal insurance policies.

How are compound curiosity accounts taxed?

Compound curiosity earned on deposits is usually topic to revenue tax. The tax implications fluctuate relying on the kind of account, rate of interest, and particular person tax standing. It is important to seek the advice of with a tax skilled to know the tax implications of compound curiosity accounts.

Are compound curiosity accounts insured?

Compound curiosity accounts supplied by banks and credit score unions are sometimes insured by the Federal Deposit Insurance coverage Company (FDIC) or the Nationwide Credit score Union Administration (NCUA). Which means deposits are insured as much as $250,000 per account holder, per establishment, defending your financial savings within the occasion of an establishment failure.