Greatest Credit score Card for Airbnb Bookings guarantees to be a complete useful resource for exploring the world of bank cards, their advantages, and the most effective choices for Airbnb bookings. From understanding the significance of bank cards in Airbnb transactions to navigating the intricacies of bank card charges and rewards applications, this information goals to empower customers with the data to make knowledgeable choices.

This useful resource offers a deep dive into the options to think about when selecting a bank card for Airbnb bookings, together with rewards applications, rates of interest, and overseas transaction charges. It additionally explores the safety measures in place for bank card funds on Airbnb, the advantages of providing bank card funds for Airbnb hosts, and techniques for maximizing rewards and factors for Airbnb bookings.

Options to Contemplate in a Credit score Card for Airbnb

With regards to renting out properties on Airbnb, having the appropriate bank card could make all of the distinction. Not solely can it provide help to earn rewards and journey miles, however it will probably additionally present helpful safety and advantages to your Airbnb enterprise. On this part, we’ll delve into the important thing options to think about when selecting a bank card for Airbnb.

Rewards Applications

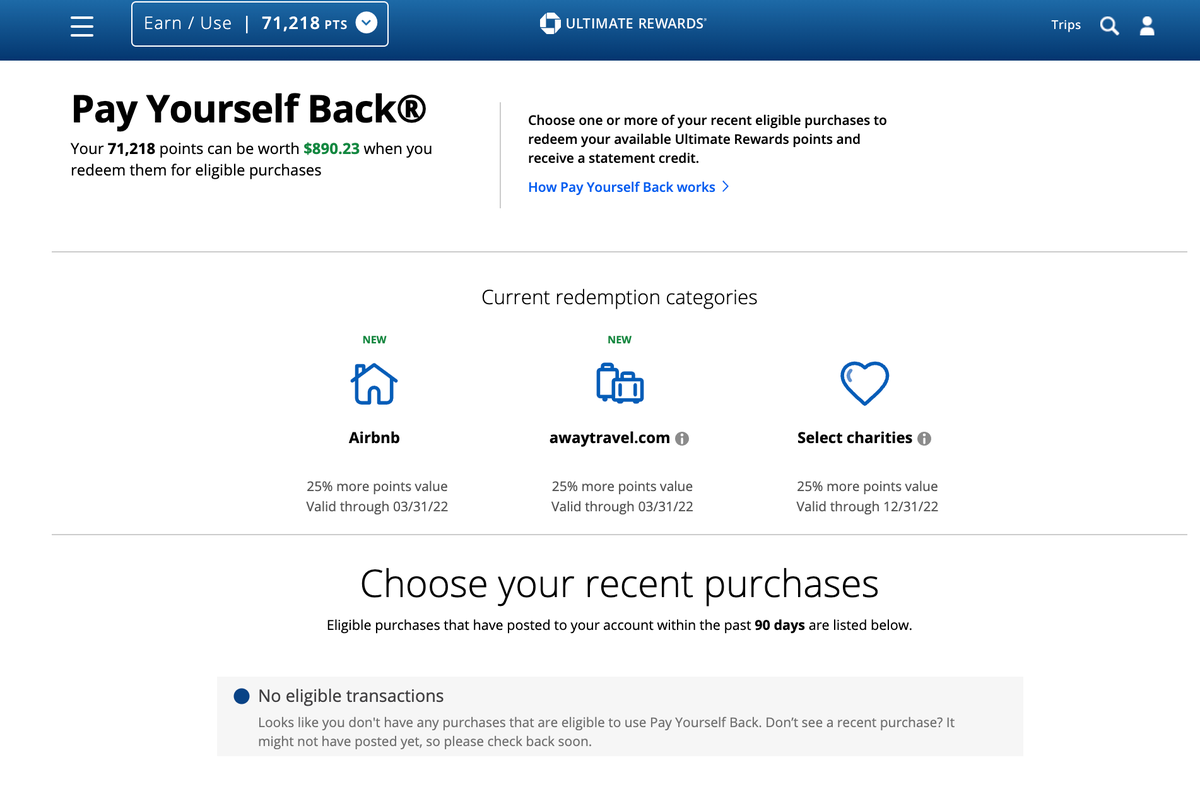

Rewards applications are a vital facet of any bank card, and for an Airbnb host, they are often significantly helpful. By incomes rewards in your bank card, you possibly can redeem factors or journey miles for flights, lodge stays, and even Airbnb bookings. When selecting a bank card for Airbnb, take into account a program that gives a excessive rewards price or bonus classes that align along with your internet hosting enterprise.

- Search for bank cards with excessive rewards charges on journey bills, which may embrace flights, lodge stays, and transportation.

- Contemplate bank cards with rewards applications that provide a excessive worth per level or mile, corresponding to these that allow you to switch rewards to a number of airline or lodge loyalty applications.

- Some bank cards supply bonus rewards classes which will embrace issues like eating, gasoline, or leisure bills, which will be related for Airbnb hosts who might incur these kinds of bills whereas managing their properties.

Curiosity Charges

Rates of interest is usually a vital issue when selecting a bank card for Airbnb. For those who’re not paying your stability in full every month, excessive rates of interest can rapidly add up and negate the advantages of rewards applications. When contemplating a bank card for Airbnb, search for playing cards with low or no rates of interest, particularly for introductory intervals.

- Search for bank cards with 0% introductory APRs on stability transfers or purchases for the primary 6-12 months.

- Contemplate bank cards with low common APRs, corresponding to 12.99% – 20.99% (Variable), which will be useful for hosts who pay their balances in full every month.

- Some bank cards supply rewards applications that may assist offset excessive rates of interest, corresponding to those who supply money again or rewards factors on purchases.

Overseas Transaction Charges, Greatest bank card for airbnb

Overseas transaction charges can add up rapidly when touring overseas for work or pleasure. When selecting a bank card for Airbnb, take into account playing cards that do not cost overseas transaction charges. This may be particularly necessary for hosts who take part within the short-term rental market in fashionable locations like Bali.

| Credit score Card | No Overseas Transaction Price |

|---|---|

| Bamboo Card | $0 overseas transaction charge |

| Financial institution of America Journey Rewards Visa Signature | $0 overseas transaction charge |

Cashback, Factors, and Journey Miles Rewards

Rewards applications supply a variety of advantages, from cashback to journey miles. When selecting a bank card for Airbnb, take into account a program that aligns along with your internet hosting enterprise. Whereas some rewards applications might supply greater rewards charges, others might present extra flexibility or advantages.

- Cashback rewards applications supply a set share of your purchases as money or assertion credit.

- Factors rewards applications assist you to earn and redeem factors for rewards, corresponding to journey, present playing cards, or assertion credit.

- Journey miles rewards applications assist you to earn and redeem miles for flights, lodge stays, and different journey bills.

Annual Charges

Annual charges can add up rapidly, particularly for high-end bank cards. When selecting a bank card for Airbnb, take into account the worth you may get from the cardboard’s advantages and rewards. If the annual charge is simply too excessive, it is probably not price the associated fee.

“The important thing to creating an annual charge worthwhile is to give attention to the cardboard’s advantages and rewards, fairly than its status or exclusivity.” – The Factors Man

Introductory Provides

Introductory presents will be an effective way to earn rewards and advantages when selecting a bank card for Airbnb. Search for playing cards that provide sign-up bonuses, 0% APRs, or different incentives to get you began along with your internet hosting enterprise.

“Introductory presents will be an effective way to earn rewards and advantages when selecting a bank card for Airbnb, however you’ll want to learn the phrases and situations rigorously to grasp any situations or restrictions.” – Enterprise Insider

Rewards Applications for Airbnb Bookings

Rewards applications for bank cards will be an effective way to earn rewards on Airbnb bookings, making your stays much more reasonably priced and gratifying. Some bank cards supply rewards applications particularly designed for journey and lodging, whereas others might supply extra basic rewards that may nonetheless be used for Airbnb bookings.

Forms of Rewards Applications Out there for Credit score Playing cards

—————————————————-

There are numerous sorts of rewards applications obtainable for bank cards, together with:

* Factors-based rewards: These applications assist you to earn factors in your purchases, which may then be redeemed for rewards corresponding to assertion credit, journey, or money again.

* Miles-based rewards: These applications assist you to earn miles in your purchases, which will be redeemed for journey rewards, corresponding to flights or lodge stays.

* Fastened-value rewards: These applications supply a set worth for every greenback spent, corresponding to 2% money again or 1 level per greenback.

* Tiered rewards: These applications supply completely different rewards ranges primarily based in your spending, with greater tiers providing extra beneficiant rewards.

Earn and Redeem Rewards Factors for Airbnb Bookings

————————————————–

Incomes rewards factors for Airbnb bookings is usually simple, and entails utilizing a bank card that gives rewards on journey or lodging purchases. Some bank cards might also supply bonus rewards for reserving journey via their rewards portal or for reserving particular sorts of lodging.

As soon as you have earned your rewards factors, redeeming them for Airbnb bookings is often a easy course of, involving logging into your bank card’s rewards portal and clicking on the “Journey” or “Lodging” part to seek for obtainable rewards flights or lodge stays.

Some fashionable rewards applications for journey and lodging embrace:

### Instance of a preferred Rewards Program:

* Chase Sapphire Most popular Card: This card presents 2X factors on journey and eating purchases, plus a 60,000 level bonus after spending $4,000 within the first 3 months.

* Capital One Enterprise Rewards Credit score Card: This card presents 2X miles on all purchases, plus a miles-earner on all miles redeemed.

* Citi Premier Card: This card presents 3X factors on journey, together with gasoline stations, and 2X factors on eating and leisure purchases, plus a 60,000 level bonus after spending $4,000 within the first 3 months.

* Barclays Arrival Plus World Elite Mastercard: This card presents 2X miles on all purchases, plus a miles-claimer on all miles redeemed.

Rewards Program Particulars

### Earn Rewards Factors at:

-

* Eating places

* Airways

* Lodges

* Automobile rental corporations

### Redeem Rewards Factors for:

-

* Flights

* Lodge stays

* Journey packages

* Eating experiences

### Examples of The way to Earn and Redeem Rewards Factors:

* Incomes 50,000 factors on a $10,000 Airbnb reserving

* Redeeming factors for a $500 Airbnb reserving

* Utilizing factors to ebook a free flight

### Rewards Program Phrases and Situations:

Please word that rewards applications and phrases might range relying on the bank card issuer and the rewards program. All the time overview the phrases and situations earlier than signing up for a rewards program.

Credit score Card Charges and Prices for Airbnb

When reserving an Airbnb via a bank card, there are numerous charges to think about that may add up rapidly. The excellent news is that by understanding these charges and utilizing the appropriate bank card to your Airbnb bookings, you possibly can decrease the fees and profit from your bank card rewards.

Overseas Transaction Charges, Greatest bank card for airbnb

Overseas transaction charges are costs levied on transactions made in a overseas forex, which is usually a vital concern for vacationers who usually ebook Airbnb properties in numerous nations. Most bank cards cost a overseas transaction charge starting from 0.5% to three% of the transaction quantity.

For instance, when you ebook an Airbnb property in Bali, Indonesia for $100 USD, you may possible incur a overseas transaction charge of $1 to $3 USD, relying in your bank card.

With the intention to decrease overseas transaction charges, search for bank cards that do not cost these charges, such because the Chase Sapphire Reserve or the Capital One Enterprise Rewards Credit score Card. These playing cards usually include different advantages like journey insurance coverage, airport lounge entry, and rewards applications that may make up for the dearth of overseas transaction charges.

Stability Switch Charges

Stability switch charges are costs levied on bank card balances transferred from one card to a different. Whereas indirectly associated to Airbnb bookings, stability switch charges is usually a concern when you plan to repay your bank card stability over time. Most bank cards cost a stability switch charge starting from 3% to five% of the transferred quantity.

- Chase Slate Edge: This card presents 0% introductory APR for 18 months, however costs a 3% stability switch charge.

- Citi Simplicity Card: This card has a 21-month 0% APR promo interval, however costs a 3% stability switch charge.

Late Cost Charges

Late cost charges are costs levied on bank card holders who miss the cost deadline. These charges can vary from $25 to $38, relying on the bank card issuer and the cost quantity.

- Chase Sapphire Most popular Card: This card costs a late cost charge of $27 to $38.

- Capital One Quicksilver Money Rewards Credit score Card: This card costs a late cost charge of $27 to $38.

Methods for Minimizing Charges and Prices

To reduce charges and costs, take into account the next methods:

- Select a bank card with no overseas transaction charges, stability switch charges, or late cost charges.

- Pay your bank card stability in full every month to keep away from curiosity costs and late cost charges.

- Contemplate a bank card with a 0% introductory APR for stability transfers or purchases.

- Choose a bank card with rewards applications that align along with your spending habits, corresponding to journey or eating rewards.

Safety Measures for Credit score Card Funds on Airbnb

With regards to making funds on Airbnb, safety needs to be your prime precedence. With the rise of on-line transactions, bank card funds have develop into extra handy, but in addition extra weak to id theft and bank card fraud. As a traveler, it is important to pay attention to the safety measures in place to guard your bank card data and forestall any potential points.

Safe Cost Choices on Airbnb

Airbnb presents a number of safe cost choices to make sure a clean and safe transaction expertise. When utilizing bank cards on the platform, you possibly can count on the next safe cost choices:

-

The Cost Gateway: Airbnb makes use of a third-party cost gateway that encrypts your bank card data and protects it from unauthorized entry.

Which means even when somebody positive factors entry to your account, they will not be capable of steal your bank card particulars.

- Two-Issue Authentication (2FA): Airbnb requires a second type of verification to forestall unauthorized entry to your account. This provides an additional layer of safety to make sure that solely you possibly can entry your account.

- Card Verification Worth (CVV): Once you enter your bank card data, you may be required to enter the CVV, which is a three-digit code discovered on the again of your card. This helps to forestall counterfeit playing cards from getting used.

Defending Towards Identification Theft and Credit score Card Fraud

To make sure your bank card data stays safe, it is important to pay attention to the widespread ways utilized by scammers and take vital precautions:

- By no means share your bank card particulars with anybody, together with Airbnb workers or different customers. Airbnb won’t ever ask to your bank card data through e-mail, messaging apps, or telephone calls.

- Ensure to make use of sturdy passwords and allow two-factor authentication (2FA) to your account. This provides an additional layer of safety to forestall unauthorized entry.

- Recurrently test your bank card statements for any suspicious transactions. For those who discover any uncommon exercise, report it to your financial institution or bank card issuer instantly.

Advantages of a Credit score Card for Airbnb Enterprise House owners

Providing bank card funds for Airbnb hosts can convey quite a few advantages, growing cost choices and income alternatives. With extra methods to pay, hosts can cater to a wider vary of visitors, in the end boosting their probabilities of receiving bookings and producing revenue. By accepting bank card funds, hosts can set up themselves as extra welcoming and accommodating, making their properties extra fascinating to potential renters.

Elevated Cost Choices and Income Alternatives

Airbnb hosts who supply bank card funds expertise a major enhance in reserving inquiries and confirmed reservations. Bank card funds present visitors with a larger sense of safety and adaptability, encouraging them to ebook with hosts who supply this cost possibility. This, in flip, will increase the probability of repeat enterprise and constructive critiques, which may considerably increase a number’s popularity and scores on the platform.

- Hosts who supply bank card funds are inclined to obtain extra inquiries and bookings, as visitors really feel extra comfy when paying with a significant bank card.

- Accepting bank card funds can result in elevated income, as hosts usually tend to appeal to repeat enterprise and obtain constructive critiques.

- By providing bank card funds, hosts can set up themselves as extra skilled and respected, making their properties extra engaging to potential visitors.

Advantages of Utilizing a Devoted Credit score Card Reader or On-line Cost Platforms

With regards to processing bank card funds, hosts have two main choices: utilizing a devoted bank card reader or on-line cost platforms. Each choices have their benefits and drawbacks.

Utilizing a Devoted Credit score Card Reader

A devoted bank card reader permits hosts to course of bank card funds straight from their Airbnb listings. This may be accomplished via a bodily reader linked to a smartphone or pill. Some fashionable manufacturers for devoted bank card readers embrace PayPal Right here, Sq., and Stripe.

- detailed and exact calculations for every transaction.

- permits hosts to course of bank card funds straight from Airbnb listings and eliminates the necessity for cost hyperlinks.

- some readers require a month-to-month charge or cost a small transaction charge.

Utilizing On-line Cost Platforms

On-line cost platforms, then again, permit hosts to course of bank card funds via a safe on-line checkout system. This may be accomplished via platforms like Airbnb Funds or third-party companies like Stripe or PayPal.

- presents a handy and safe solution to course of bank card funds.

- many platforms cost a small transaction charge, usually starting from 2-3%.

- some platforms might have further charges or require a month-to-month minimal cost.

Making a Price range and Monitoring Bills with a Credit score Card for Airbnb

As an Airbnb host, managing your funds successfully is essential to sustaining a profitable enterprise. This contains making a funds and monitoring your bills to make sure you’re taking advantage of your earnings. A bank card is usually a helpful device in serving to you obtain this objective.

Significance of Budgeting and Expense Monitoring

Budgeting and expense monitoring assist you to perceive the place your cash goes and make knowledgeable choices about what you are promoting. By monitoring your bills, you possibly can establish areas the place you possibly can reduce prices, optimize your monetary assets, and make strategic investments to develop what you are promoting. That is significantly necessary for Airbnb hosts, who usually have various ranges of bills relying on the season, occupancy charges, and different elements.

Budgeting Strategies for Airbnb Hosts

There are a number of budgeting strategies that may be efficient for Airbnb hosts. The 50/30/20 rule, for instance, entails allocating 50% of your revenue in the direction of vital bills, 30% in the direction of discretionary spending, and 20% in the direction of saving and debt compensation. One other fashionable methodology is the envelope system, the place you divide your bills into classes (e.g., housing, utilities, advertising and marketing) and allocate a selected sum of money for every class.

Expense Monitoring Instruments for Airbnb Hosts

With regards to monitoring bills, there are quite a few apps and instruments obtainable that may provide help to keep organized and on prime of your funds. Some fashionable choices embrace:

- Zelle: A cell cost service that lets you ship and obtain funds, in addition to observe your bills.

- QuickBooks: An accounting software program that gives instruments for invoicing, expense monitoring, and monetary reporting.

- Airbnb’s personal instruments: The platform presents a built-in messaging system for visitors and hosts, in addition to options for monitoring earnings and bills.

Utilizing a Credit score Card to Monitor Bills and Handle Money Stream

A bank card is usually a great tool for monitoring bills and managing money circulate. By utilizing a bank card for business-related bills, you possibly can simply categorize and observe your spending, in addition to earn rewards and advantages. Some bank cards, corresponding to these provided by Airbnb’s companions, might also supply further options and advantages particularly designed for Airbnb hosts.

Monitoring your bills and making a funds can assist you make knowledgeable choices about what you are promoting and optimize your monetary assets.

Monitoring your bills and making a funds can assist you make knowledgeable choices about what you are promoting and optimize your monetary assets.

Methods for Maximizing Rewards and Factors for Airbnb Bookings

To maximise rewards and factors for Airbnb bookings, you might want to perceive the bank card’s rewards program and how you can leverage it for journey and lodging. By reserving Airbnb via a rewards bank card, you possibly can earn factors and miles that may be redeemed for reductions, free stays, and different journey perks.

Using Bonus Classes for Most Rewards

Many rewards bank cards supply bonus classes for particular spending areas, corresponding to journey, eating, or groceries. In case your bank card presents bonus classes for journey or lodging, take into account reserving Airbnb via it to earn further factors. For instance, in case your bank card presents 3x factors on journey bookings, reserving Airbnb via it could earn you 3x factors for your entire keep, not simply the preliminary reserving charge.

- Search for bank cards with bonus classes for journey, lodging, or eating.

- Ensure the bank card presents rewards factors or miles for Airbnb bookings particularly.

- Test the cardboard’s phrases and situations for any restrictions or limitations on incomes rewards for Airbnb bookings.

Signed-Up Bonuses for Most Rewards

Bank cards usually supply sign-up bonuses for brand new candidates, which is usually a vital solution to accumulate rewards factors. When making use of for a brand new bank card, take into account reserving Airbnb via it to earn the sign-up bonus. You should utilize the factors earned from the sign-up bonus to offset the price of your Airbnb reserving or redeem them for different journey perks.

- Analysis bank cards with engaging sign-up bonuses for journey and lodging.

- Ensure the bank card presents rewards factors or miles for Airbnb bookings particularly.

- Test the cardboard’s phrases and situations for any restrictions or limitations on incomes rewards for Airbnb bookings.

Maximizing Rewards for Journey and Lodging

To maximise rewards for journey and lodging, take into account reserving Airbnb via a bank card that gives rewards factors or miles for journey and lodging particularly. You can even use the bank card to ebook different travel-related bills, corresponding to flights, automobile leases, or lodge stays.

| Instance Credit score Playing cards | Rewards Factors or Miles | Bonus Classes |

|---|---|---|

| Credit score Card A | 10,000 factors | 3x factors on journey and lodging |

| Credit score Card B | 5,000 miles | 2x miles on air journey and lodging |

“Reserving Airbnb via a rewards bank card is usually a profitable solution to earn factors and miles for journey and lodging.”

Wrapping Up: The Advantages of Utilizing a Credit score Card for Airbnb Bookings

Utilizing a bank card for Airbnb bookings comes with quite a few advantages that may improve your journey expertise. Not solely can it earn you rewards and cashback, but it surely additionally presents further safety and adaptability when making funds. By selecting the best bank card to your wants, you possibly can take pleasure in a extra rewarding and hassle-free expertise on Airbnb.

Beneficial Credit score Playing cards for Airbnb Hosts and Bookers

With regards to selecting the best bank card for Airbnb bookings, you may need to prioritize playing cards that provide rewards applications particularly tailor-made for journey bookings, corresponding to Airbnb stays. Listed below are some prime suggestions:

- The Chase Sapphire Most popular Credit score Card: This card presents a superb rewards program that features factors on journey purchases, together with Airbnb bookings. It additionally presents journey insurance coverage and buy safety, making it an excellent alternative for Airbnb hosts and bookers.

- The Capital One Enterprise Rewards Credit score Card: This card presents limitless miles on all purchases, together with Airbnb bookings, with no rotating classes or spending limits. It additionally contains journey insurance coverage and no overseas transaction charges, making it a preferred alternative for vacationers.

- The Barclays Arrival Plus World Elite Mastercard: This card presents miles on all purchases, together with Airbnb bookings, with no rotating classes or spending limits. It additionally contains journey insurance coverage and no overseas transaction charges, making it a stable alternative for Airbnb bookers.

- The Citi Premier Card: This card presents a superb rewards program that features factors on journey purchases, together with Airbnb bookings, in addition to a $300 credit score in the direction of journey purchases inside the first 3 months.

Every of those playing cards presents distinctive advantages and rewards applications, so it is important to decide on the one which most closely fits your wants and preferences.

Ending Remarks: Greatest Credit score Card For Airbnb

In conclusion, choosing the appropriate bank card for Airbnb bookings could make a major distinction in your monetary administration and rewards earnings. By understanding the options, charges, and rewards applications related to completely different bank cards, you may make knowledgeable choices and get essentially the most out of your Airbnb experiences.

Questions Typically Requested

How do bank cards affect Airbnb bookings?

Bank cards can affect Airbnb bookings by offering customers with rewards factors, cashback, or journey miles that may be redeemed for future bookings or different travel-related bills.

What are the advantages of utilizing a bank card for Airbnb funds?

The advantages of utilizing a bank card for Airbnb funds embrace incomes rewards factors, having fun with buy safety, and being able to dispute costs or report incidents of bank card fraud.

Can I take advantage of a bank card to buy Airbnb present playing cards?

No, bank card issuers usually don’t allow purchases of present playing cards or different pay as you go merchandise with bank cards, as these kinds of transactions are thought-about high-risk.

Can I mix rewards from completely different bank cards to earn extra factors?

Sure, many bank card issuers supply the choice to mix or switch factors between playing cards, permitting customers to maximise their rewards earnings and redeem factors for extra helpful rewards.