Greatest bank card fee processing units the stage for on-line transactions, providing readers a glimpse right into a world the place funds are seamless and safe. The advantages and disadvantages of widespread fee gateways, equivalent to Stripe and PayPal, shall be mentioned, highlighting the charges related to bank card processing and methods to decrease them.

The fee processing panorama is complicated, with a number of elements to contemplate when selecting a dependable bank card fee processing system. This contains evaluating safety requirements, equivalent to PCI-DSS compliance, and explaining the significance of fee processing integration with e-commerce platforms.

Elements to Contemplate When Selecting a Credit score Card Processor

When venturing into the world of e-commerce, deciding on a dependable bank card processor is a vital choice that may make or break the success of your enterprise. A well-chosen processor can guarantee clean transactions, shield delicate buyer knowledge, and aid you keep a aggressive edge available in the market. However, a poorly chosen processor can result in pissed off clients, monetary losses, and a tarnished repute. On this part, we’ll delve into the important elements to contemplate when selecting a bank card processor.

Key Options of a Dependable Credit score Card Cost Processing System

A dependable bank card fee processing system ought to possess the next key options:

- Safety: Be certain that the processor is PCI-DSS compliant, which suggests it has applied sturdy safety measures to safeguard delicate buyer knowledge. This contains encryption, safe servers, and frequent safety audits.

- Processing speeds: Go for a processor that may deal with a excessive quantity of transactions rapidly and effectively, decreasing the danger of delayed or declined funds.

- Person-friendly interface: Select a processor with a user-friendly interface that’s simple to navigate, even for these with restricted technical experience.

- Transaction charges: Concentrate on the transaction charges related to the processor, together with fee processing charges, gateway charges, and any extra costs for companies like chargebacks or refunds.

- Help and customer support: Be certain that the processor gives dependable buyer help, together with a number of contact channels, detailed documentation, and a strong data base.

- Integration choices: Contemplate a processor that may combine seamlessly along with your e-commerce platform, decreasing the necessity for guide knowledge entry and streamlining the fee course of.

- Scalability: Go for a processor that may scale with your enterprise, dealing with elevated transaction volumes and rising buyer base with ease.

Evaluating Safety Requirements: PCI-DSS Compliance, Greatest bank card fee processing

The Cost Card Business Information Safety Customary (PCI-DSS) is a set of safety requirements designed to make sure the safe dealing with of delicate buyer knowledge. A bank card processor should be PCI-DSS compliant to make sure the protection of buyer transactions. Key facets of PCI-DSS compliance embrace:

- Encryption: Delicate knowledge should be encrypted each in transit and at relaxation.

- Safe servers: Processors should use devoted, safe servers to course of transactions.

- Firewalls: Firewalls should be applied to forestall unauthorized entry to the community.

- Common safety audits: Processors should conduct common safety audits to determine and tackle potential vulnerabilities.

- Safe key administration: Processors should implement safe key administration practices to guard delicate knowledge.

The Significance of Cost Processing Integration with E-commerce Platforms

Cost processing integration is crucial for a seamless e-commerce expertise. A well-integrated fee processing system can:

- Scale back transaction abandonment charges: By offering a clean, streamlined fee course of, you possibly can cut back the probability of shoppers abandoning their purchases.

- Improve conversions: A well-integrated fee system can result in increased conversion charges by making the fee course of fast and hassle-free.

- Enhance buyer satisfaction: By offering a safe and environment friendly fee expertise, you possibly can enhance buyer satisfaction and loyalty.

- Enhance income: A well-integrated fee processing system can assist enhance income by decreasing transaction errors and minimizing fee processing charges.

- On the spot fee affirmation, decreasing the probability of disputes or chargebacks.

- Improved money stream administration, as funds are transferred instantly upon transaction authorization.

- Enhanced buyer satisfaction, as transactions are processed rapidly and effectively.

- Safe storage of buyer fee knowledge, decreasing the danger of knowledge breaches or unauthorized entry.

- Simple integration with current fee methods, minimizing disruptions to current operations.

- Improved buyer belief, as they know their delicate info is protected.

- Automated billing and fee processing, decreasing the probability of missed funds or subscription cancellations.

- Customizable billing cycles and fee schedules, accommodating numerous enterprise fashions and buyer preferences.

- In-depth analytics and insights, serving to companies perceive buyer habits and optimize their subscription choices.

- Use encryption algorithms like AES (Superior Encryption Customary) to safe delicate info in storage and transmission.

- Implement tokenization, which replaces delicate info with a novel token, decreasing the danger of knowledge breaches.

- Use safe protocols like HTTPS (Hypertext Switch Protocol Safe) for on-line transactions and safe file switch protocol (SFTP) for offline transactions.

- Implement sturdy verification procedures, equivalent to Handle Verification System (AVS) and Card Safety Code (CSC), to validate card info.

- Use fraud detection instruments to determine suspicious transactions and flag high-risk funds for guide overview.

- Clearly talk fee phrases, situations, and insurance policies to clients to keep away from confusion and decrease disputes.

- Develop an information safety coverage outlining procedures for storing, utilizing, and sharing delicate info.

- Conduct common safety audits to determine vulnerabilities and implement needed patches and updates.

- Present clients with clear and accessible details about knowledge assortment, use, and sharing.

- Compatibility: Making certain that the fee processor and fee gateway are suitable with the e-commerce platform.

- Error Dealing with: Implementing error dealing with mechanisms to deal with failed transactions, declined funds, and different potential points.

- Safety Audits: Frequently performing safety audits to make sure compliance with business requirements, equivalent to PCI DSS.

- Shopify: Affords a variety of fee gateways, together with Shopify Funds, Stripe, and PayPal. It additionally gives a strong reporting and analytics function to trace fee efficiency.

- WooCommerce: Gives a excessive stage of customization and adaptability, permitting retailers to combine a number of fee gateways, together with PayPal, Stripe, and Authorize.web.

- Magento: Affords a strong fee processing function, permitting retailers to combine a number of fee gateways, together with PayPal, Stripe, and Authorize.web.

- Cell Cost Strategies: Integrating widespread cellular fee strategies, equivalent to Apple Pay, Google Pay, and Samsung Pay, to offer clients with a seamless fee expertise.

- Cell-Pleasant Cost Varieties: Designing mobile-friendly fee types which can be simple to fill out and cut back cart abandonment charges.

- Safe Tokenization: Implementing safe tokenization to guard delicate fee info and cut back the danger of knowledge breaches.

- Use safe fee gateways that help cellular fee strategies.

- Implement mobile-friendly fee types and design ideas.

- Use safe tokenization to guard delicate fee info.

- Conduct common safety audits to make sure compliance with business requirements.

Benefits of Superior Credit score Card Cost Processing Options: Greatest Credit score Card Cost Processing

In at the moment’s fast-paced world, bank card fee processing has developed to fulfill the calls for of a digital economic system. Superior options have improved the effectivity, safety, and comfort of transactions, permitting companies to excel of their respective markets. With the rise of e-commerce and on-line transactions, it is important to grasp the advantages of superior bank card fee processing options.

Actual-time Cost Processing and Settlement

Actual-time fee processing and settlement allow companies to course of transactions immediately, eliminating the necessity for guide verification or prolonged settlement durations. This function permits for:

Actual-time fee processing and settlement additionally facilitate a seamless expertise for purchasers, eliminating the frustration related to delayed or failed transactions.

Tokenization for Enhanced Cost Safety

Tokenization is a strong safety function that replaces delicate card info with a novel token, enhancing the safety of transactions. Tokenization permits for:

Tokenization has turn into an important side of superior bank card fee processing, enabling companies to keep up a powerful safety posture whereas assembly regulatory necessities.

Recurring Billing and Subscription Administration

Recurring billing and subscription administration options permit companies to automate recurring funds, guaranteeing a gentle income stream and environment friendly buyer administration. This function contains:

Recurring billing and subscription administration options empower companies to give attention to progress, innovation, and buyer satisfaction, somewhat than guide fee processing and reconciliation.

Greatest Practices for Credit score Card Cost Processing Safety

Because the world turns into more and more digitized, bank card fee processing safety has turn into a prime precedence for companies and people alike. With the rise of cybercrime and knowledge breaches, it is important to implement sturdy safety measures to safeguard delicate info. On this part, we’ll delve into the perfect practices for securing bank card transactions and defending in opposition to fee processing dangers.

Safe Storage and Transmission of Credit score Card Info

Storing and transmitting bank card info securely is crucial to stopping unauthorized entry and knowledge breaches. To realize this, observe these finest practices:

Mitigating Cost Processing Dangers and Stopping Chargebacks

Mitigating fee processing dangers and stopping chargebacks require a proactive method. By following these finest practices, companies can decrease the probability of disputes and keep a wholesome fee processing document:

Compliance with Information Safety Rules

Adhering to knowledge safety rules, equivalent to GDPR (Common Information Safety Regulation) and CCPA (California Client Privateness Act), is essential to keep away from non-compliance fines and reputational harm. To make sure compliance, companies ought to:

Within the phrases of Benjamin Franklin, “An funding in data pays the perfect curiosity.” By investing time and sources in bank card fee processing safety, companies can decrease fee processing dangers and shield their repute.

Credit score Card Cost Processing for E-commerce Companies

Because the world turns into more and more digital, e-commerce companies have turn into the norm, providing comfort and accessibility to clients worldwide. Nevertheless, with this shift comes the problem of processing bank card funds on-line, which requires cautious consideration to integration, safety, and scalability.

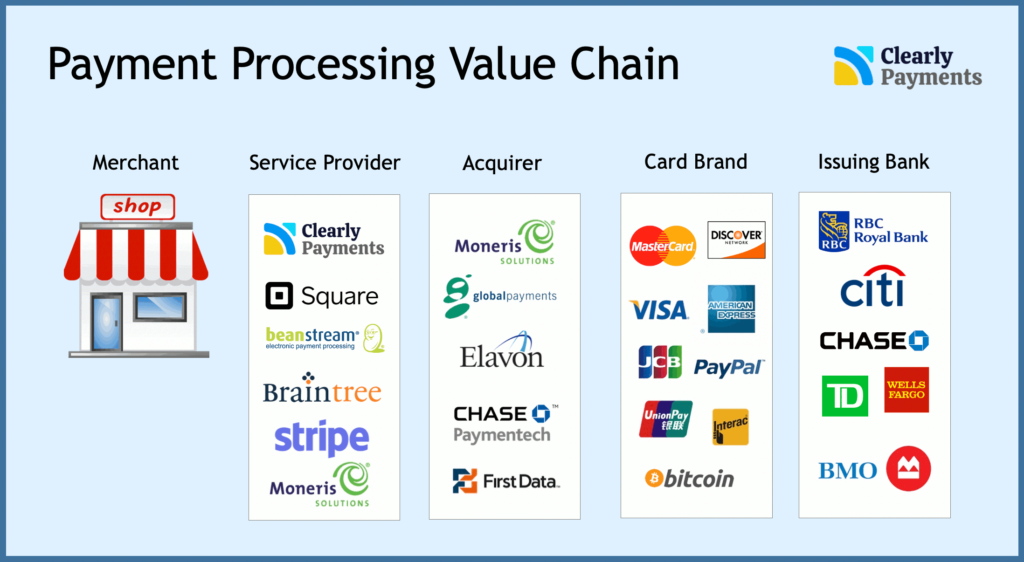

Bank card fee processing for e-commerce companies is a fancy activity, involving the combination of fee gateways, fee processors, and service provider account suppliers. The purpose is to determine a seamless fee expertise for purchasers, whereas guaranteeing that transactions are safe and compliant with business rules.

Integration Challenges for E-commerce Platforms

E-commerce platforms like Shopify, WooCommerce, and Magento supply sturdy fee processing capabilities, however integrating these options may be difficult. The first points embrace:

These challenges may be mitigated by adopting a safe fee gateway, utilizing safe encryption protocols, and implementing a strong testing technique to determine and resolve potential points.

E-commerce Platform Options and Cost Processing Capabilities

Every e-commerce platform has its strengths and weaknesses with regards to fee processing. For example:

When selecting an e-commerce platform, retailers ought to fastidiously consider the fee processing capabilities, safety features, and integrations to make sure that they meet their enterprise wants.

Optimizing Credit score Card Cost Processing for Cell Commerce

Cell commerce has turn into a major channel for e-commerce companies, providing clients the comfort of procuring on-the-go. Nevertheless, optimizing bank card fee processing for cellular commerce requires cautious consideration to the next elements:

By optimizing bank card fee processing for cellular commerce, e-commerce companies can enhance the client expertise, cut back cart abandonment charges, and enhance conversions.

Implementing Greatest Practices for Cell Cost Processing

To make sure a seamless cellular fee expertise, e-commerce companies ought to implement the next finest practices:

By following these finest practices, e-commerce companies can present their clients with a safe, handy, and seamless cellular fee expertise.

Conclusion

In conclusion, finest bank card fee processing is a vital side of on-line transactions, requiring cautious consideration of a number of elements. By understanding the advantages and disadvantages of widespread fee gateways and following finest practices for safety, companies can guarantee seamless and safe fee processing.

Skilled Solutions

What’s the fundamental distinction between Stripe and PayPal?

Stripe and PayPal are each widespread fee gateways, however they function in a different way. Stripe is a fee processor that permits companies to just accept bank card funds immediately, whereas PayPal is a digital pockets that permits clients to make funds on-line.

What are the charges related to bank card processing?

The charges related to bank card processing fluctuate relying on the fee gateway and the kind of transaction. Some widespread charges embrace processing charges, interchange charges, and evaluation charges.

How can companies decrease bank card processing charges?

Companies can decrease bank card processing charges by selecting a fee gateway with low processing charges, negotiating with their fee processor, and optimizing their fee processing stream.

What’s PCI-DSS compliance and why is it essential?

PCI-DSS compliance is a set of safety requirements for fee card business knowledge safety. It’s important as a result of it ensures that companies deal with fee card info securely and shield delicate knowledge from cyber threats.