As greatest crypto staking platforms takes heart stage, this opening passage beckons readers right into a world of digital belongings and monetary freedom, the place they’ll discover the alternatives and challenges of crypto staking.

Crypto staking is a course of that permits holders of sure cryptocurrencies to earn rewards within the type of further cash by taking part within the validation of transactions on a blockchain community.

Introduction to Crypto Staking: Greatest Crypto Staking Platforms

Crypto staking is a course of the place customers lock up their cryptocurrencies to help the operation of a blockchain community, just like how miners validate transactions. The advantages of staking embody incomes passive earnings, taking part within the decision-making means of the blockchain community, and contributing to the general safety of the community.

In easy phrases, the method of staking cryptocurrencies includes the next steps:

The Staking Course of

Validators, usually these with excessive computational energy or holding giant quantities of cash, gather and confirm transactions on the blockchain community. To validate transactions, validators want to unravel complicated mathematical issues and guarantee they’ve a enough quantity of cash locked in a selected timeframe. If the validators efficiently confirm the transactions, they’re rewarded with newly minted cash or transaction charges.

Staking vs. Mining

In contrast to mining, staking would not require the person to unravel complicated mathematical issues to validate transactions. As a substitute, staking includes locking up cash to help the community. One other key distinction is that staking requires considerably much less computational energy in comparison with mining, as customers need not resolve these mathematical issues, thus making it extra accessible to a wider viewers. Nonetheless, staking usually requires customers to carry a minimal quantity of cash, which generally is a barrier to entry.

Determinants of Staking

A number of elements decide the profitability of staking, together with the kind of cryptocurrency being staked, the staking reward, the period of the staking interval, and the community’s block time, amongst others. For instance, customers staking in smaller networks could earn greater rewards, however the threat of community collapse could also be greater because of its smaller dimension and lesser variety of validators.

High Crypto Staking Platforms

Crypto staking platforms have turn out to be more and more widespread in recent times, providing customers the chance to earn curiosity on their cryptocurrencies whereas contributing to the safety and decentralization of blockchain networks. With numerous choices obtainable, it is important to grasp the options, necessities, and costs related to every platform to make an knowledgeable choice.

Crypto staking platforms range when it comes to their minimal steadiness necessities, rates of interest, and fee constructions. Here is a breakdown of a number of the hottest crypto staking platforms:

Widespread Crypto Staking Platforms

Blockchain-based staking platforms supply customers the power to stake their cryptocurrencies and earn rewards.

- Coinbase Staking: Coinbase Staking permits customers to stake their Ethereum, Solana, and different supported cryptocurrencies. The minimal steadiness requirement is $1, and rates of interest range relying on the asset staked.

- Kraken Staking: Kraken Staking presents customers the power to stake their Ethereum, Polkadot, and different supported cryptocurrencies. The minimal steadiness requirement is $10, and rates of interest range relying on the asset staked.

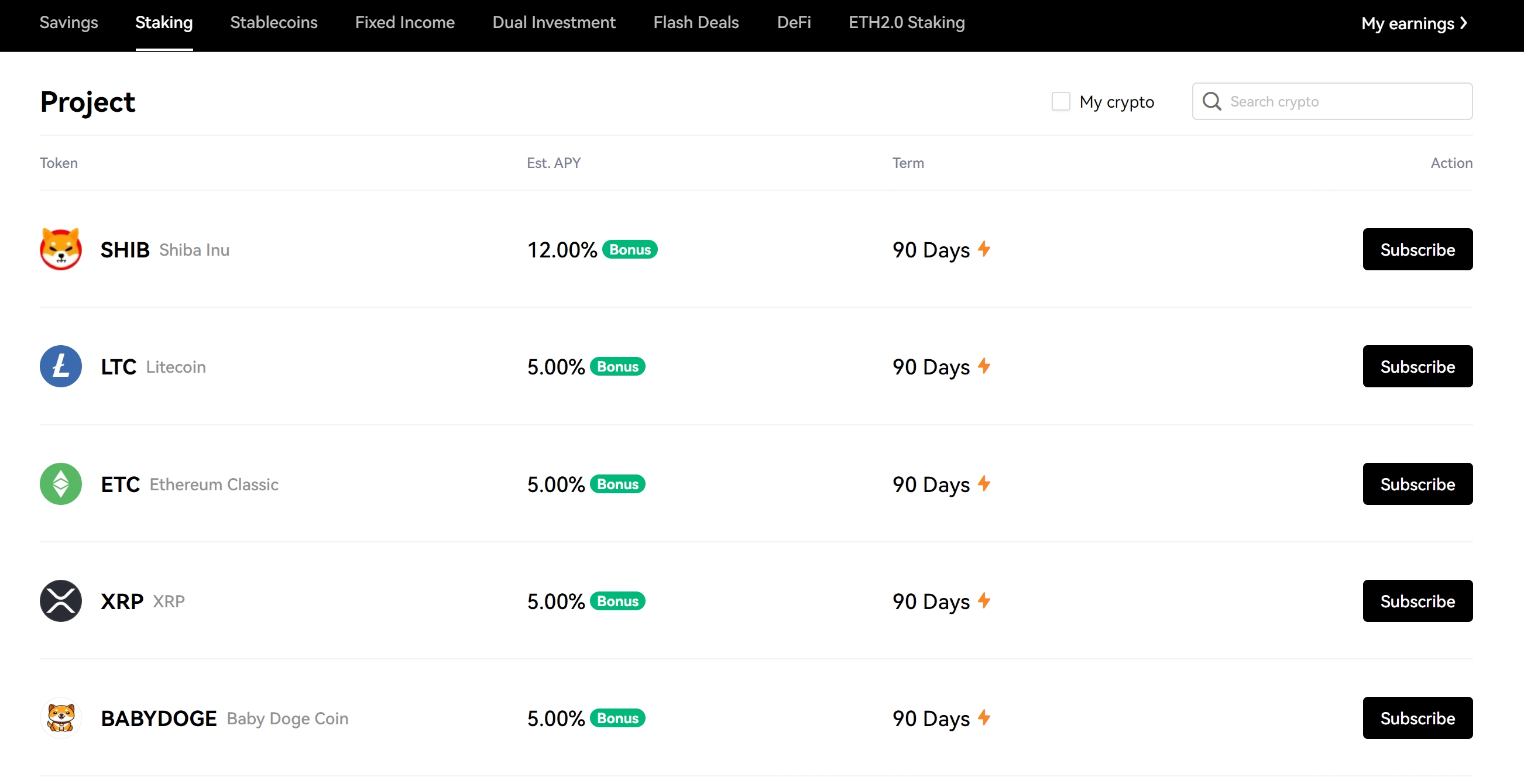

- Binance Staking: Binance Staking permits customers to stake their cryptocurrencies and earn rewards. The minimal steadiness requirement varies relying on the asset staked, and rates of interest vary from 3% to twenty% APR.

- Celsius Community: Celsius Community permits customers to stake their cryptocurrencies and earn curiosity. The minimal steadiness requirement is $1,000, and rates of interest range relying on the asset staked.

- BlockFi Staking: BlockFi Staking presents customers the power to stake their Ethereum, Tezos, and different supported cryptocurrencies. The minimal steadiness requirement varies relying on the asset staked, and rates of interest vary from 4% to 25% APR.

Comparability of Charges and Fee Constructions

The charges and fee constructions of crypto staking platforms can considerably affect the person’s earnings. Here is a comparability of the charges related to every platform:

| Platform | Withdrawal Charges | Deposit Charges | Fee Construction |

|---|---|---|---|

| Coinbase Staking | $0.99-$1.50 (for Ethereum) | $10-$50 (for big deposits) | Mounted price of 15% |

| Kraken Staking | $5-$10 (for Ethereum) | $5-$10 (for small deposits) | |

| Binance Staking | $1-$10 (for Ethereum) | $1-$5 (for small deposits) | Variable price of three%-20% |

| Celsius Community | $10-$50 (for big withdrawals) | $10-$50 (for big deposits) | Variable price of 5%-20% |

| BlockFi Staking | $10-$50 (for big withdrawals) | $10-$50 (for big deposits) | Variable price of 4%-25% |

It is important to rigorously evaluation the charges and fee constructions of every platform earlier than making a call. Whereas some platforms could supply greater rates of interest, others could cost greater charges, which might affect the person’s total returns.

Advantages and Drawbacks of Staking on Totally different Platforms

Every crypto staking platform has its distinctive advantages and downsides. Here is a abstract:

- Coinbase Staking: Presents a user-friendly interface and aggressive rates of interest, however expenses greater charges for withdrawals and deposits.

- Kraken Staking: Permits customers to stake a variety of cryptocurrencies, however expenses greater charges for small deposits and withdrawals.

- Binance Staking: Presents aggressive rates of interest and a variety of staking choices, however requires a major minimal steadiness.

- Celsius Community: Permits customers to earn curiosity on their cryptocurrencies, however expenses greater charges for big withdrawals and deposits.

- BlockFi Staking: Presents aggressive rates of interest and a user-friendly interface, however requires a major minimal steadiness.

When selecting a crypto staking platform, it is important to contemplate the minimal steadiness necessities, rates of interest, and costs related to every possibility. By rigorously reviewing these elements, customers could make knowledgeable selections and maximize their returns.

Safety Concerns for Crypto Staking

On the subject of crypto staking, safety must be on the prime of your record. Along with your belongings locked up in a validator, you may wish to be sure that your chosen staking platform is safe and respected. A single safety breach may lead to important monetary losses, so it is important to take the mandatory precautions. On this part, we’ll discover the significance of safety when selecting a crypto staking platform and supply tips about how you can establish safe staking platforms.

Significance of Safety when Selecting a Crypto Staking Platform

The safety of a staking platform is vital to the success of your staking endeavor. A dependable platform may have sturdy safety measures in place to guard towards numerous forms of threats. If a platform is susceptible to hacking or different safety breaches, your belongings may very well be in danger. Moreover, a safe platform may have a clear system for dealing with errors and resolving disputes, providing you with confidence within the staking course of.

Easy methods to Determine Safe Staking Platforms

To establish a safe staking platform, search for the next traits:

- A robust monitor report of safety: Analysis the platform’s historical past and status. Search for opinions and rankings from different customers to gauge their degree of satisfaction with the platform’s safety measures.

- Clear system for error dealing with: A safe platform may have a clear system for dealing with errors and resolving disputes. Search for clear procedures and communication from the platform’s help staff.

- Sturdy safety measures: Examine if the platform has sturdy safety measures in place, comparable to multi-signature wallets, safe {hardware} wallets, and common updates to guard towards recognized vulnerabilities.

- Certifications and audits: Search for certifications and audits from respected third-party organizations that confirm the platform’s safety requirements.

Ideas for Defending Your Property whereas Staking Cryptocurrencies

Whereas selecting a safe staking platform is essential, you also needs to take steps to guard your belongings whereas staking cryptocurrencies. Listed here are some suggestions that can assist you achieve this:

- Use a {hardware} pockets: {Hardware} wallets are safer than software program wallets and can be utilized to retailer your staking keys.

- Use multi-signature wallets: Multi-signature wallets require a number of signatures to entry the funds, making them safer than single-signature wallets.

- Maintain your software program and firmware updated: Recurrently replace your staking software program and firmware to guard towards recognized vulnerabilities.

- Recurrently again up your keys: Recurrently again up your staking keys to forestall knowledge loss in case of a safety breach or system failure.

Safety is a shared duty between the staking platform and the person. Whereas the platform ought to have sturdy safety measures in place, it is important for customers to take steps to guard their belongings.

Widespread Cryptocurrencies for Staking

Staking within the cryptocurrency area has turn out to be more and more widespread because of its potential for passive earnings technology. Nonetheless, not all cryptocurrencies are created equal on the subject of staking. On this part, we are going to delve into essentially the most stakable cryptocurrencies and their respective necessities and rates of interest.

Tezos (XTZ)

Tezos is a well-liked cryptocurrency for staking because of its distinctive delegated proof-of-stake (DPoS) consensus algorithm. With Tezos, validators, also called “bakers,” are liable for validating transactions and creating new blocks. By staking Tezos, customers can act as bakers and earn a proportion of the block reward.

In Tezos, the rate of interest is round 5-6% every year.

The staking necessities for Tezos are as follows:

* Minimal stake: 10 XTZ

* Most stake: 2,000 XTZ

* Rate of interest: 5-6% every year

* Block time: 60 seconds

Cosmos (ATOM)

Cosmos is one other widespread cryptocurrency for staking because of its inter-blockchain communication (IBC) protocol. Cosmos makes use of a delegated proof-of-stake (DPoS) consensus algorithm, just like Tezos. By staking Cosmos, customers can earn a proportion of the block reward and act as validators on the community.

In Cosmos, the rate of interest is round 8-10% every year.

The staking necessities for Cosmos are as follows:

* Minimal stake: 10 ATOM

* Most stake: 100 ATOM

* Rate of interest: 8-10% every year

* Block time: 3 seconds

Cardano (ADA), Greatest crypto staking platforms

Cardano is a proof-of-stake (PoS) cryptocurrency that makes use of a singular Ouroboros consensus algorithm. By staking Cardano, customers can earn a proportion of the block reward and act as validators on the community.

In Cardano, the rate of interest is round 5-7% every year.

The staking necessities for Cardano are as follows:

* Minimal stake: 1 ADA

* Most stake: 10,000 ADA

* Rate of interest: 5-7% every year

* Block time: 20 seconds

Polkadot (DOT)

Polkadot is a decentralized platform that allows interoperability between completely different blockchain networks. By staking Polkadot, customers can earn a proportion of the block reward and act as validators on the community.

In Polkadot, the rate of interest is round 10-12% every year.

The staking necessities for Polkadot are as follows:

* Minimal stake: 1 DOT

* Most stake: 10,000 DOT

* Rate of interest: 10-12% every year

* Block time: 6 seconds

Easy methods to Stake Cryptocurrencies

Staking cryptocurrencies includes committing your cash to a blockchain community to be able to earn rewards. To begin staking, you may have to arrange a digital pockets and safe your non-public keys, as we’ll talk about within the subsequent part.

To stake cryptocurrencies, you may have to observe these steps:

Setting Up Your Pockets

First, you may have to arrange a digital pockets that helps the cryptocurrency you wish to stake. Hottest cryptocurrencies have their very own official wallets, or you should utilize a third-party pockets that helps a number of cryptocurrencies. It is important to decide on a pockets that’s safe and straightforward to make use of, as you may be storing your non-public keys and cash in it.

Securing Your Personal Keys

Your non-public keys are the safe info related together with your pockets, and so they’re used to authorize transactions. To safe your non-public keys, use a powerful password, allow two-factor authentication (2FA), and retailer your keys in a safe location, comparable to a {hardware} pockets or a secure. It will stop unauthorized entry to your pockets and shield your investments.

Understanding Staking Strategies

There are two primary forms of staking strategies: {hardware} and software program staking. {Hardware} staking includes utilizing a specialised gadget, comparable to a {hardware} pockets, to retailer your cash and stake them on a blockchain community. Software program staking, then again, includes utilizing a pc or cellular gadget to stake your cash.

{Hardware} Staking

{Hardware} staking includes utilizing a specialised gadget, comparable to a Ledger or Trezor {hardware} pockets, to retailer your cash and stake them on a blockchain community. These units are designed to be extremely safe and can be utilized to retailer a number of cryptocurrencies. Some widespread {hardware} wallets for staking embody:

- Ledger Nano X

- Trezor Mannequin T

- KeepKey

Software program Staking

Software program staking includes utilizing a pc or cellular gadget to stake your cash on a blockchain community. To software program stake, you may have to obtain and set up a staking software program or use a staking pool service. Some widespread software program staking choices embody:

- MyEtherWallet

- Belief Pockets

- Atomic Pockets

Benefits and Disadvantages of Crypto Staking

Crypto staking has emerged as a viable possibility for cryptocurrency house owners, providing quite a few advantages and downsides that have to be thought-about. On the one hand, staking cryptocurrencies offers a passive supply of earnings, permitting customers to earn rewards for holding and validating transactions on the blockchain. Then again, staking carries sure dangers, together with market volatility and safety considerations.

Benefits of Crypto Staking

Staking cryptocurrencies has a number of benefits that make it a pretty possibility for customers.

- Passive Earnings Era: Staking cryptocurrencies generates a passive earnings stream for customers, permitting them to earn rewards with out actively contributing to the community.

- Decentralization: Staking helps to decentralize the cryptocurrency’s validation course of, decreasing the reliance on a government.

- Predictable Returns: With staking, customers can count on predictable returns on their funding, which is not like many different funding choices.

Disadvantages of Crypto Staking

Whereas staking cryptocurrencies has a number of benefits, it additionally carries sure disadvantages that have to be thought-about.

- Market Volatility: The worth of cryptocurrencies will be extremely risky, and staking losses can happen if the market worth of the staked asset decreases.

- Safety Dangers: Staking includes storing a considerable amount of cryptocurrency, making it a major goal for hackers and different safety threats.

- Slashing Mechanism: Some staking protocols function a slashing mechanism, the place customers who quickly lose their stake (e.g., because of an sudden reboot) are penalized with a lowered reward and even lose their complete stake.

Danger vs. Reward

When contemplating staking cryptocurrencies, customers should weigh the potential dangers towards the rewards.

| Danger Issue | Reward Potential |

|---|---|

| Market volatility | Predictable returns |

| Safety dangers | Decentralization and lowered reliance on central authority |

| Slashing mechanism | Passive earnings technology |

Conclusion

The choice to stake cryptocurrencies must be primarily based on an intensive understanding of the benefits and drawbacks. Whereas staking presents quite a few advantages, together with passive earnings technology and decentralization, it additionally carries dangers, together with market volatility and safety considerations. By rigorously weighing the dangers towards the rewards, customers could make an knowledgeable choice about whether or not staking is correct for them.

“Staking isn’t a get-rich-quick scheme, however slightly a long-term funding technique that requires endurance and understanding of the underlying dangers and rewards.”

Regulatory Surroundings for Crypto Staking

The regulatory atmosphere for crypto staking has been evolving quickly, with governments and regulatory our bodies world wide grappling with how you can classify and oversee the staking trade. As the recognition of staking continues to develop, it is important to grasp the present regulatory panorama and the way it could affect staking actions.

In 2023, the USA Securities and Change Fee (SEC) took a major step by saying plans to manage staking below current securities legal guidelines. The SEC said that staking actions involving the creation of recent tokens or derivatives could also be thought-about securities choices, topic to registration necessities. This transfer highlights the rising concern amongst regulators that staking could also be exposing traders to dangers just like these related to conventional securities.

Regulatory Developments and Their Affect

Regulatory developments are having a major affect on the staking trade, with some platforms and tasks adapting shortly to adjust to new necessities. For instance, some decentralized finance (DeFi) platforms are introducing Know Your Buyer (KYC) and Anti-Cash Laundering (AML) procedures to keep away from regulatory scrutiny.

Nation-by-Nation Regulation Overview

Some nations have carried out particular rules for crypto staking, whereas others are nonetheless within the means of clarifying their stance. Here’s a temporary overview of the regulatory atmosphere in a number of key jurisdictions:

- United States: As talked about earlier, the SEC is taking an in depth have a look at staking actions. The Commodity Futures Buying and selling Fee (CFTC) has declared staking a commodity, making some staking actions eligible for registration and oversight.

- European Union: The European Parliament is engaged on a complete regulatory framework for cryptocurrencies, together with staking. The proposed rules intention to harmonize the regulatory atmosphere throughout member states and supply clear tips for staking actions.

- China: China has banned staking actions, citing dangers related to market volatility and potential for market manipulation.

- Japan: Japan’s Monetary Providers Company (FSA) has launched rules for staking, requiring platforms to acquire a license and cling to strict anti-money laundering and know-your-customer procedures.

Regulatory developments are influencing the staking trade, with some platforms and tasks adapting shortly to adjust to new necessities. Because the regulatory panorama continues to evolve, staking contributors should keep knowledgeable about compliance necessities and potential dangers related to staking actions.

Rising Tendencies in Crypto Staking

The crypto staking trade is continually evolving, with new tendencies and applied sciences rising which are reshaping the way in which staking is completed. From the shift from proof-of-work to proof-of-stake algorithms to the growing recognition of layer 2 scaling options, there are various thrilling developments which are reworking the staking panorama.

Proof-of-Stake vs. Proof-of-Work

One of the crucial important rising tendencies in crypto staking is the shift from proof-of-work (PoW) to proof-of-stake (PoS) algorithms. PoW requires miners to unravel complicated mathematical issues to validate transactions and create new blocks, which will be energy-intensive and costly. In distinction, PoS selects validators primarily based on the quantity of cash they maintain, which will be extra energy-efficient and cost-effective.

Blockchain, for instance, makes use of a PoS algorithm, which permits validators to take part within the validation course of primarily based on the quantity of cash they maintain. This has led to elevated recognition and adoption of PoS-based blockchains.

Layer 2 Scaling Options

Layer 2 scaling options are one other rising pattern in crypto staking. These options are designed to extend the scalability of blockchains by implementing further layers on prime of the principle chain. This may also help to cut back congestion and improve transaction throughput, making it extra environment friendly for validators to take part within the validation course of.

Examples of layer 2 scaling options embody the Lightning Community and Optimism. These options use good contracts to allow quicker and extra environment friendly transactions, which will be helpful for validators and customers alike.

Delegated Proof-of-Stake

Delegated proof-of-stake (DPoS) is one other rising pattern in crypto staking. DPoS is a variation of PoS that permits validators to delegate their voting energy to different nodes, which may also help to extend decentralization and participation within the validation course of.

Blockchain and EOS are examples of blockchains that use DPoS algorithms. This has led to elevated adoption and recognition of DPoS-based blockchains.

The Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is one other rising pattern in crypto staking. DeFi is a set of monetary protocols and purposes which are constructed on blockchain know-how and permit for peer-to-peer lending, borrowing, and buying and selling.

DeFi has the potential to revolutionize the way in which we take into consideration finance and lending, and it’s more likely to play a serious position in the way forward for crypto staking.

| Rising Development | Description |

|---|---|

| Proof-of-Stake (PoS) | A consensus algorithm that selects validators primarily based on the quantity of cash they maintain. |

| Layer 2 Scaling Options | A set of options designed to extend the scalability of blockchains. |

| Delegated Proof-of-Stake (DPoS) | A variation of PoS that permits validators to delegate their voting energy to different nodes. |

| Decentralized Finance (DeFi) | A set of monetary protocols and purposes constructed on blockchain know-how. |

Blockchain, for instance, makes use of a PoS algorithm, which permits validators to take part within the validation course of primarily based on the quantity of cash they maintain. This has led to elevated recognition and adoption of PoS-based blockchains.

The Affect of Rising Tendencies on the Staking Market

The emergence of recent tendencies and applied sciences within the crypto staking trade can have a major affect on the staking market. From growing adoption and recognition of PoS-based blockchains to the rise of DeFi purposes, there are various thrilling developments which are reworking the staking panorama.

The growing recognition of PoS-based blockchains, for instance, can result in elevated decentralization and participation within the validation course of, which might make it tougher for unhealthy actors to control the community.

Equally, the rise of DeFi purposes can result in elevated adoption and recognition of crypto belongings, which might improve the demand for validation companies and improve the income for validators.

Nonetheless, the emergence of recent tendencies and applied sciences may also result in elevated competitors and decreased income for validators, which generally is a problem for the staking market.

Conclusion

The crypto staking trade is continually evolving, with new tendencies and applied sciences rising which are reshaping the way in which staking is completed. From the shift from proof-of-work to proof-of-stake algorithms to the growing recognition of layer 2 scaling options, there are various thrilling developments which are reworking the staking panorama.

Because the staking market continues to evolve, it’s important to remain up-to-date with the newest tendencies and applied sciences to stay aggressive and worthwhile.

Way forward for Crypto Staking

The way forward for crypto staking is unsure, however one factor is evident: the trade is continually evolving and altering. As new tendencies and applied sciences emerge, the staking panorama will proceed to shift and adapt.

One potential future improvement is the emergence of recent consensus algorithms that may enhance the scalability and effectivity of blockchains. One other potential improvement is the growing adoption of DeFi purposes, which might result in elevated adoption and recognition of crypto belongings.

The way forward for crypto staking is unsure, however one factor is evident: the trade is continually evolving and altering.

“The way forward for crypto staking is brilliant, and it’ll proceed to form the way in which we take into consideration finance and lending.”

Final Phrase

In conclusion, choosing the right crypto staking platforms requires cautious consideration of the options, necessities, and costs related to every platform, in addition to a complete understanding of the underlying know-how and market tendencies.

By staying knowledgeable and adapting to the evolving regulatory and technological panorama, crypto staking lovers can navigate the advantages and dangers of this thrilling area and unlock the complete potential of their digital belongings.

FAQ Insights

What’s crypto staking?

Crypto staking is a course of that permits holders of sure cryptocurrencies to earn rewards within the type of further cash by taking part within the validation of transactions on a blockchain community.

Is crypto staking secure?

Crypto staking generally is a secure and worthwhile enterprise if completed accurately, however dangers comparable to market volatility, safety dangers, and regulatory uncertainties must be rigorously managed and mitigated.

What are the advantages of crypto staking?

The advantages of crypto staking embody incomes passive earnings, taking part within the validation of transactions, and contributing to the decentralization of the blockchain community.

What are the dangers of crypto staking?

The dangers of crypto staking embody market volatility, safety dangers, regulatory uncertainties, and the potential for illiquid belongings.