Kicking off with finest Disney bank card, this opening paragraph is designed to captivate and have interaction the readers, setting the tone with every phrase. Think about getting rewarded for spending cash on Disney merchandise, tickets, and experiences. Whether or not you are a die-hard Disney fan or simply love the nostalgia of Disney magic, utilizing the appropriate bank card could make your goals come true.

The most effective Disney bank card presents a spread of rewards and advantages that may be tailor-made to fit your spending habits and preferences. From cashback and factors to unique perks and reductions, these bank cards are designed to make your Disney experiences much more particular.

Advantages of the Finest Disney Credit score Card

In terms of being a die-hard Disney fan, having a Disney bank card generally is a dream come true. Not solely are you able to accumulate Disney {dollars} and get monetary savings, however you may also take pleasure in unique advantages and rewards that make your Disney experiences much more magical.

The most effective Disney bank cards provide a spread of rewards and advantages that cater to completely different wants and preferences. Listed here are among the hottest forms of rewards supplied by Disney bank cards:

Rewards Varieties

Rewards are an important facet of any bank card, and Disney bank cards are not any exception. The forms of rewards supplied by Disney bank cards will be broadly categorized into the next:

- Merchandise Rewards: Some Disney bank cards provide rewards within the type of merchandise, equivalent to character collectible figurines, collectible pins, and even unique Disney-themed gadgets.

- Disney {Dollars} Rewards: Disney bank cards usually provide rewards within the type of Disney {dollars}, which will be redeemed for merchandise, reward playing cards, and even experiences like Disney theme park tickets.

- Annual Assertion Credit: Annual assertion credit are an effective way to earn rewards in your Disney bank card, permitting you to redeem them for money or Disney {dollars}.

By understanding the forms of rewards supplied by Disney bank cards, you can also make an knowledgeable determination about which card most accurately fits your wants and preferences.

Unique Advantages

Along with rewards, the most effective Disney bank cards additionally provide unique advantages that make your Disney experiences much more magical. A few of these advantages embrace:

- Early entry to ticket gross sales for Disney theme parks and resorts

- Unique reductions on Disney merchandise and experiences

- Invites to particular occasions and preview days

- Precedence entry to character meet-and-greets and autograph classes

These unique advantages make your Disney experiences much more particular and memorable.

Advantages for Disney Followers

For Disney followers, having a Disney bank card generally is a dream come true. Listed here are some examples of how a Disney bank card can profit you:

- Accumulate Disney {dollars} or rewards that may be redeemed for unique Disney merchandise or experiences

- Take pleasure in early entry to ticket gross sales for Disney theme parks and resorts

- Get unique reductions on Disney merchandise and experiences

- Benefit from precedence entry to character meet-and-greets and autograph classes

By changing into a Disney bank card holder, you possibly can take pleasure in a spread of advantages that make your Disney experiences much more magical and memorable.

Conclusion

In conclusion, the most effective Disney bank cards provide a spread of rewards and advantages that cater to completely different wants and preferences. By understanding the forms of rewards supplied, unique advantages, and advantages for Disney followers, you can also make an knowledgeable determination about which card most accurately fits your wants and preferences.

Prime Disney Credit score Playing cards and Their Options

In terms of Disney lovers, they’re usually in search of methods to immerse themselves within the magical world of Disney. From merchandise to holidays, followers can simply get caught up within the pleasure. One strategy to indulge their ardour is through the use of a Disney-themed bank card. With a number of choices accessible, it is important to know which one most accurately fits their wants. On this part, we’ll delve into the listing of prime Disney bank cards accessible out there.

Disney Parks Mastercard

The Disney Parks Mastercard is a novel providing from Chase Financial institution, solely designed for Disney lovers. The cardboard advantages embrace incomes rewards on all Disney purchases, in addition to unique reductions and presents. Cardholders even have entry to the Disney Trip Bundle, permitting them to e book trip packages with factors. Moreover, cardholders will obtain a welcome bonus of 10,000 factors, redeemable for Disney merchandise or different experiences. As for the eligibility necessities, one should have good credit score, be a U.S. resident, and be at the least 18 years previous. Upon approval, the bank card comes with a variable annual charge, starting from $49 to $89.

Discovery Disney Credit score Card

The Disney-issued Discovery Disney Credit score Card gives cardholders with 1% cashback on all purchases and a ten% low cost on reward card purchases. Cardholders who’ve a minimal stability of $1,000 can even switch their factors to earn 1% cashback in journey kind. The annual charge for this card ranges from $25 to $49. To be eligible, candidates ought to be at the least 18 years previous and have an lively, legitimate e mail handle.

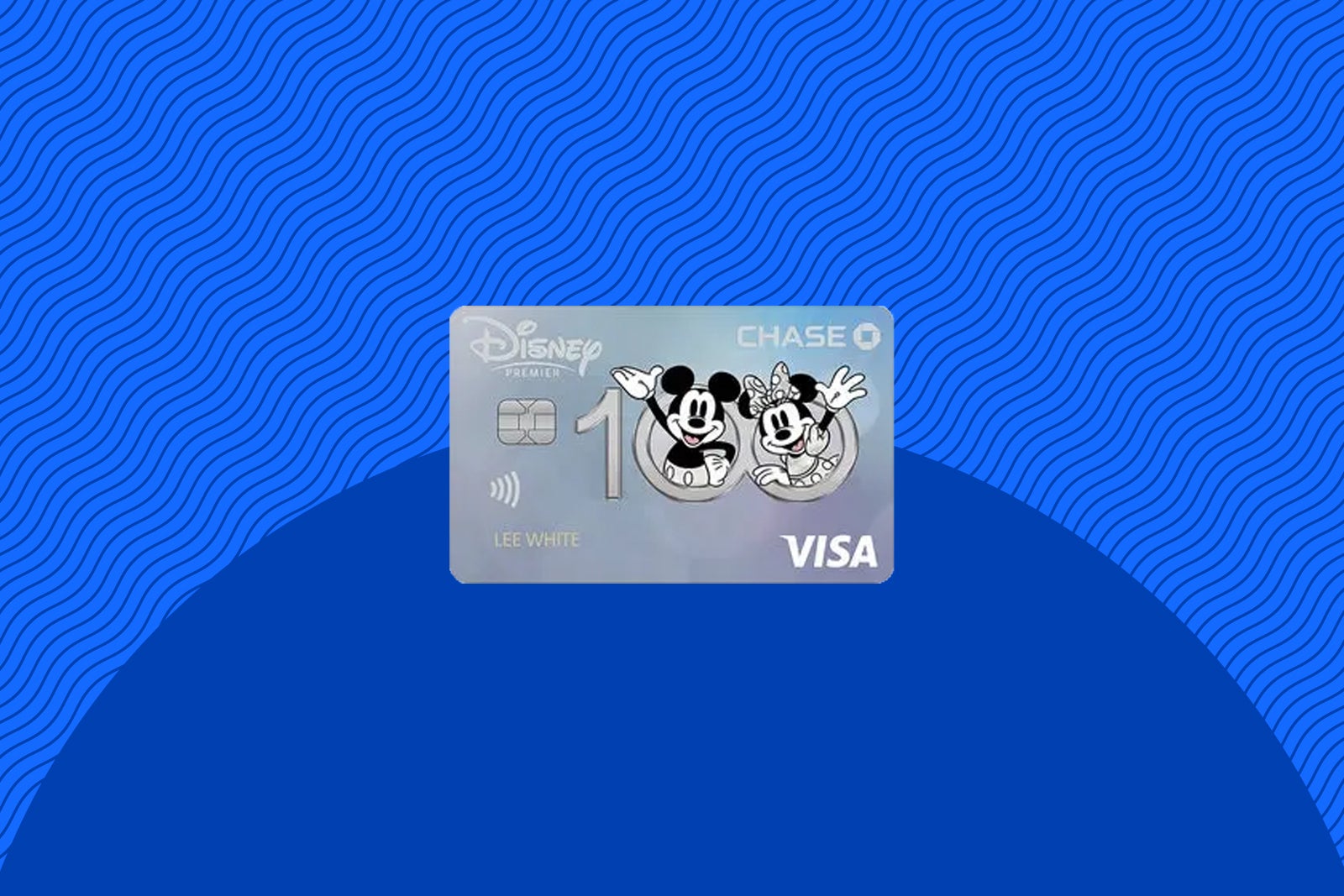

Disney Premier Visa Card

The Disney Premier Visa Card is a card supplied by Chase Financial institution, in collaboration with Disney. Cardholders earn rewards on all Disney purchases, with a welcome bonus of two% cashback on $1,000 in purchases throughout the first 90 days. In addition they get complimentary Disney PhotoPass playing cards and entry to unique cardmember occasions at Disney theme parks. Cardholders who accumulate 10,000 factors can redeem them for Disney experiences or merchandise. The eligibility requirement consists of being a U.S. resident, having good credit score, and being at the least 18 years previous.

Walt Disney World Credit score Card, Finest disney bank card

The Walt Disney World Credit score Card is likely one of the prime Disney bank cards accessible out there, providing advantages equivalent to 6% cashback on all purchases associated to Walt Disney World, plus 2% cashback on all different purchases, and a $50 assertion credit score once you spend at the least $1,000. Cardholders additionally get entry to unique Disney Visa Rewards card advantages. The required eligibility consists of being a U.S. resident, having good credit score, and being at the least 18 years previous. With a variable annual charge, starting from $49 to $89, cardholders can reap the benefits of these rewards.

Selecting the Finest Disney Credit score Card for Your Wants

In terms of choosing probably the most appropriate Disney bank card, it is important to contemplate your distinctive spending habits, preferences, and monetary targets. With a number of Disney bank cards accessible, every providing distinct rewards and advantages, it is essential to method this determination methodically.

To start with, it is important to guage your spending patterns and decide which forms of rewards would align finest along with your way of life. Are you a frequent customer to Disney parks and resorts? Do you take pleasure in buying at Disney Retailer places or on-line? Maybe you are focused on reserving Disney-themed holidays or experiencing Disney’s culinary delights? Understanding your spending habits will enable you slender down the choices and select a Disney bank card that rewards your frequent purchases.

One other essential issue to contemplate is the rate of interest and costs related to every bank card. Whereas a decrease rate of interest could also be interesting, you also needs to consider the annual charges and any extra fees, equivalent to international transaction charges. Make sure you fastidiously overview the phrases and circumstances earlier than making a choice.

Evaluating Rewards and Advantages

Disney bank cards provide a spread of rewards and advantages, together with cashback, journey factors, merchandise credit, and unique Disney experiences. When evaluating these rewards, think about the next elements:

Reward Construction

Search for bank cards with rewards packages that align along with your spending habits. For instance, if you happen to regularly dine at Disney eating places, a bank card with a eating rewards program could also be an excellent match.

Spend Necessities

Examine the minimal spend necessities to earn rewards, in addition to any caps or limitations on the forms of purchases that qualify for rewards.

Redemption Choices

Contemplate the convenience of redeeming rewards and the flexibleness of redemption choices. Some bank cards provide versatile redemption choices, equivalent to redemption at Disney shops or on-line, whereas others might solely provide redemption for particular experiences or providers.

Deciding on the Finest Disney Credit score Card for Your Wants

Now that you’ve got evaluated the elements talked about above, it is time to choose the most effective Disney bank card in your wants. Listed here are some tricks to think about:

Select a Credit score Card that Aligns with Your Spending Habits

Choose a bank card that rewards your frequent purchases and aligns along with your spending habits.

Contemplate the Annual Charge

Rigorously overview the annual charges and any extra fees, equivalent to international transaction charges, to make sure that the rewards and advantages outweigh the prices.

Learn Evaluations and Evaluate Affords

Analysis and examine presents from completely different bank card issuers to seek out the most effective Disney bank card in your wants.

Apply for a Credit score Card that Affords a 0% Introductory APR

When you plan to make a big buy or switch an present stability, think about making use of for a bank card that provides a 0% introductory APR.

In conclusion, selecting the right Disney bank card in your wants requires cautious analysis of your spending habits, preferences, and monetary targets. By contemplating the elements talked about above and selecting a bank card that aligns along with your way of life, you possibly can take pleasure in unique rewards and advantages that improve your Disney expertise.

Disney Credit score Card Rewards and Incomes Alternatives

In terms of incomes rewards from a Disney bank card, there are a number of forms of rewards that cardholders can accumulate factors for his or her loyalty. These embrace cashback rewards, Disney merchandise rewards and unique entry to Disney experiences. The most effective Disney bank cards provide beneficiant rewards packages, which allow cardholders to earn factors on purchases, redeem for Disney-related rewards and experiences or money again.

Credit score Card Introductory Affords and Perks

Disney bank cards might provide a spread of introductory incentives to draw new clients, entice repeat funds, or promote loyalty amongst present cardholders. These perks will be extraordinarily profitable when used successfully to finance Disney excursions. Bank card suppliers normally present varied promotional offers to entice customers to enroll in their providers.

Sort of Introductory Affords and Perks

The forms of promotional presents range considerably, with suppliers attempting to face out in an more and more aggressive market. A couple of frequent examples embrace:

-

Low or zero annual proportion charges (APRs) for a selected interval

No charges or lowered charges for the primary few months

Elevated rewards factors or cashback on the primary purchases inside a time restrict

Introductory bonus factors or miles for opening a brand new card

No charges for the primary few months

Introductory rates of interest decrease than regular charges

Making use of and Utilizing Introductory Affords and Perks

Many bank card suppliers concern these offers for a brief period they usually sometimes have circumstances or limitations on their software. Card suppliers normally state these circumstances clearly on their web sites. Cardholders, due to this fact, can’t apply for these incentives as soon as the promotional interval is over.

For Disney bank cards, the phrases and circumstances usually stipulate the period of the promotional incentives or rewards supplied to cardholders.

Examples of Disney Credit score Card Introductory Affords and Perks

For instance, customers might obtain a $300 bonus in Disney Present Playing cards as soon as they make a purchase order of $1,000, after a 3-month promotional interval with 0% APR

Disney Credit score Card Annual Charges and Curiosity Charges

Disney bank cards, like some other bank card, include annual charges and rates of interest that may considerably affect your pockets. These charges and charges generally is a important consideration when deciding which Disney bank card to use for. On this part, we’ll delve into the forms of annual charges and rates of interest related to Disney bank cards and supply recommendations on how one can decide if the advantages outweigh the prices.

Sorts of Annual Charges

Disney bank cards include varied forms of annual charges, which will be categorized as follows:

“Annual charges generally is a one-time charge, a charge that will increase over time, or a charge that applies solely to sure advantages.”

- Signal-up charges: Some Disney bank cards provide a sign-up bonus within the type of a one-time charge. For instance, the Disney Premier Visa Card presents a $75 sign-up bonus.

- Membership charges: Disney bank cards usually include membership charges, which might vary from $49 to $99 per yr. These charges sometimes present entry to unique advantages, equivalent to reductions on merchandise and eating.

- Annual charges: These are the usual charges related to Disney bank cards, which might vary from $0 to $500 per yr. Some Disney bank cards waive the annual charge for the primary yr, whereas others provide a decreased annual charge for the primary yr.

Sorts of Curiosity Charges

Disney bank cards include varied rates of interest, which will be categorized as follows:

“Rates of interest will be variable or fastened, and may vary from 11.99% to 26.99% APR.”

- Variable rates of interest: These rates of interest can change over time primarily based on market circumstances. For instance, if the prime charge will increase, your variable rate of interest may improve.

- Mounted rates of interest: These rates of interest stay the identical over time, no matter market circumstances. For instance, the Disney Premier Visa Card has a set rate of interest of 11.99% APR.

Decide if the Advantages Outweigh the Annual Charge and Curiosity Charge

When deciding whether or not the advantages of a Disney bank card outweigh the annual charge and rate of interest, think about the next elements:

“The advantages of a Disney bank card can embrace rewards earnings, reductions on merchandise and eating, and unique entry to occasions.”

- Rewards earnings: When you can earn rewards factors or miles in your Disney bank card, think about whether or not the rewards are definitely worth the annual charge.

- Reductions on merchandise and eating: When you regularly store at Disney shops or dine at Disney eating places, think about whether or not the reductions accessible in your Disney bank card are definitely worth the annual charge.

- Unique entry to occasions: When you’re a fan of Disney occasions, think about whether or not the unique entry to occasions accessible in your Disney bank card is definitely worth the annual charge.

Ideas for Minimizing the Influence of Annual Charges and Curiosity Charges

To attenuate the affect of annual charges and rates of interest in your Disney bank card, think about the next suggestions:

“The important thing to managing annual charges and rates of interest is to pay your stability in full every month and reap the benefits of rewards and reductions.”

- Paying your stability in full every month: Make sure that to pay your stability in full every month to keep away from curiosity fees.

- Profiting from rewards and reductions: Contemplate whether or not the rewards and reductions accessible in your Disney bank card are definitely worth the annual charge.

- Selecting a bank card with a low or no annual charge: When you’re not a frequent Disney client, think about selecting a bank card with a low or no annual charge.

Disney Credit score Card Fee Choices and Necessities

Fee choices and necessities for Disney bank cards are comparatively commonplace and accessible. Disney bank card issuers provide varied channels and schedules for paying your stability, making on-time funds, and avoiding late fees.

The advantages of paying your Disney bank card stability in full or making on-time funds are substantial, as this helps to reduce curiosity fees and late charges. These funds additionally assist preserve a wholesome credit score rating. It is important to pay greater than the minimal cost to stop owing extra in curiosity over time than you had been initially charged.

Fee Strategies

Disney bank card issuers sometimes settle for on-line funds, cellphone funds, mail funds, and in-person funds. These cost strategies allow you to handle your account and fulfill obligations effectively. You too can test your stability and make funds on-line by way of your account dashboard.

On-Time Fee Advantages

Paying your Disney bank card stability in full or making on-time funds presents a spread of advantages, together with:

- Decrease curiosity fees: Paying off your stability in full prevents curiosity fees from accumulating.

- No late charges: Making well timed funds ensures you keep away from late charges and penalties.

- Improved credit score rating: On-time funds contribute to a more healthy credit score rating, serving to you qualify for higher credit score and mortgage choices.

- Enhanced monetary self-discipline: Paying your stability in full or on time cultivates accountable monetary habits and helps you develop a price range.

- Elevated rewards: By making well timed funds, you possibly can totally make the most of your bank card rewards, together with factors, cashback, or journey perks.

Avoiding Late Fee Charges and Curiosity Costs

To forestall late cost charges and curiosity fees in your Disney bank card, adhere to the next finest practices:

- Arrange computerized funds: Prepare for computerized funds to be deducted out of your checking account or debit card on a scheduled date.

- Pay greater than the minimal: Make greater than the minimal cost to scale back curiosity fees and repay your stability extra effectively.

- Pay your stability in full: Paying your stability in full every month prevents curiosity fees from accumulating.

- Monitor your cost due date: Maintain observe of your cost due date to keep away from lacking funds.

- Talk along with your issuer: Inform your issuer of any adjustments to your account or cost schedule to keep away from pointless fees or penalties.

Methods for Optimizing the Benefits of a Disney Credit score Card

When using a Disney bank card, combining it with different cost strategies can improve its advantages. This synergy can unlock new incomes alternatives and improve the general worth of your rewards.

Pairing with Different Fee Strategies

One efficient method is to pair your Disney bank card with different types of cost. This might contain utilizing the cardboard for sure purchases and reserving different types of cost, equivalent to money, debit playing cards, or different bank cards, for others. By strategically combining these cost strategies, you possibly can maximize your rewards incomes potential.

- Think about using your Disney bank card for giant bills, equivalent to airplane tickets or lodge stays, and reserving money or debit playing cards for smaller purchases.

- In case you have a number of bank cards with completely different rewards constructions, you need to use every card for particular purchases to optimize your incomes potential.

- When you’re buying one thing that does not provide a excessive rewards incomes charge, think about using a special cost technique to maximise your rewards on different purchases.

Incomes Rewards on On a regular basis Purchases

To maximise the advantages of your Disney bank card, deal with making on a regular basis purchases that supply excessive rewards incomes charges. This might contain utilizing your card for groceries, gasoline, or eating bills.

- In case your Disney bank card presents excessive rewards incomes charges on groceries, use it in your weekly grocery buying journeys to build up factors or cashback.

- In case your card presents excessive incomes charges on gasoline, use it in your day by day gas purchases to build up rewards.

- In case your card presents excessive incomes charges on eating, use it for restaurant meals or takeout to build up rewards.

Combining Disney Credit score Card Advantages with Loyalty Packages

To additional improve the advantages of your Disney bank card, think about combining its rewards with different loyalty packages and perks. This will unlock new incomes alternatives and improve the general worth of your rewards.

- In case you have a loyalty program for a selected retailer or restaurant, mix your Disney bank card rewards with the shop’s loyalty program to unlock extra advantages.

- In case you have a rewards bank card for a selected class, equivalent to a gasoline station or division retailer, mix your Disney bank card rewards with the rewards from the opposite card to optimize your incomes potential.

- In case you have a journey rewards bank card, mix your Disney bank card rewards with the rewards from the journey card to unlock extra journey advantages.

Making a Customized Disney Credit score Card Reward System

Making a personalized reward system in your Disney bank card can carry quite a few advantages, together with enhanced incomes alternatives and tailor-made rewards that cater to your preferences. By designing a bespoke reward system, you possibly can maximize your incomes potential and take advantage of your Disney bank card.

Customized Rewards Choices

With a customized Disney bank card reward system, you possibly can select from varied rewards and incomes alternatives that align along with your pursuits and spending habits. For example, you might go for rewards within the type of:

- Disney merchandise or experiences, equivalent to tickets to Disneyland or Disney+ membership.

- Cashback or bank card factors redeemable for assertion credit, journey bookings, or different purchases.

- Unique entry to Disney occasions, equivalent to character meet-and-greets or behind-the-scenes excursions.

- Particular reductions or promotions on Disney merchandise, providers, or accomplice manufacturers.

Digital Instruments and Apps for Customized Rewards

Leveraging digital instruments and apps can assist you create and handle a personalized Disney bank card reward system. Some fashionable choices embrace:

- On-line budgeting and monitoring apps, equivalent to Mint or Private Capital, to watch your spending and optimize rewards earnings.

- Digital rewards platforms, like Ibotta or Rakuten, to earn cashback or rewards on on a regular basis purchases.

- Cell apps, such because the Disney World or Disneyland apps, to redeem rewards or entry unique experiences.

“The important thing to maximizing your Disney bank card rewards is to know your spending habits and tailor your reward system accordingly. By leveraging digital instruments and apps, you possibly can create a bespoke reward system that delivers personalised advantages and enhances your general Disney bank card expertise.”

Closing Notes: Finest Disney Credit score Card

So, are you able to degree up your Disney sport with the most effective Disney bank card? Whether or not you are planning a magical Disney trip or simply wish to earn rewards in your on a regular basis purchases, this bank card is the right alternative for any Disney fan. Make your Disney goals come true with the most effective Disney bank card – it is a small worth to pay for a complete lot of magic.

Solutions to Widespread Questions

Q: What’s the finest Disney bank card for novices?

A: The most effective Disney bank card for novices is usually a no-annual-fee card that provides rewards on Disney purchases, such because the Disney Premier Visa Card.

Q: Can I exploit my Disney bank card on Disney retailer purchases?

A: Sure, you need to use your Disney bank card on Disney retailer purchases each in-store and on-line.

Q: Do Disney bank cards provide any unique perks?

A: Sure, some Disney bank cards provide unique perks equivalent to early entry to Disney tickets, particular eating experiences, and unique merchandise.