Finest REITs to spend money on 2025 units the stage for this enthralling narrative, providing readers a glimpse right into a story that’s wealthy intimately and brimming with originality from the outset. REITs have grow to be a staple in lots of traders’ portfolios, offering a singular solution to spend money on actual property with out the hands-on administration and excessive upfront prices related to direct property funding.

The subject of REIT investing is advanced and multifaceted, encompassing a variety of industries, methods, and threat administration methods. This text will delve into the world of REITs, exploring the top-performing REITs in 2024, the sector developments and outlook for 2025, and the varied funding methods and approaches that can be utilized to maximise returns whereas minimizing threat.

Actual Property Funding Belief Overview

Actual Property Funding Trusts (REITs) are a well-liked method for people to spend money on actual property with out straight proudly owning bodily properties. They provide a singular alternative for traders to diversify their portfolios and doubtlessly earn rental earnings streams.

Definition of REIT

A Actual Property Funding Belief (REIT) is an organization that owns or funds income-generating actual property properties, similar to workplace buildings, residences, buying facilities, resorts, and extra. The first objective of a REIT is to supply a method for people to spend money on actual property by pooling funds from numerous traders, thus spreading the danger.

Benefits of REIT

Traders can profit from REITs in a number of methods. Firstly, they provide an opportunity to diversify a portfolio, because the efficiency of REITs is commonly not correlated with the general inventory market. In addition they enable people to spend money on actual property with out straight managing properties, which might be time-consuming and requires vital experience. REITs can even provide common earnings streams, as they’re required to distribute at the very least 90% of their taxable earnings to shareholders annually.

Forms of REITs

There are a number of sorts of REITs, every with its distinctive funding technique and threat profile.

- Fairness REITs: These REITs personal and function income-generating properties, similar to workplace buildings, residences, and buying facilities. They generate income by means of hire and property gross sales.

- Mortgage REITs: These REITs present financing for actual property properties by issuing mortgage-backed securities. They earn curiosity earnings from the mortgages they originate.

- Hybrid REITs: As their identify suggests, these REITs mix parts of each fairness and mortgage REITs. They personal properties and likewise present financing by means of mortgage-backed securities.

- Specialised REITs: These REITs deal with particular sorts of properties or industries, similar to healthcare services, knowledge facilities, or timberlands.

- Actual Property CEFs (Closed-Finish Funds): These REITs are just like conventional REITs however are structured as closed-end funds, that are traded on the inventory market like particular person shares.

Every sort of REIT affords a singular funding alternative, and traders should rigorously consider their threat tolerance, funding targets, and general portfolio composition earlier than selecting which kind of REIT to spend money on.

Key Advantages of Specialised REITs

Specialised REITs provide a number of advantages, together with:

- Area of interest focus: Specialised REITs think about particular sorts of properties or industries, which might result in a deeper understanding of the market and improved funding choices.

- Diversification: Investing in specialised REITs can present further diversification advantages by spreading threat throughout completely different sectors and asset lessons.

- Potential for greater returns: Specialised REITs may provide greater returns by means of their deal with rising developments and alternatives in particular markets.

Nevertheless, it is important to evaluate the potential dangers related to investing in specialised REITs, similar to restricted market liquidity and elevated reliance on a single sector.

Conclusion

REITs provide a singular funding alternative that enables people to take part in the actual property market with out straight proudly owning properties. With varied sorts of REITs accessible, traders should rigorously consider their threat tolerance, funding targets, and general portfolio composition earlier than selecting which kind of REIT to spend money on.

REIT Sector Evaluation

As we dive into the world of Actual Property Funding Trusts (REITs) in 2025, it is important to investigate the present market developments and outlook for the sector. The REIT market has been experiencing vital development in recent times, pushed by rising demand for housing, workplace house, and different sorts of industrial properties.

The REIT sector might be broadly categorized into a number of sub-sectors, every with its distinctive traits and development potential. On this evaluation, we’ll establish the sectors anticipated to expertise vital development in 2025.

Healthcare REITs

The healthcare sector is anticipated to be a significant driver of development within the REIT market in 2025. With the worldwide inhabitants getting older quickly, there’s a rising want for healthcare services, similar to hospitals, nursing properties, and assisted dwelling services. This demand is driving up property values and rental earnings for healthcare REITs.

In response to a report by Inexperienced Road Advisors, the healthcare REIT sector is anticipated to develop by 10% in 2025, pushed by rising demand for healthcare providers and the restricted provide of healthcare properties. A number of the high healthcare REITs embrace Ventas, Inc. (NYSE: VTR) and Welltower Inc. (NYSE: WELL).

- Ventas, Inc. (NYSE: VTR) is a number one healthcare REIT with a portfolio of over 2,000 properties throughout america and the UK.

- Welltower Inc. (NYSE: WELL) is one other main healthcare REIT with a portfolio of over 1,200 properties throughout america and Canada.

Information Heart REITs

The rise of e-commerce and cloud computing has pushed up demand for knowledge heart house, making knowledge heart REITs a promising development space in 2025. Information heart REITs spend money on and function knowledge facilities, which offer essential infrastructure for companies to retailer and course of knowledge.

In response to a report by Cushman & Wakefield, the demand for knowledge heart house is anticipated to develop by 15% in 2025, pushed by the rising adoption of cloud computing and the rising want for knowledge storage. A number of the high knowledge heart REITs embrace Digital Realty Belief, Inc. (NYSE: DLR) and Equinix, Inc. (NASDAQ: EQIX).

- digital Realty Belief, Inc. (NYSE: DLR) is a number one knowledge heart REIT with a portfolio of over 200 knowledge facilities the world over.

- Equinix, Inc. (NASDAQ: EQIX) is one other main knowledge heart REIT with a portfolio of over 200 knowledge facilities the world over.

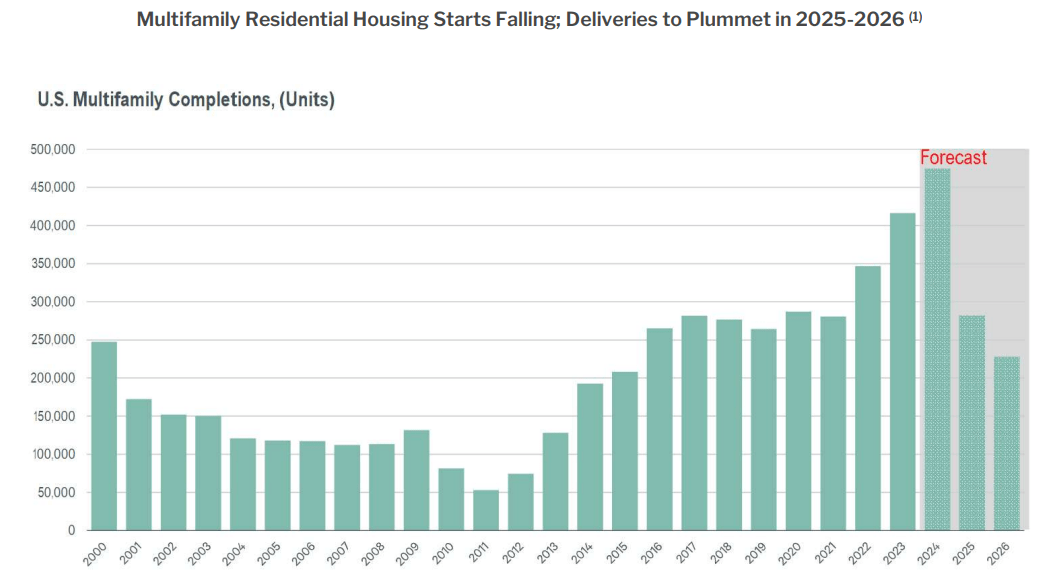

Multifamily Housing REITs

The demand for multifamily housing is anticipated to stay robust in 2025, pushed by demographic developments and restricted provide of housing stock. Multifamily housing REITs spend money on and function condominium buildings and different sorts of multifamily housing.

In response to a report by CBRE, the demand for multifamily housing is anticipated to develop by 8% in 2025, pushed by the rising want for housing and the rising adoption of leases. A number of the high multifamily housing REITs embrace Realogy Holdings Corp. (NYSE: RLGY) and Invitation Houses Inc. (NYSE: INVH).

- Invitation Houses Inc. (NYSE: INVH) is one other main multifamily housing REIT with a portfolio of over 1,500 condominium buildings throughout america.

REIT Funding Methods

On the subject of investing in Actual Property Funding Trusts (REITs), varied methods might help you obtain your monetary targets. These methods deal with producing dividend earnings, capital appreciation, and sector rotation. On this part, we are going to talk about completely different funding approaches and supply recommendations on easy methods to diversify your REIT portfolio to reduce threat and maximize returns.

Dividend Earnings Technique

The dividend earnings technique entails investing in REITs with a historical past of paying constant and rising dividends. This method is appropriate for income-seeking traders who wish to earn a daily stream of earnings from their REIT investments. By selecting REITs with a powerful dividend payout ratio, you may generate a predictable earnings stream and revel in the advantages of long-term investing.

- Excessive dividend yield: REITs with a dividend yield above 4% can present a gorgeous earnings stream.

- Constant dividend funds: REITs with a historical past of constant dividend funds display their skill to generate money flows.

- Dividend development: REITs with a monitor document of accelerating dividend funds can present a possible supply of long-term earnings development.

To profit from this technique, it’s important to conduct thorough analysis on the REIT’s monetary well being, administration staff, and trade developments.

Capital Appreciation Technique

The capital appreciation technique entails investing in REITs with the potential for long-term capital development. This method is appropriate for traders who wish to profit from the rise within the worth of their REIT investments over time. By selecting REITs with a powerful development trajectory, you may doubtlessly earn vital returns in your funding.

- Analysis potential for development: Establish REITs with a historical past of speedy development and a powerful development trajectory.

- Business developments: Put money into REITs working in rising industries with a powerful demand for properties.

- Administration staff: Consider the expertise and experience of the REIT’s administration staff in driving development.

In immediately’s fast-changing market surroundings, it’s essential to conduct thorough analysis and analyze trade developments to make knowledgeable funding choices.

Sector Rotation Technique

The sector rotation technique entails investing in REITs that function in particular sectors with a powerful potential for development. This method is appropriate for traders who wish to profit from the cyclical nature of the REIT market. By selecting REITs with a powerful presence in a selected sector, you may doubtlessly earn returns by using the sector’s development wave.

- Business cyclicality: Put money into REITs working in sectors with a transparent cycle of development and decline.

- Sector outperformance: Give attention to REITs working in sectors which have traditionally outperformed the market.

- Administration experience: Consider the expertise and experience of the REIT’s administration staff in navigating sector developments.

To succeed with this technique, it’s important to remain up-to-date with trade developments and alter your portfolio accordingly.

Portfolio Diversification

Diversifying your REIT portfolio is essential to minimizing threat and maximizing returns. By spreading your investments throughout completely different sectors, geographies, and asset lessons, you may cut back your publicity to market volatility and enhance the potential for long-term development.

In response to a research by the Nationwide Affiliation of Actual Property Funding Trusts (NAREIT), a diversified REIT portfolio can doubtlessly cut back threat and improve returns by 30%.¹

- Asset allocation: Allocate your investments throughout completely different asset lessons, similar to workplace, retail, and residential properties.

- Geographic diversification: Unfold your investments throughout completely different geographic areas, similar to america, Europe, and Asia.

- Sector diversification: Put money into REITs working in numerous sectors, similar to healthcare, know-how, and industrials.

By adopting a diversification technique, you may create a extra resilient and growth-oriented REIT portfolio that’s higher outfitted to deal with market fluctuations.

¹National Affiliation of Actual Property Funding Trusts (NAREIT), “The Advantages of Diversification in REIT Investing.”

REIT Inventory Screening: Finest Reits To Make investments In 2025

On the subject of investing in REITs, cautious scrutiny is important to make sure that you make knowledgeable choices. A complete analysis of REIT shares entails a multifaceted method that considers each quantitative and qualitative elements. One of the vital essential facets of this analysis is key evaluation, which types the bedrock of REIT inventory screening.

Distinction between Elementary Evaluation in REITs and Different Inventory Screening

Elementary evaluation is essential in REIT inventory screening as a result of distinctive traits of actual property funding trusts. In contrast to different shares, REITs have particular necessities that should be met to make sure compliance with tax legal guidelines and regulatory frameworks. In consequence, the main target of elementary evaluation in REITs shifts in direction of evaluating the corporate’s skill to generate money flows, handle debt, and preserve a secure monetary place. This method helps traders establish REITs which can be poised for long-term development and stability.

Debt-to-Fairness Ratio

The debt-to-equity ratio is a essential metric in evaluating a REIT’s monetary well being. This ratio measures the proportion of an organization’s property which can be funded by debt versus fairness. A better debt-to-equity ratio might point out {that a} REIT is susceptible to market fluctuations and rate of interest adjustments.

* REITs with a debt-to-equity ratio above 1 could also be thought of riskier investments on account of their greater reliance on debt.

* Nevertheless, a debt-to-equity ratio of 1 or much less doesn’t essentially point out a wholesome monetary place, as it could be the results of an organization’s incapacity to tackle debt.

* A debt-to-equity ratio between 0.5 and 1 could also be thought of optimum, because it suggests a steadiness between debt and fairness.

Money Movement Margin

The money circulation margin is one other important metric in evaluating a REIT’s profitability. This metric measures the proportion of an organization’s money flows which can be accessible for distribution to shareholders. A better money circulation margin signifies {that a} REIT has a secure and sustainable monetary place.

* REITs with a money circulation margin above 80% are usually thought of to be well-positioned to take care of their dividend payouts.

* A money circulation margin between 70% and 80% might point out {that a} REIT is going through some challenges in sustaining its dividend payouts.

* A money circulation margin beneath 70% could also be a priority for traders, as it could point out {that a} REIT is struggling to generate adequate money flows to satisfy its monetary obligations.

Worth-to-Earnings Ratio (P/E Ratio)

The P/E ratio is a extensively used metric in evaluating a inventory’s valuation. Within the context of REIT shares, the P/E ratio might help traders decide whether or not a REIT’s inventory worth is affordable in comparison with its earnings.

* A P/E ratio above 20 might point out {that a} REIT’s inventory worth is overvalued.

* A P/E ratio between 15 and 20 could also be thought of honest.

* A P/E ratio beneath 15 might point out {that a} REIT’s inventory worth is undervalued.

* For instance, an organization with a P/E ratio of 15 and a development price of 5% could also be thought of undervalued.

Dividend Yield

The dividend yield is an important metric in evaluating a REIT’s attractiveness to earnings traders. This metric measures the proportion of a REIT’s dividend payouts to its inventory worth.

* A dividend yield above 5% could also be thought of engaging to earnings traders.

* A dividend yield between 3% and 5% could also be thought of reasonable.

* A dividend yield beneath 3% could also be a priority for earnings traders.

* As an illustration, a REIT with a dividend yield of 4% could also be thought of extra engaging than one with a dividend yield of two%.

Diversified REIT Portfolios

A well-diversified REIT portfolio can present traders with a spread of advantages, together with diminished threat and improved returns. By spreading their investments throughout varied REIT sectors and methods, traders can decrease their publicity to market volatility and maximize their potential for long-term development.

The advantages of diversification in REIT investing might be attributed to the distinctive traits of every sector and technique. As an illustration, property sort REITs, similar to workplace and retail, are usually much less risky than industrial or mortgage REITs. Equally, sector-specific REITs, like healthcare, are typically much less delicate to financial downturns than these within the hospitality or leisure industries.

Allocating to Property Kind REITs

Property sort REITs is usually a essential element of a diversified portfolio, as they provide a spread of advantages, together with secure money flows and regular development potential.

- Workplace REITs: Traders who allocate to workplace REITs can profit from the secure demand for industrial house and the potential for long-term appreciation in property values.

- Retail REITs: Retail REITs provide traders an opportunity to take part within the rising e-commerce market whereas additionally benefiting from the regular demand for brick-and-mortar shops.

- Industrial REITs: Industrial REITs can present traders with publicity to the commercial sector, which is experiencing vital development as a result of rise of e-commerce and logistics.

Traders can think about allocating to property sort REITs by deciding on a mixture of workplace, retail, and industrial shares, every with its distinctive traits and advantages.

Advantages of Sector-Particular REITs

Sector-specific REITs can even play a vital function in a diversified portfolio, as they provide traders publicity to distinctive market developments and drivers.

- Healthcare REITs: Healthcare REITs have traditionally offered traders with regular earnings development and secure money flows, making them a gorgeous choice for earnings seekers.

- Lodge and Leisure REITs: Because the hospitality trade continues to recuperate from the pandemic, resort and leisure REITs provide traders an opportunity to take part within the development of this sector whereas additionally benefiting from the regular demand for journey and tourism.

- Mortgage REITs: Mortgage REITs present traders with publicity to the mortgage market, which has been experiencing a surge in demand on account of low rates of interest and government-sponsored initiatives.

Traders can think about allocating to sector-specific REITs by deciding on a mixture of healthcare, resort and leisure, and mortgage shares, every with its distinctive traits and advantages.

Advantages of Hybrid REITs

Hybrid REITs mix the traits of property sort and sector-specific REITs, providing traders a singular mixture of advantages.

- Blended-Use REITs: Blended-use REITs mix workplace, retail, and industrial house, offering traders with publicity to a number of property sorts and market developments.

- Specialised REITs: Specialised REITs deal with particular sectors, similar to healthcare or hospitality, whereas additionally investing in property sorts associated to those sectors.

Traders can think about allocating to hybrid REITs by deciding on a mixture of mixed-use and specialised shares, every with its distinctive traits and advantages.

By allocating to property sort REITs, sector-specific REITs, and hybrid REITs, traders can create a diversified portfolio that gives a spread of advantages, together with diminished threat and improved returns. Because the REIT market continues to evolve, traders should adapt their methods to remain forward of the sport and maximize their potential for long-term development.

Diversification is the spine of a profitable REIT portfolio. By spreading your investments throughout varied sectors and methods, you may decrease your publicity to market volatility and maximize your potential for long-term development.

Threat Administration for REIT Traders

Threat administration is a essential side of investing in REITs (Actual Property Funding Trusts). As with every funding, there are inherent dangers related to REITs that may result in losses if not correctly managed. This part highlights key methods and ideas to assist mitigate these dangers and guarantee a extra secure and worthwhile funding expertise.

Greenback-Value Averaging

Greenback-cost averaging is a threat administration technique that entails investing a set sum of money at common intervals, whatever the market circumstances. This method helps to scale back the influence of market volatility by smoothing out the funding course of. By investing a set quantity repeatedly, you may be shopping for extra shares when costs are low and fewer shares when costs are excessive, which might help to scale back the common price per share over time.

- It reduces the influence of market volatility on investments.

- Helps to keep away from timing dangers related to attempting to foretell market fluctuations.

- Encourages long-term funding self-discipline.

As an illustration, for those who make investments $100 in a selected REIT firstly of the 12 months, and the market is in a downturn, your preliminary funding can be affected by the decrease market worth. Nevertheless, for those who proceed to speculate the identical quantity, say $100, each month, you may be including extra shares to your portfolio over time, which might help to steadiness out the consequences of market fluctuations.

Cease-Loss Orders

A stop-loss order is a commerce instruction that mechanically sells a safety when it falls to a sure worth, referred to as the stop-loss worth. This helps to restrict potential losses by promoting the safety earlier than it will probably drop additional. Cease-loss orders might be particularly helpful in risky markets, as they might help to stop vital losses.

| Cease-Loss Order Sorts | Operate |

|---|---|

| Restrict Order Cease-Loss | Sells the safety when it hits a particular worth (stop-loss worth). |

| Market Order Cease-Loss | Sells the safety as quickly as it’s attainable on the present market worth (not on the set stop-loss worth). |

When utilizing stop-loss orders, it is important to set an affordable stop-loss worth. A really low worth can lead to promoting too early, whereas a really excessive worth might not be efficient in limiting losses. As a common rule of thumb, think about setting stop-loss costs 5-10% beneath the market worth of your funding to maximise potential losses whereas minimizing the possibilities of promoting too early.

Further Threat Administration Methods

Whereas dollar-cost averaging and stop-loss orders are important methods for managing REIT funding dangers, different methods will also be useful. These embrace:

- Asset allocation: Spreading investments throughout varied asset lessons (e.g., shares, bonds, actual property) to scale back general portfolio threat.

- Threat evaluation: Analyzing potential dangers and rewards related to a selected REIT or funding technique.

- Common portfolio rebalancing: Periodically reviewing and adjusting the portfolio to make sure it aligns with the investor’s threat tolerance and funding targets.

- Diversification: Investing in a mixture of high-performing and lower-performing REITs and different securities to reduce the influence of any single funding on the general portfolio.

By incorporating these threat administration methods into an funding method, REIT traders can navigate the complexities of the market and obtain a extra secure and worthwhile funding expertise.

Keep in mind, threat administration is an ongoing course of that requires steady monitoring and adaptation to altering market circumstances.

REIT Tax Implications

REITs are topic to a singular tax surroundings that gives tax advantages to traders whereas guaranteeing that they meet the company earnings tax commonplace. In consequence, REIT traders can get pleasure from tax-free earnings from dividends and deferred capital good points, which we are going to talk about intimately beneath.

Tax Remedy of REIT Dividends

REITs distribute a good portion of their taxable earnings to shareholders within the type of dividends. The tax remedy of REIT dividends is as follows:

- REIT dividends are handled as abnormal earnings to people and are taxed in accordance with their marginal tax price.

- No tax advantages or deductions are offered for REIT dividends, that means that people will be unable to say any deductions in opposition to the earnings acquired.

- REIT dividends aren’t topic to the Different Minimal Tax (AMT), which signifies that traders is not going to face further tax liabilities.

The flexibility to gather tax-free dividends from REITs contributes to the attractiveness of REIT investing for a lot of people, because it permits them to take care of a bigger portion of their funding returns.

Tax Advantages for REIT Traders:

Along with the tax-free earnings from REIT dividends, traders can even profit from deferred capital good points by means of the sale of REIT securities.

- REIT traders can profit from the 20% capital good points tax exclusion for long-term capital good points, which is on the market for good points on the sale of REIT securities held for multiple 12 months.

- REITs are pass-through entities, that means that they aren’t topic to company earnings tax on capital good points. This enables REIT traders to get pleasure from the advantages of tax-deferred capital good points, which might be realized by promoting their REIT shares at a revenue.

The tax advantages of REIT investing make it a gorgeous choice for particular person traders trying to diversify their portfolios and generate tax-efficient earnings streams.

Instance of Tax Advantages for REIT Traders:, Finest reits to spend money on 2025

For example the tax advantages of REIT investing, let’s think about an instance. Assume a person buys $10,000 value of shares in a REIT and sells them after one 12 months for $12,000, leading to a acquire of $2,000. If the person is in a 25% tax bracket, they might usually pay 25% of the acquire as taxes, leading to a web acquire of $1,500. Nevertheless, if the person owns the REIT shares for multiple 12 months, they’ll profit from the 20% capital good points tax exclusion, decreasing their tax legal responsibility to 10% and rising their web acquire to $1,800. This instance highlights the significance of understanding the tax implications of REIT investing and the potential advantages of tax-deferred capital good points.

Deferred Capital Good points:

When a person sells REIT shares at a revenue, they have to report the acquire as abnormal earnings on their tax return. Nevertheless, if the REIT shares have been held for multiple 12 months, the acquire could also be eligible for the 20% long-term capital good points tax exclusion. This exclusion reduces the tax legal responsibility on the acquire and gives a extra favorable tax remedy to REIT traders. To qualify for the long-term capital good points tax exclusion, the next circumstances should be met:

- The REIT shares will need to have been held for multiple 12 months

- The acquire should be eligible for long-term capital good points remedy

- The person should be a taxpaying entity (e.g., particular person, company)

In abstract, REIT tax implications can provide tax advantages to traders within the type of tax-free earnings from dividends and deferred capital good points from the sale of REIT shares. Particular person traders can profit from the pass-through tax construction of REITs, permitting them to defer capital good points taxes and revel in a extra tax-efficient funding technique.

Final Recap

In conclusion, investing in the perfect REITs for 2025 requires a complete understanding of the REIT sector, its developments, and the varied funding methods that may be employed. By doing all your analysis, diversifying your portfolio, and utilizing threat administration methods, you may navigate the complexities of REIT investing and reap the rewards that this distinctive funding class has to supply.

Important Questionnaire

What are the advantages of investing in REITs?

REITs provide a singular solution to spend money on actual property with out the hands-on administration and excessive upfront prices related to direct property funding. REITs can even present a gradual earnings stream and the potential for long-term capital appreciation.

How do I select the perfect REITs to spend money on?

When selecting REITs to spend money on, think about elements such because the REIT’s monetary efficiency, administration staff, trade, and aggressive place. It is also important to diversify your portfolio by investing in REITs from completely different sectors.

What are the dangers related to REIT investing?

REIT investing carries a number of dangers, together with market volatility, rate of interest adjustments, and regulatory dangers. To mitigate these dangers, think about using threat administration methods similar to dollar-cost averaging and stop-loss orders.

Can I spend money on REITs with a small quantity of capital?

Sure, it’s attainable to spend money on REITs with a small quantity of capital. Many REITs provide fractional share buying, permitting you to purchase a portion of a share moderately than the complete share.

How do I monitor and alter my REIT funding portfolio?

Frequently assessment your REIT portfolio to evaluate its efficiency and make changes as wanted. Contemplate rebalancing your portfolio to take care of an optimum asset allocation and tax effectivity.