With one of the best ways to take a position 50k on the forefront, this journey begins with an thrilling quest to uncover the best methods for making your cash develop. As we delve into the world of funding, you will uncover the secrets and techniques to turning your life financial savings right into a treasure trove of wealth.

This complete information will stroll you thru varied conservative and high-risk funding choices, highlighting the professionals and cons of every strategy. From high-yield financial savings accounts to actual property funding trusts, we’ll look at the most effective methods to diversify your portfolio and maximize returns.

Conservative Funding Methods for $50k: Greatest Manner To Make investments 50k

When you’re trying to develop your wealth with out taking extreme threat, a conservative funding strategy is an effective way to start out. This technique includes investing your cash in low-risk belongings that generate steady returns over the long-term. On this part, we’ll discover a number of the greatest conservative funding methods for a $50k funding.

Excessive-Yield Financial savings Accounts

A high-yield financial savings account is a sort of financial savings account that earns a better rate of interest than a conventional financial savings account. This account is ideal for individuals who need to earn a steady return on their funding with out taking over an excessive amount of threat. With a high-yield financial savings account, you’ll be able to earn as much as 2% curiosity in your deposit, which can not look like quite a bit, but it surely’s a assured return that is greater than what you’d earn in a conventional financial savings account.

Some examples of high-yield financial savings accounts embrace:

- Ally Financial institution On-line Financial savings Account: This account earns an rate of interest of as much as 2.20% APY and has no charges or minimal stability necessities.

- Citibank Premier Excessive Yield Financial savings: This account earns an rate of interest of as much as 2.15% APY and has no charges or minimal stability necessities.

Low-Danger Investments with Steady Earnings

Investing in low-risk belongings with steady earnings can present a gentle return on funding whereas minimizing threat. Some examples of low-risk investments that may generate steady earnings embrace bonds and dividend-paying shares.

Bonds are a sort of funding the place you lend cash to a borrower (equivalent to an organization or authorities) in trade for normal curiosity funds. Any such funding is taken into account low-risk as a result of it is backed by the creditworthiness of the borrower. With bonds, you’ll be able to earn between 4-6% curiosity every year, relying on the kind of bond and the issuer.

Some examples of bond investments embrace:

- Authorities Bonds: These bonds are backed by the total religion and credit score of the federal government and provide a comparatively low-risk funding with steady returns.

- Company Bonds: These bonds are issued by firms and provide a barely greater threat than authorities bonds, however nonetheless provide a steady return on funding.

Dividend-paying shares are one other sort of low-risk funding that may generate steady earnings. Dividend-paying shares are shares in an organization that pays out a portion of its earnings to shareholders within the type of dividends. Any such funding is taken into account low-risk as a result of it is tied to the efficiency of the underlying firm.

Some examples of dividend-paying shares embrace:

- Johnson & Johnson (JNJ): This firm has a protracted historical past of paying constant dividends and has a market capitalization of over $1 trillion.

- Procter & Gamble (PG): This firm has a protracted historical past of paying constant dividends and has a market capitalization of over $300 billion.

Significance of Greenback-Price Averaging

Greenback-cost averaging is a technique that includes investing a set amount of cash at common intervals, whatever the market’s efficiency. This technique is necessary for conservative buyers as a result of it helps to scale back the influence of market volatility in your funding returns.

By investing a set amount of cash at common intervals, you are primarily averaging out the price of your investments over time. This can assist to scale back the influence of market downturns and make sure that you are investing constantly, even in periods of low market efficiency.

Greenback-cost averaging is a long-term investing technique that helps to scale back market threat and volatility.

Different Funding Choices

![How to Invest $50k in Canada [2026] | 5 Best Strategies Best way to invest 50k](https://assets.finbold.com/uploads/2023/07/How-to-Invest-50k-in-Canada.jpg)

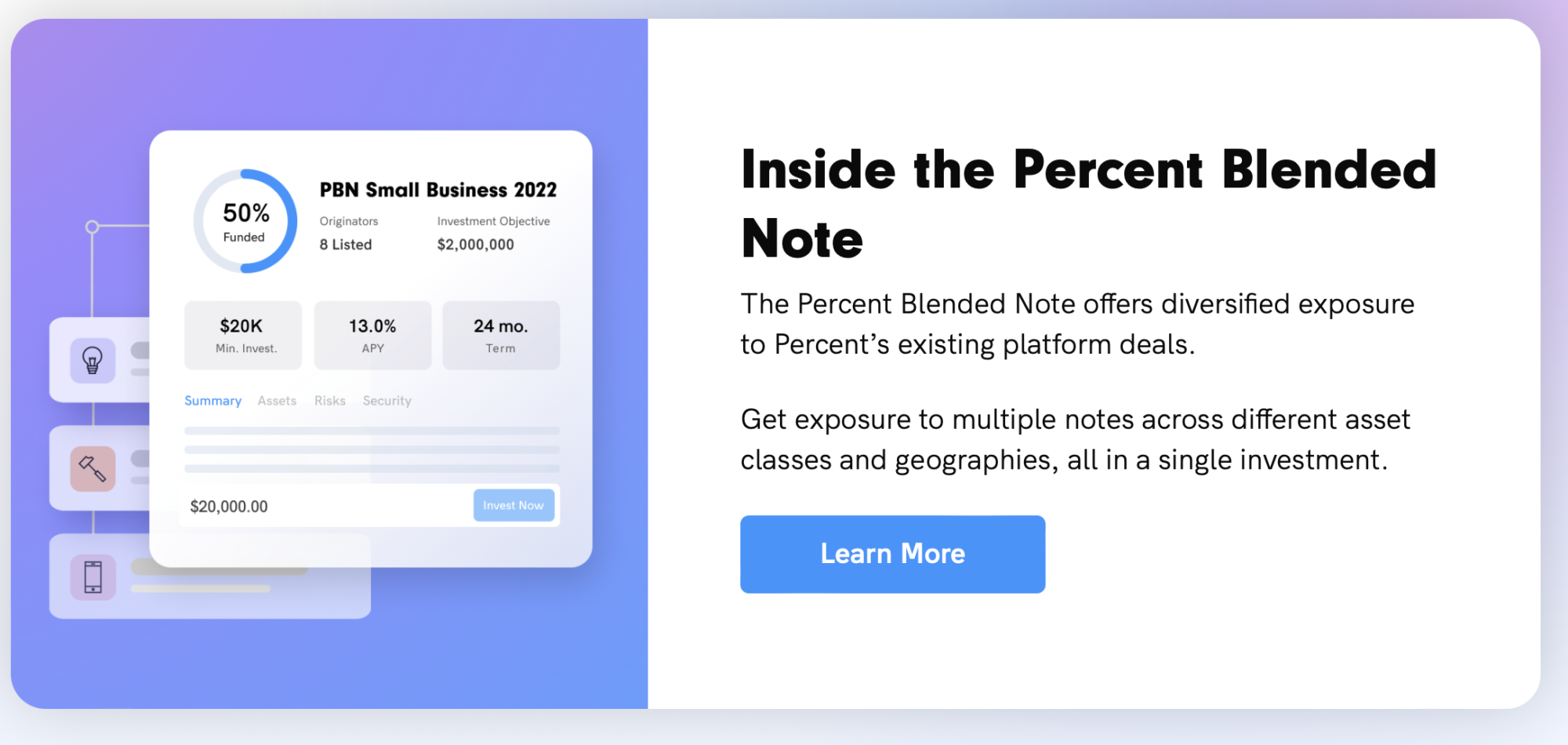

Different funding choices present people with alternatives to diversify their funding portfolios, doubtlessly rising returns and lowering threat. Not like conventional investments like shares and bonds, various investments provide distinctive methods to spend money on belongings equivalent to actual property, commodities, and mental property. On this part, we are going to discover two in style various funding choices: peer-to-peer lending and crowdfunding.

Peer-to-Peer Lending

Peer-to-peer lending is another funding technique the place people lend cash to companies or people in want of funding. This strategy permits buyers to earn curiosity on their investments whereas offering loans to those that could not have entry to conventional financing choices. Platforms like Lending Membership and Prosper join buyers with debtors, facilitating the lending course of.

Peer-to-peer lending gives a variety of advantages, together with:

- Greater potential returns: Peer-to-peer lending can present greater rates of interest than conventional investments like bonds.

- Diversification: By investing in a number of loans, buyers can scale back their threat and enhance potential returns.

- Low minimal funding: Many peer-to-peer lending platforms require solely a small preliminary funding, making it accessible to a wider vary of buyers.

Nevertheless, peer-to-peer lending additionally includes dangers, equivalent to:

To mitigate these dangers, buyers ought to:

rigorously consider mortgage choices and borrower creditworthiness

Crowdfunding

Crowdfunding is a platform that enables people to spend money on inventive tasks or merchandise in trade for rewards or fairness. Platforms like Kickstarter and Indiegogo allow artists, entrepreneurs, and inventors to lift funds for his or her tasks. Buyers can contribute to those tasks in trade for rewards equivalent to unique entry to the product or challenge updates.

Crowdfunding gives a number of advantages, together with:

- Help modern tasks: Crowdfunding permits buyers to assist modern tasks that might not be viable by means of conventional funding channels.

- Diversification: By investing in a number of tasks, buyers can scale back their threat and enhance potential returns.

- Low minimal funding: Many crowdfunding platforms require solely a small preliminary funding, making it accessible to a wider vary of buyers.

Nevertheless, crowdfunding additionally includes dangers, equivalent to:

To mitigate these dangers, buyers ought to:

analysis the challenge and its creator, consider the challenge’s potential for achievement, and perceive the phrases and situations of funding

Retirement Account Choices

In relation to managing your funds, investing in a retirement account is likely one of the only methods to safe your future. By contributing to a retirement account, you are not solely saving on your golden years, however you are additionally lowering your tax legal responsibility and doubtlessly incomes funding returns. On this part, we’ll discover the advantages of contributing to a 401(okay) or IRA account, the variations between conventional and Roth IRA accounts, and the tax implications of investing in a retirement account.

Advantages of Contributing to a 401(okay) or IRA Account

Contributing to a 401(okay) or IRA account can have a major influence in your retirement financial savings. For starters, the cash you contribute to a retirement account is usually deducted out of your paycheck earlier than taxes, lowering your taxable earnings for the yr. This may result in a decrease tax invoice, leaving you with more cash to take a position. Moreover, many employers provide matching contributions to their 401(okay) plans, which implies they will contribute a sure amount of cash to your account based mostly in your contributions. This may be an effective way to spice up your retirement financial savings.

Contributing to a retirement account can even assist you save constantly and robotically. By organising an computerized switch out of your checking account to your retirement account, you’ll be able to make sure that you are saving a set amount of cash every month, with out having to consider it.

Contributing to a retirement account can even present tax advantages, equivalent to deductions for contributions and tax-deferred progress of your funding.

Variations between Conventional and Roth IRA Accounts, Greatest option to make investments 50k

In relation to selecting a retirement account, you’ve two principal choices: conventional and Roth IRA accounts. Whereas each forms of accounts provide tax advantages, there are some key variations between them.

Conventional IRA:

– Contributions are tax-deductible, which implies you’ll be able to scale back your taxable earnings for the yr.

– Earnings develop tax-deferred, that means you will not pay taxes on funding progress till you withdraw the cash.

– Withdrawals are taxed as peculiar earnings.

Roth IRA:

– Contributions are made with after-tax {dollars}, which implies you have already paid earnings tax on the cash.

– Earnings develop tax-free, that means you will not pay taxes on funding progress.

– Withdrawals are tax-free, supplied you meet sure situations, equivalent to ready till age 59 1/2.

Tax Implications of Investing in a Retirement Account

In relation to tax implications, investing in a retirement account is usually a bit advanced. Nevertheless, listed here are some key factors to bear in mind:

– Contributions to a conventional IRA are tax-deductible, which implies you’ll be able to scale back your taxable earnings for the yr.

– Earnings develop tax-deferred, that means you will not pay taxes on funding progress till you withdraw the cash.

– Withdrawals from a conventional IRA are taxed as peculiar earnings.

– Contributions to a Roth IRA are made with after-tax {dollars}, which implies you have already paid earnings tax on the cash.

– Earnings develop tax-free, that means you will not pay taxes on funding progress.

– Withdrawals from a Roth IRA are tax-free, supplied you meet sure situations.

It is value noting that tax legal guidelines and rules can change, so it is at all times a good suggestion to seek the advice of with a tax skilled or monetary advisor to make sure you’re taking advantage of your retirement financial savings.

Instance of Retirement Account Funding

For instance you contribute $5,000 to a conventional IRA every year for 10 years, incomes a mean annual return of seven%. After 10 years, your account could be value roughly $74,400, assuming the return is compounded yearly. When you withdraw the cash at age 65, you will pay taxes on the withdrawals as peculiar earnings.

Then again, in case you contribute $5,000 to a Roth IRA every year for 10 years, incomes a mean annual return of seven%, and withdraw the cash at age 65, you will not pay taxes on the withdrawals, supplied you meet sure situations.

Keep in mind, the important thing to profitable retirement planning is to start out early and be constant. By contributing to a retirement account and benefiting from tax advantages, you’ll be able to construct wealth over time and safe your monetary future.

Keep in mind, compound curiosity is your good friend on the subject of retirement saving!

Funding Diversification Methods

Funding diversification is the method of spreading investments throughout varied asset lessons to attenuate threat and maximize returns. It includes allocating investments to various kinds of belongings, equivalent to shares, bonds, actual property, and commodities, to scale back dependence on anybody asset class.

By diversifying investments, buyers can scale back their publicity to market volatility and enhance the potential for long-term progress. A diversified portfolio can assist buyers climate market downturns and capitalize on alternatives which will come up in periods of financial progress.

Evaluating Diversification Utilizing Correlation Coefficient

The correlation coefficient is a statistical measure that calculates the connection between two variables. Within the context of funding diversification, the correlation coefficient is used to find out the extent of correlation between asset lessons.

CORRELATION COEFFICIENT FORMULA: ρxy = cov(x,y) / (σx σy)

The place ρxy is the correlation coefficient, cov(x,y) is the covariance between x and y, and σx and σy are the usual deviations of x and y respectively.

A correlation coefficient near 1 signifies a robust constructive correlation, whereas a coefficient near -1 signifies a robust damaging correlation. A correlation coefficient near 0 signifies minimal correlation.

Examples of Profitable Portfolio Diversification Methods

Listed here are a couple of examples of profitable portfolio diversification methods:

- Elementary Diversification: This includes allocating investments to totally different sectors or industries, equivalent to know-how, healthcare, and finance. For instance, an investor might allocate 30% of their portfolio to know-how shares, 20% to healthcare shares, and 20% to finance shares.

- Fashion Diversification: This includes allocating investments to totally different asset lessons or funding types, equivalent to worth investing, progress investing, or dividend investing. For instance, an investor might allocate 40% of their portfolio to worth shares, 30% to progress shares, and 30% to dividend shares.

- Market Diversification: This includes allocating investments to totally different geographic areas or markets, equivalent to US shares, worldwide shares, or rising markets. For instance, an investor might allocate 50% of their portfolio to US shares, 20% to worldwide shares, and 30% to rising markets.

Calculating a Portfolio’s Danger Degree and Potential Returns

To calculate a portfolio’s threat stage and potential returns, buyers can use the next formulation:

1. Portfolio threat: σp = √(w1^2 σ1^2 + w2^2 σ2^2 + … + wn^2 σn^2), the place σp is the portfolio threat, wi is the burden of every asset, and σi is the volatility of every asset.

2. Portfolio return: Rp = w1R1 + w2R2 + … + wnRn, the place Rp is the portfolio return, wi is the burden of every asset, and Ri is the return of every asset.

For a extra detailed evaluation, buyers can use threat evaluation instruments equivalent to Monte Carlo simulations or situation evaluation to estimate the potential dangers and returns of their portfolios.

Epilogue

As we conclude our exploration of one of the best ways to take a position 50k, do not forget that investing is a private journey that requires endurance, dedication, and a transparent understanding of your monetary targets. Whether or not you are trying to safe your retirement or obtain long-term wealth, this information has outfitted you with the data and confidence to make knowledgeable selections about your cash.

Important Questionnaire

What’s the greatest funding for rookies?

For rookies, a high-yield financial savings account is commonly a terrific start line, because it gives a low-risk funding choice with liquidity and suppleness.

How do I spend money on shares for the primary time?

To spend money on shares for the primary time, take into account opening a brokerage account with a good on-line dealer, transferring funds, and deciding on particular person shares or investing in a diversified index fund.

What’s the distinction between a 401(okay) and an IRA?

A 401(okay) is a employer-sponsored retirement plan, whereas an IRA (Particular person Retirement Account) is a private retirement account that may be contributed to by people, providing tax advantages and suppleness.

How do I calculate my threat tolerance?

Your threat tolerance may be decided by contemplating your monetary targets, funding horizon, and luxury stage with market fluctuations, utilizing instruments equivalent to the chance tolerance questionnaire.

What’s dollar-cost averaging?

Greenback-cost averaging includes investing a set amount of cash at common intervals, whatever the market’s efficiency, to scale back the influence of market volatility and timing dangers.