With which is the very best description of licensed shares on the forefront, this text delves into the intricacies of an organization’s capital construction, exploring the definition, goal, and kinds of licensed shares. It additionally examines the advantages and disadvantages of using licensed shares in company governance and monetary administration.

From the variations between licensed and issued shares to the varied varieties, similar to widespread inventory, most well-liked inventory, and restricted inventory, this dialogue covers all of it. Moreover, we’ll delve into the tax implications, accounting necessities, and finest practices for managing licensed shares.

Definition and Function of Approved Shares

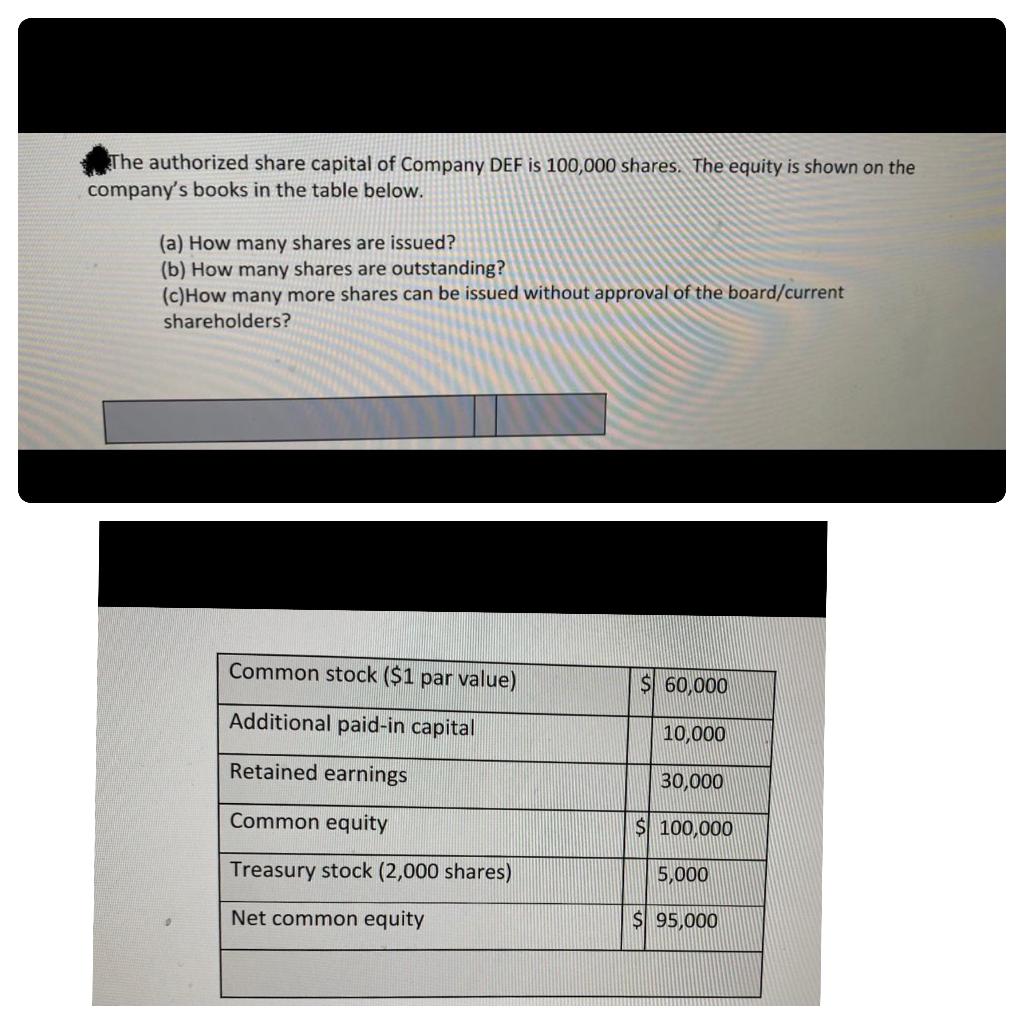

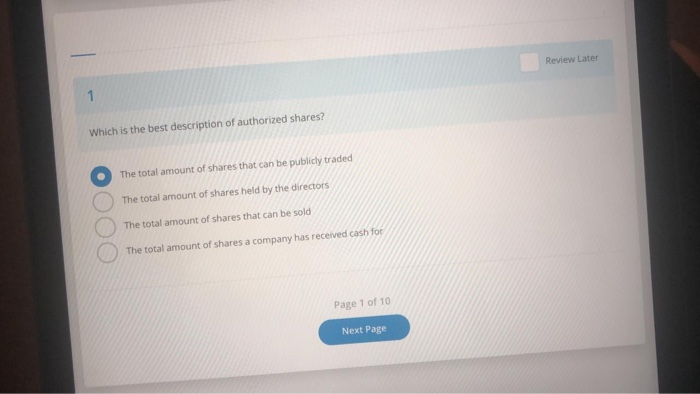

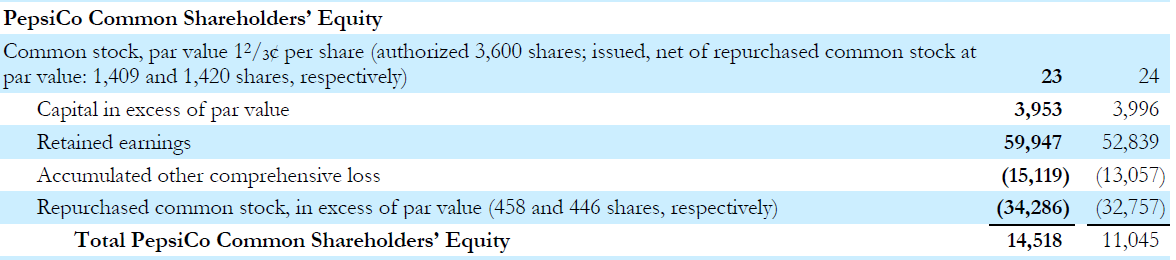

Approved shares, often known as licensed inventory, consult with the full variety of shares an organization is legally allowed to subject to its shareholders. These shares are licensed by the corporate’s board of administrators and are listed within the firm’s articles of incorporation or constitution. The aim of licensed shares is to find out the utmost variety of shares that may be issued to the general public or to traders, thereby controlling the corporate’s capital construction.

Approved shares play a big position in an organization’s capital construction as they decide the full quantity of capital that the corporate can elevate from shareholders. This, in flip, impacts the corporate’s possession construction, monetary scenario, and development plans.

Distinction between Approved and Issued Shares

Approved shares and issued shares are two distinct ideas in company finance. Whereas licensed shares signify the utmost variety of shares an organization is allowed to subject, issued shares consult with the precise variety of shares which have been distributed to shareholders.

Approved shares stay unissued till the corporate decides to subject them, whereas issued shares are the shares which have been distributed to the general public or to traders. The distinction between licensed and issued shares is crucial in understanding an organization’s monetary scenario and development plans.

Significance of Approved Shares

Approved shares are essential in figuring out an organization’s monetary scenario and development plans. The overall variety of licensed shares impacts the corporate’s capital construction, possession construction, and monetary flexibility. Listed here are some the reason why licensed shares are necessary:

- Capital Construction: Approved shares decide the utmost variety of shares that may be issued, thereby controlling the corporate’s capital construction. This, in flip, impacts the corporate’s monetary scenario and development plans.

- Possession Construction: The overall variety of licensed shares impacts the corporate’s possession construction, because it determines the variety of shares out there for public or investor possession.

- Monetary Flexibility: Approved shares present the corporate with the flexibleness to subject further shares sooner or later, thereby elevating capital and financing development alternatives.

The significance of licensed shares may also be illustrated by way of a easy instance:

Suppose an organization has 1,000,000 licensed shares however has solely issued 500,000 shares to the general public. If the corporate needs to lift further capital by way of a public providing, it may well subject as much as 500,000 extra shares, thereby growing its capital and monetary flexibility.

Kinds of Approved Shares: Which Is The Greatest Description Of Approved Shares

Approved shares consult with the utmost variety of shares an organization is allowed to subject to its shareholders. The kinds of licensed shares fluctuate relying on their designations, and every sort has its traits and options. The primary kinds of licensed shares are widespread inventory, most well-liked inventory, and restricted inventory.

### Kinds of Approved Shares

#### Widespread Inventory

Widespread inventory represents nearly all of the possession and management in an organization. It often carries voting rights and is entitled to share a portion of the corporate’s earnings by way of dividends. Holders of widespread inventory have the ability to elect members of the board of administrators and affect main enterprise selections. Within the occasion of the corporate’s liquidation, widespread shareholders are entitled to a pro-rata distribution of property in any case different claims have been settled.

* Voting Rights: Widespread inventory often carries voting rights, permitting shareholders to take part in firm selections.

* Dividends: Widespread stockholders are entitled to obtain a portion of the corporate’s earnings by way of dividends.

* Conversion Ratio: There is no such thing as a conversion ratio for widespread inventory.

#### Most well-liked Inventory

Most well-liked inventory is a kind of share that provides precedence over widespread stockholders by way of dividend funds and liquidation of property. Most well-liked stockholders sometimes wouldn’t have voting rights however can take part in voting if a specified quorum of shareholders agrees to take action. Most well-liked inventory often has the next liquidation choice than widespread inventory, that means most well-liked shareholders obtain property in case of liquidation earlier than widespread shareholders.

* Voting Rights: Most well-liked stockholders often wouldn’t have voting rights except specified in any other case.

* Dividends: Most well-liked stockholders obtain a set dividend at a specified fee.

* Conversion Ratio: Most well-liked inventory could have a conversion ratio, permitting for conversion to widespread inventory at a specified fee.

#### Restricted Inventory

Restricted inventory, often known as restricted inventory models (RSUs), is a kind of licensed share that grants a shareholder rights to personal the safety, albeit below sure restrictions. The restrictions could specify the interval throughout which the shareholder could train its rights or the circumstances that have to be met. Upon vesting, the restrictions on the restricted inventory are eliminated, permitting the shareholder to train its rights totally.

* Voting Rights: Restricted inventory is often entitled to voting rights as soon as totally vested.

* Dividends: Restricted stockholders could not obtain dividends till the restrictions are totally happy.

* Conversion Ratio: There is no such thing as a conversion ratio for restricted inventory.

Approved Share Repurchases and Issuances

Approved share repurchases and issuances are necessary instruments for firms to handle their capital construction and make strategic selections about their funds. The board of administrators performs a vital position in authorizing share repurchases and issuances, making certain that these actions align with the corporate’s targets and are in the very best pursuits of shareholders.

The method of licensed share repurchases and issuances entails the next steps:

The Function of the Board of Administrators

The board of administrators is accountable for making strategic selections concerning the firm’s capital construction, together with authorizing share repurchases and issuances. When contemplating a share repurchase or issuance, the board should weigh the potential advantages and dangers and decide whether or not the motion is in the very best pursuits of the corporate and its shareholders.

Approved share repurchases contain the corporate shopping for again its personal shares from the market, lowering the variety of excellent shares and doubtlessly growing earnings per share. This could be a strategic transfer to:

- Return capital to shareholders by way of a share buyback program

- Cut back the variety of excellent shares and improve earnings per share

- Enhance the corporate’s monetary metrics, similar to debt-to-equity ratio

- Sign to the market that the corporate’s administration is assured in its future prospects

Nevertheless, share repurchases may also be costly and will not at all times end in the next inventory value. There are additionally dangers related to share repurchases, similar to:

- Overpaying for shares, which may scale back the corporate’s money reserves

- Shopping for again shares on the incorrect time, similar to throughout a market downturn

- Signaling to the market that the corporate is struggling to seek out alternatives for development

Approved share issuances, then again, contain the corporate promoting new shares to the market, growing the variety of excellent shares. This may be carried out to:

- Elevate capital for development initiatives, similar to acquisitions or investments in new applied sciences

- Enhance the corporate’s monetary metrics, similar to growing its market capitalization

- Sign to the market that the corporate has a powerful development technique

Nevertheless, share issuances also can have adverse penalties, similar to:

- Diluting possession and management amongst present shareholders

- Rising the corporate’s debt ranges, doubtlessly resulting in the next debt-to-equity ratio

- Signaling to the market that the corporate is struggling to generate money flows

Examples of firms which have used licensed share repurchases or issuances to regulate their capital construction embrace:

| Firm | Repurchase/Difficulty | Yr |

|---|---|---|

| Apple Inc. | Repurchase | 2015 |

| Netflix, Inc. | Issuance | 2015 |

| Microsoft Company | Repurchase | 2016 |

These examples display the significance of licensed share repurchases and issuances in managing an organization’s capital construction and making strategic selections about its funds.

In conclusion, licensed share repurchases and issuances are necessary instruments for firms to handle their capital construction and make strategic selections about their funds. The board of administrators performs a vital position in authorizing these actions, making certain that they align with the corporate’s targets and are in the very best pursuits of shareholders.

Approved Share Construction and Possession

The optimum construction of licensed shares for a corporation is a vital issue that influences its possession and management. A well-designed licensed share construction may help firms appeal to and retain traders, whereas additionally making certain that the corporate stays accountable to its shareholders. On this part, we’ll focus on the optimum construction of licensed shares, together with the variety of licensed shares and their cut up between widespread and most well-liked inventory.

Optimum Construction of Approved Shares

The optimum construction of licensed shares for a corporation is dependent upon varied components, together with its dimension, business, development stage, and possession construction. A standard method is to have a comparatively small variety of licensed shares to take care of flexibility and ease. This additionally helps to forestall inventory dilution, which may have adverse penalties for traders.

A basic rule of thumb is to have 2-5 million licensed shares, relying on the corporate’s particular wants and targets.

A well-designed licensed share construction ought to strike a steadiness between widespread and most well-liked inventory. Widespread inventory is usually most well-liked by traders because it represents possession and voting rights, whereas most well-liked inventory gives a set dividend and choice within the occasion of liquidation. The perfect cut up between widespread and most well-liked inventory varies relying on the corporate’s particular wants and targets.

Widespread Inventory

Widespread inventory is the commonest sort of inventory and represents possession and voting rights. Firms often have a a lot bigger float of widespread inventory in comparison with most well-liked inventory. The variety of widespread shares licensed ought to mirror the corporate’s long-term development potential and capital necessities.

- Firms with a powerful development potential and excessive capital necessities could authorize a bigger variety of widespread shares.

- Firms with restricted development potential and low capital necessities could authorize a smaller variety of widespread shares.

Most well-liked Inventory

Most well-liked inventory, then again, gives a set dividend and choice within the occasion of liquidation. Firms sometimes use most well-liked inventory as a software to lift capital at a selected value or to draw traders with a steady return.

- Firms could authorize a smaller variety of most well-liked shares to take care of flexibility and ease.

- Firms could select to authorize a bigger variety of most well-liked shares to draw traders with a steady return.

- Firms could use most well-liked inventory to fulfill particular capital necessities or to finance a selected mission.

The position of institutional traders and main shareholders in influencing licensed share construction can’t be overstated. These traders typically have important voting energy and will demand modifications to the licensed share construction to align with their pursuits.

The Function of Institutional Traders and Main Shareholders

Institutional traders and main shareholders play a big position in shaping the licensed share construction of an organization. These traders typically have important voting energy and will demand modifications to the licensed share construction to align with their pursuits.

*

- Institutional traders could demand modifications to the licensed share construction to align with their funding methods and threat tolerance.

- Main shareholders could demand modifications to the licensed share construction to guard their pursuits and keep management.

In conclusion, the optimum construction of licensed shares for a corporation is a vital issue that influences its possession and management. A well-designed licensed share construction may help firms appeal to and retain traders, whereas additionally making certain that the corporate stays accountable to its shareholders.

Taxation and Accounting Concerns for Approved Shares

Approved shares can have important implications for a corporation’s tax legal responsibility and monetary reporting. Understanding the tax implications and accounting necessities for licensed shares is essential for companies to make knowledgeable selections about their capital construction and monetary planning.

Capital Positive factors Taxation

When an organization points licensed shares, it might create a taxable occasion, leading to capital good points tax liabilities. This may happen when the corporate points new shares at a value increased than the par worth of the prevailing shares. For instance, if an organization points 10,000 new shares at a value of $100 every, and the par worth of the prevailing shares is $10, the corporate will incur capital good points tax on the distinction between the difficulty value and the par worth.

Capital good points tax therapy can fluctuate relying on the jurisdiction and the particular circumstances of the share subject. Basically, firms can declare a taxable capital achieve on the distinction between the difficulty value and the par worth of the shares. The tax legal responsibility will be calculated as follows:

* Taxable achieve = (Difficulty value – Par worth) x Variety of shares issued

* Tax fee = Relevant tax fee (e.g., company tax fee)

As an example, if the corporate points 10,000 shares at $100 every, with a par worth of $10, and the relevant tax fee is 20%, the calculation could be:

* Taxable achieve = ($100 – $10) x 10,000 = $90,000

* Tax fee = 20%

* Tax legal responsibility = $90,000 x 20% = $18,000

Dividend Taxation

Approved shares also can have implications for dividend taxation. When an organization declares a dividend, it might be topic to tax on the company degree. The tax therapy of dividends is dependent upon the jurisdiction and the particular circumstances of the dividend distribution. Basically, firms can declare a taxable dividend on the quantity distributed to shareholders.

Dividend tax therapy can fluctuate relying on the kind of shares held by the shareholder (e.g., widespread or most well-liked shares). The tax legal responsibility will be calculated as follows:

* Taxable dividend = Dividend quantity x Variety of shares held

* Tax fee = Relevant tax fee (e.g., company tax fee)

For illustration functions, let’s assume an organization declares a dividend of $100,000 and has 10,000 shares excellent. If the shareholder owns 1,000 shares, the calculation could be:

* Taxable dividend = $100,000 x 1,000 = $100,000

* Tax fee = 20%

* Tax legal responsibility = $100,000 x 20% = $20,000

Foundation Changes, Which is the very best description of licensed shares

Approved shares also can impression the premise of a shareholder’s shares. The premise of a share is the unique price of the share to the shareholder, together with any tax liabilities related to the share. When an organization points licensed shares, it might change the premise of the shareholder’s shares, leading to a brand new foundation for tax functions.

Foundation changes will be advanced and depend upon varied components, together with the kind of shares and the circumstances of the share subject. Basically, shareholders can declare a brand new foundation for his or her shares primarily based on the adjusted price of the shares.

Taxation Situations

The desk beneath illustrates totally different tax therapy eventualities for licensed shares:

| Situation | Description | Taxable Achieve/Dividend | Tax Legal responsibility |

| — | — | — | — |

| 1 | Firm points new shares at a value increased than par worth | Capital good points tax | Company tax fee (e.g., 20%) |

| 2 | Firm declares dividend | Dividend tax | Company tax fee (e.g., 20%) |

| 3 | Shareholder purchases new shares at market worth | No taxable achieve or dividend | 0 |

| 4 | Shareholder receives new shares as a bonus | No taxable achieve or dividend | 0 |

| Situation | Description | Taxable Achieve/Dividend | Tax Legal responsibility |

|---|---|---|---|

| 1 | Firm points new shares at a value increased than par worth | Capital good points tax | Company tax fee (e.g., 20%) |

| 2 | Firm declares dividend | Dividend tax | Company tax fee (e.g., 20%) |

| 3 | Shareholder purchases new shares at market worth | No taxable achieve or dividend | 0 |

| 4 | Shareholder receives new shares as a bonus | No taxable achieve or dividend | 0 |

Word: This desk is for illustrative functions solely and precise tax therapy could fluctuate relying on the jurisdiction and particular circumstances.

Finish of Dialogue

In conclusion, licensed shares play an important position in an organization’s monetary administration and development plans. With the complexities of company governance and taxation, it’s important to know the very best description of licensed shares to make knowledgeable selections. By greedy the intricacies of licensed shares, traders could make extra knowledgeable selections, and firms can appeal to the required funding for development and success.

FAQ Nook

Query: What’s the major goal of licensed shares in an organization’s capital construction?

Reply: Approved shares are used to find out the utmost variety of shares an organization can subject, offering flexibility in company governance and monetary administration.

Query: What are the primary variations between licensed and issued shares?

Reply: Approved shares signify the utmost variety of shares an organization can subject, whereas issued shares are the precise shares excellent, which can be totally different from the licensed quantity.

Query: Are you able to clarify the advantages and disadvantages of licensed shares?

Reply: The advantages embrace flexibility in company governance and monetary administration, whereas the drawbacks embrace dilution of possession and elevated complexity in taxation and accounting.